Greeks bearing debts: Last week Greek politicians attacked Germany for not paying for the damage caused in World War Two. Overnight two German politicians replied with insults of their own, telling Greeks they should sell some of their islands to reduce debt. Josef Schlarmann, a senior member of Merkel’s Christian Democrats, said: “Those in insolvency have to sell everything they have to pay their creditors.” In the interview with Bild newspaper, he said: “Greece owns buildings, companies and uninhabited islands, which could all be used for debt redemption.” Bild headlined the story: “Sell your islands, you bankrupt Greeks! And sell the Acropolis too!”

Greeks borrowing money: The day after the Greek government slashes spending for the third time, bringing a round of ritual protests, the country managed to get a €5 billion 10-year bond issue away, but at a cost. The loan was heavily oversubscribed, but cost Greece 6.4% — twice what Germany pays. More strikes by private and public sector unions have been called for tonight, our time, when the Greek parliament votes on the latest austerity package. The country needs to borrow €53 billion this year — at least 20 billion of it by end May — to repay existing debt and finance the still huge budget deficit.

Snow cones: The huge snow storms in the US have been blamed for weak car sales in February, poor home starts, weaker than expected home sales and US officials have already warned us that tonight’s jobs numbers will be impacted by the snow. But shoppers were impervious to the cold and blizzard conditions in the east, south and mid-west … they went shopping, so much so that same store sales in US retailers were the best for a couple of years. Of course, the figures do not include the giant Wal-Mart, which no longer reports monthly sales number. But according to Thomson Reuters, same store sales (at shops open a year or more), jumped 4% last month, above estimates for a 2.9% rise and much better than the 4.7% a year ago. Some retailers, such as Macy’s, the department store group, said sales would have been better but for the snow.

America’s productivity illusion #1: Those local commentators who compare the high US productivity at the moment to Australia’s will be salivating this morning: America’s productivity “miracle” is better than even they thought. US productivity grew at an annual rate of 6.9% in the final quarter of last year, according to US Government figures, up from the first estimate of 6.2%. Over the last half of 2009, output grew 2.5%, while cutting working hours by 1.3% (simple, isn’t it, want to boost productivity, just sack workers and give those with a job less hours to do their labour in). And pay employees less with unit labour costs falling 1.7% over the year as a whole, the biggest annual fall in this measure since records started in 1949. Productivity in the third quarter actually was revised upwards to an annual rate of 7.8%. For all of 2009 productivity rose 3.8%, the highest rate for seven years (since the end of the last recession, strange that).

America’s productivity illusion #2: What these commentators ignore is that productivity always rises as an economy comes out of recession and output starts rising, but employers don’t add jobs. Boosting productivity in the US is easy when 8.4 million people have lost their jobs in a recession and 11.5 million workers were collecting unemployment benefits as of last week. Getting these people back to work is a bigger and more important task. Weak demand in coming years will make America’s productivity look weak to appalling as jobs are slowly created. That’s why our growing economy and falling unemployment are far better stories. Tonight we find out if America has made any inroads into its 9.7% rate. Commentators are now saying the snow storms will have caused jobless numbers to rise in February, but no impact on retail sales?

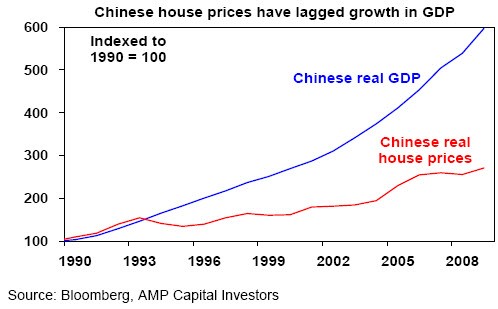

Who’s got a housing bubble?: The AMP’s Dr Shane Oliver asks who’s got the housing bubble? Not China. He points out that while China’s average 70 city house price index rose 9.5% over the year to January this is not that strong given nominal GDP is rising by about 13%. This contrasts, for example, with Australian average capital city property prices, which rose by 13.6% last year at a time when nominal GDP growth was actually flat. It’s been a similar story over longer periods with average house prices not keeping up with growth in GDP. For example, over the past decade China’s real GDP growth averaged 9% pa but real house prices only rose 5.3% pa. By contrast in Australia over the past decade real GDP growth averaged 2.9% pa, but real house prices rose an average 6.4% pa. Who has the bubble here?

How conveniently Germans forget the economic contribution to their recovery and expansion in Europe to the tens of thousands of migrant guestworkers from southern Europe and Turkey whose cheap labour meant West Germans could become the rich people of Europe. It seems their memories need a bit of jogging on fronts other than the Holocaust.