Something we don’t pay much attention to around this place are the various political betting markets – so from now through until the election, we’ll have Betting Market Friday as a regular post. Essentially, what we’ll do is look at the federal election prices from five betting agencies – Centrebet, IASbet, Sportingbet, Betfair and Sportsbet – and do all sorts of nerdy things with them over time.

As we approach the election, we’ll be able to answer questions on whether poll results lead the betting markets around by the nose, which pollster has the biggest impact on the betting markets, and as individual seat markets open up, we’ll also be able to do some monte carlo simulations on them and see how the predicted election results differ from the latest polling snapshot election simulation.

We’ll also add the betting market implied probabilities for each party into the sidebar as a little graphic – because, well, that sidebar isn’t quite filled with enough information yet 😛

To start the ball rolling, we have to calculate ourselves some implied probabilities from the prices that the betting agencies are offering. This is a two stage process – firstly we have to get ourselves some nominal probabilities. Secondly, we have to adjust those nominal probabilities for the overround – the effective commission that the betting agency makes from the book.

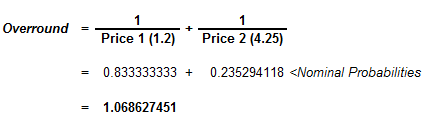

To calculate the overround and the nominal, unadjusted probabilities – we just simply take the inverse of the prices to get the latter, and sum them together to calculate the former. Using an example, the latest Centrebet prices have the ALP on $1.20 to win the next election, while the Coalition is sitting on $4.25. The calculations then look like this:

These prices give nominal probabilities of 83.3% likelihood of victory for the ALP compared to the Coalition’s 23.5%. However, you may notice that the probabilities add up to 106.86%? That excess probability is how the betting agencies make their money.It represents the cream they take from the market.

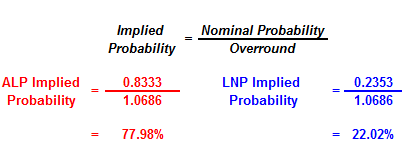

If we assume that the betting agencies are making money equally from both sides of the betting equation (in that the ALP probabilities are inflated in the same approximate proportion as the Coalition probabilities), we can adjust for this overround to get at the true implied probabilities associated with the prices by simply dividing the nominal probability of each price by the overround.

Currently, the Centrebet prices imply that there is a 77.98% probability of the ALP winning this coming election compared to the Coalition’s 22.02%.

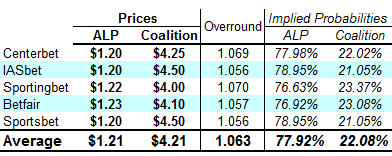

If we do that for all five betting agencies and calculate an average based on the raw data from those agencies, this is what we end up with.

Our five agency average is what we will primarily use this year to track the markets.

But wait, there’s more! Hold onto your handbags folks, we can graph it!

OK, so it’s not particularly exciting yet – but over time I’m sure that will change.

As we get more data, we’ll also look over the literature – particularly the Australian literature – on betting markets in politics. One of the good things here is that some of our favourite economists pretty much dominate the Australian academic literature with the likes of Andrew Leigh, Justin Wolfers and Simon Jackman being particularly prominent.

Disclaimer: Gamble at own risk. I may be many things, but a fortune teller is not one of them.

UPDATE:

I missed Sportsbet, so that’s now been added into the mix

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.