Brussels, we have a problem. The eurozone is on the nose as investors, especially hedge funds, are in a frenzy over what might become the next sovereign debt disaster.

Greece, of course, is top of pops, but overnight Spanish shares suffered their worst fall in 15 months , Portugal’s bonds dropped sharply and the euro fell to its lowest level against the greenback since last May and the Aussie dollar fell by around 2 US cents. And other markets tanked by 2% or more. There’s an old fashion market pack hunt underway, just as there was in the wake of Lehman’s failure that saw some of the world’s biggest banks (Goldman Sachs, Morgan Stanley) protected from failure by the American Government, UK, German and other Governments.

The European Central Bank left interest rates at 1% overnight, and President Jean-Claude Trichet tried his best to sell the line that the region shouldn’t be punished for Greece’s decade of statistical fudging and budgetary deception. He was talking but no-one was listening — they were too busy shorting Greece, Spain and Portugal, and eying the UK and US. There’s easy money to be made in euro-pessimism at the moment .

Short everything? Even gold, the perceived store of value in uncertain times, plunged a nasty 4% and more, oil was down 5%, copper, 4%. The smarty pants speculators are heading for the sidelines and parking their money in US dollars. Even booming sugar (in genuine short supply) fell 3.3% as punters took their profits and ran. Wall Street fell 2.6%, ending below 10,000 points for the first time since last November. 2010 has opened miserably.

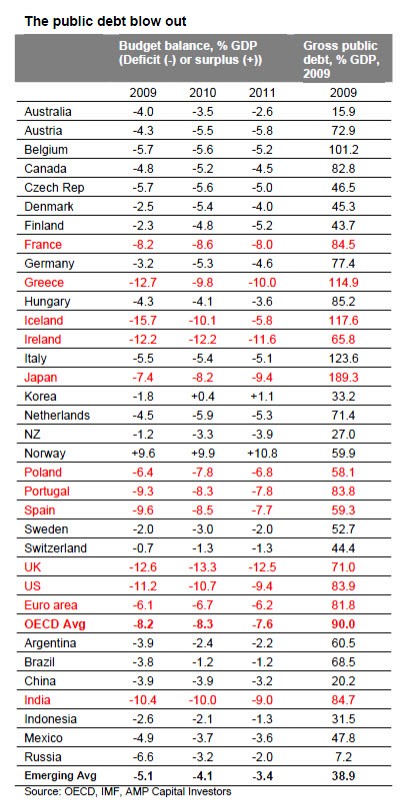

The problem? Spain’s public debt will rise to 74% of GDP by 2011 from 54% in 2009, Greece’s debt will increase to 135% of GDP from 113%, and Portugal’s will increase to 91% from 77%, according to EU estimates. And then there are the real “whales” — Japan (closing in on 200%), the UK, 71% and rising and the US, 83% and also rising. Moody’s warned this week that the US AAA rating was in real danger if the country couldn’t get more growth from the economy in the next few years to lift revenues and cut the deficit and debt. For a insight, read this piece from The Financial Times about the background to this emerging battle between hedge funds and speculators — many of whom are American — and the European financial and political establishments.

Go long Australia? The AMP’s chief economist, Dr Shane Oliver has provided this helpful table covering the major budget and sovereign debtors of the world. As you can see, Australia is best placed of the major economies, a fact that may interest Messrs Abbott, Joyce and Hockey, who seem to find it politically inconvenient that debt and deficits are not a concern in Australia:

Another latte, please. Yesterday’s retail sales figures for December contained the usual headline material — sales down 0.7% — but as usual there’s a wealth of info buried underneath. For instance: the performances of cafes and other eateries, with original sales jumping 16.8%, or more than $400 million, from December 2008 to $2.896 billion in December 2009. Apart from a near half a billion dollar rise in food retailing sales, cafes and other eateries was the best performing retail sector. There was a 2.5% rise in December alone in spending in cafes, restaurants and takeaway outlets. Other significant increases in the December quarter, seasonally adjusted, were household good retailing (2.3%), clothing, footwear and other personal accessory retailing (1.2%) , department stores (0.6%) and food retailing (0.3%). That’s an awful lot of lattes, pastries and BLT’s, not to mention Big Macs, Whoppers and fish and chips.

