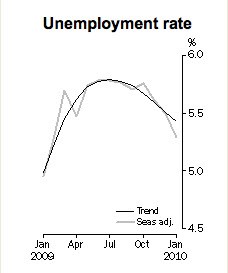

Meanwhile, in the real world, unemployment has plummeted, a small reminder that for all its problems this week, the Government has got the big picture right.

Reckon unemployment has peaked? 16,000 new full-time jobs, 37,000 part-time jobs, off a steady participation rate.

The only fly in the ointment is that seasonally adjusted hours worked is down a touch, but trend hours were up slightly.

The drop was right across the country, too. South Australia had a huge fall, to 4.4% from 5.2%, and on the back of a big rise in the participation rate, burnishing Mike Rann’s pre-election economic management claims. Queensland was the next biggest fall, 0.4%, down to 5.5%, albeit off a fall in participation. NSW fell 0.3 to 5.6% — making it the worst performer but still much better than last year. Victoria was steady off a higher participation rate. WA eased down to 5.0%, the Tasmanians steady.

Again economists, analysts and commentators failed to pick the fall. Reflexively, the media has instantly focused on the implications for mortgage interest rates.

A few journalists and editors might benefit from a visit to recession-era America, where unemployment tops 10% and the resultant misery, coupled with a dysfunctional political system, has crippled the world’s biggest economy.

The peaking of unemployment is also perfectly timed: the withdrawal of the Government’s stimulus package will be curbing economic growth over coming quarters. We’re now looking to the animal spirits of the private sector to take over the task of keeping Australians employed from Government, which has handled the task, it must be said, admirably. This transition back to normal growth patterns won’t be without its difficulties, particularly with the banking cartel threatening to inflate their super-profits further by increasing their loan margins.

It is, however, the sort of transitional problem other countries would dearly love to have.

Yes but the pundits only like tomorrow, not next week.

once again Crikey displays its bias

the story is not about decreasing unemployment, more jobs, and being the only developed country to avoid recession.

it’s the interest rates, stupid.

You just don’t get it, do you Bernard? Labor is never allowed to get anything right, especially economic management, because that’s the sole province of the Liberals.

If the ALP is internationally admired for heading off the worst of the recession caused by conservative free-market fundamentalism, it can only be because the UN one-world government climate conspiracy cabal has activated the RFSD chips in the Left-wing MSM. What kind of nutjob would suggest that Rudd and Swan are just good at their jobs?

The true unemployment rate will never be revealed so long as the ABS continues to use outrageous sampling methods -the underemployed, the hidden unemployed all are swept under the carpet as the ABS defines being employed as working 1 hour per week! Like most economic data it is seriously flawed and shows that all market driven economies cannot exist without data being dressed up, books being cooked and figures fabricated all in the name of the money gods..

It is true Alexander what you say about the way unemployment is measured. However, it is still a measure and the method used to determine it is the same every time. So as an indicator of what is happening – it could be considered to be reasonably reliable.