They have got to be joking. The weekend stories about changes to alcohol taxation are bound to turn out to be silly season nonsense. For a start they would result in a reduction in the price of alcopops. After the controversy of the past year, that is just not on for the Labor government. A second reason is that it would devastate the bulk wine industry at a time when grape growers are in great distress. The idea of taxing forms of alcohol on the basis of their alcohol content might be logical but it is not politically sensible.

And so must they. The Australian Education Union must believe in fairies if it thinks that there will be any change in the short term of federal funding for schools. The report the union released at the weekend showing that the third of students attending private schools will end up with two thirds of the money sent from Canberra will be ignored in this election year.

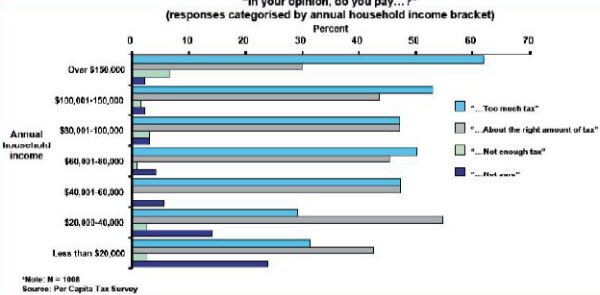

What a surprise. There are very few Australians who believe they do not pay enough tax.

This amazing conclusion was discovered by the so-called think tank Per Capita in a survey of attitudes towards taxation. If you would like to see further examples of this useless research, click here.

Sex sells. Sometimes I amuse myself by posting links on one of those social network kind of sites of interesting stories that I happen upon and this little Newsvine site of mine even pays me a share of the advertising revenue. Over the past year I have averaged an income of 50 cents or so a month until this week when, hey presto, a hundred proper US dollars has jumped in. Naturally I have conducted serious research into which of my serious observations was responsible for this windfall and discovered that I had 35,000 visitors in one day to read my summary of a story about the woman who bit off the tongue of a man who made an unsolicited kissing advance. I am now pondering giving up my interest in politics and producing a daily page of the world’s best sex stories.

Why not do both!

any chance you can post that link again? 😉

I do not see why tax should be varied to favour one form of alcohol over another. The current problems of the wine industry may justify phasing in the rationalisation of alcohol taxes over several years, but not for maintaining wine’s lower taxation in the long term.