So ignore the 0.7% fall in December’s retail sales. Instead focus on the bigger picture. Retailing is solid, not booming like it was in 2006-07. Look at the original sales figures for guidance (not seasonally adjusted ones) Original sales figures are too raw to be used in stats because they can distort, that’s why seasonal adjustment is used. The difference between the original and seasonally adjusted figures is enormous. December 2009 saw original retail sales estimated at $25.94 billion, compared to the seasonally adjusted figure of $19.9 billion. In other words Christmas was worth, according to the ABS, an estimated $6 billion to the retailer sector as a whole. Comparing spending last December with spending in December, 2008, we find there was a $760 million rise, or around 3% (around $400 million seasonally adjusted). That extra $760 million will be sprinkled onto the profit reports of retailers large and small, starting with the current market darling, JB Hi-Fi early next week.

Oh, What a Recall! Ever the optimist, Toyota reckons it will make a profit in the Japanese financial year ending March 31 of 80 billion yen ($US880 million), down from the previous estimate of a 200 billion loss (almost $US2 billion). This includes an estimated $US2 billion cost for the recall and lost sales, mostly in the US and Europe, which is now up to 8.4 million vehicles. That’s more than a year’s production for the world’s biggest car maker. The company lost $US5 billion in the 2009 year. So far investors have chopped $US30 billion off the company’s market value because of the recall debacles. Now Toyota has been forced to add 270,000 of its Prius hybrid to the recalls in Japan and the US after the Japanese government told Toyota to investigate complaints about braking problems. The same car is sold in Australia and Toyota here is investigating. One person who had a problem in the US was Steve Jobs, the man behind Apple, who said his Prius accelerated without explanation.

Why Warren Buffett is clever, Chapter XMCLI. This week the big German reinsurer Munich Re revealed a 66% jump in 2009 profits. And guess who’s in there making a killing? Warren Buffett’s Berkshire Hathaway, which picked up 3% of Munich Re cheaply, with options to go to more than 5% and become the German giant’s biggest shareholder. Buffett already owns 3.2% of rival, Swiss Re, which he purchased at the Swiss group’s invitation when it needed a friend during the GFC, much in the same way as he snapped up shares in Goldman Sachs and General Electric as the shareholder of last resort. Berkshire already owns its own reinsurers such as General Re, so Buffett and his managers would have known that 2009 claims were running well under previous years — no Katrinas or Twin Towers, and not too many plane crashes. But not even clever deals like this could stop Standard & Poor’s from cutting Berkshire’s AAA credit rating, joining Moody’s and Fitch in downgrading it to a lower level. All three don’t like the fact that Berkshire is taking on more debt to buy the Burlington Sante Fe railroad. Toot, toot.

A lot of money for a stickman. A world record price for the sculpture “L’Homme qui marche I”, by Alberto Giacometti, has made it the most expensive work of art ever sold at auction when it fetched $US104.3 million at Sotheby’s London on Wednesday night. It had been estimated to sell for 12-18 million pounds, but instead it went for 65 million pounds, beating Picasso’s painting “Garçon à la pipe” by $US100,000 which sold in May 2004:

But the vendor is the interesting story. Commerzbank AG, which acquired it after it took over Dresdner Bank last year. Commerzbank is 25% owned by the German Government. Commerzbank said proceeds from the sale are to be put towards supporting its charitable foundations as well as selected museums. “Charitable foundations” is not understood to mean executives short of a bonus, or the Merkel Government, but the question arises, why charity and not repaying German taxpayers from this windfall?

” As you can see, Australia is best placed of the major economies” – Doesn’t Russia count as a major economy, after all they are part of the G8 ? And their debt as a % of GDP is put at only 7.2%.

Of course there is more to the health of a nation than it’s debt as a proportion of GDP, still I would have thought it worth a mention.

What I find fascinating about the debt table is how the major Latin American nations are well below the OECD average. Used to be that they were the big debt junkies.

“The smarty pants speculators are heading for the sidelines and parking their money in US dollars. ” Yeah, the US really is the obvious safe choice as its economy is in such great shape [sarcasm] “Even booming sugar (in genuine short supply) fell 3.3% as punters took their profits and ran.” More proof these idiots don’t know their a***es from their elbows and have lost contact with economic fundamentals.

“But not even clever deals like this could stop Standard & Poor’s from cutting Berkshire’s AAA credit rating, joining Moody’s and Fitch in downgrading it to a lower level. All three don’t like the fact that Berkshire is taking on more debt to buy the Burlington Sante Fe railroad. Toot, toot.”

That would be the Standard & Poor’s and Moody’s who rated dodgy securities as AAA and IMHO did more than any other institutions to spark the GFC? Exactly what credibility are they supposed to have in rating risk???? Lessee, these discredited clowns on one side and Warren Buffett on the other. Gee, I wonder who I’d back 😉