The real fear of mining companies emerges. It has taken a few weeks but the stock market analysts are beginning to wake up to what the BHP Billitons and Rio Tintos of the world are really worried about when it comes to the proposed Australian super profits tax. It is not just the extra dollars that will be paid in Australia that concerns them.

The miners realise that the increased share of mineral wealth going to the host country here, at the expense of those that dig things up, will quickly spread to other countries around the world. If and when that happens the stock market valuations based as they are on growing future earnings will come crashing down.

The likelihood of this happening was something I alluded to when the Australian tax was first announced earlier this month. I wrote then:

“Some things about politicians are universal and seizing an opportunity for extra tax revenue is one of them. Hence the idle nature of the threats by the mining industry in Australia to take future developments somewhere else if the resources tax is finally imposed. It will not be long before the international mining taxation playing field is level again.”

This morning the Bloomberg news service has taken up this theme with a story saying that Australia’s planned 40 percent tax on mining profits has set a benchmark for other countries weighing higher levies, reducing earnings forecasts for BHP Billiton Ltd and Rio Tinto Group and the attraction of mining stocks.

It quotes, among others, Tom Price, commodities analyst with UBS AG in Sydney, as saying “it could create what the miners are now describing at a global level as a type of tax contagion. They might levy a new tax at the miners in Brazil. Canada is another mineral province and South Africa.”

Repeating a warning – don’t bother listening. I tried, I promise I really tried, to work out what Joe Hockey was trying to tell us at the National Press Club yesterday about what the Coalition would do with economic policy if it was the government. I just failed to grasp it that’s all.

Sure I gathered that there would be less spending than Labor proposes and the new tax on mining company profits would be done away with but then I got confused when the shadow Finance Minister Andrew Robb started counting as spending cuts the abolition of tax changes by Labor that would only apply if there was a new tax on mining company profits. What the …?

Then in answer to a question the would-be Treasurer trotted out that old Howard favourite, which can never be tested, that interest rates would always be lower under the Coalition than under Labor. Thanks Joe for keeping a meaningless statement alive.

I should have known better than to even listen. Politicians are in election mode where they think the only way to treat the public is as fools. Words from now until election day are cheap and mean nothing.

And it’s not just Messrs Hockey and Robb who are speaking in riddles. I am still waiting for someone in the Labor Government to explain in terms I can understand how this mining super profits tax will actually work.

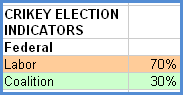

A Labor improvement. If last week the opinion polls led the Crikey Australian Election Indicator downwards then perhaps this week the Indicator is suggesting that the polls will start showing a Labor improvement. The probability of a Labor victory is put by the market this morning back at 70 per cent after the fall to around 66%.

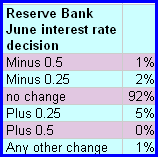

The Crikey Interest Rate Indicator is also pointing in a more favourable direction for the Government with the Reserve Bank making no change to official rates seen as the most probable outcome.

Hogging the limelight. The one-man-band style of Kevin Rudd has reached a ridiculous level. The man has now taken it upon himself to pose for the television cameras reading out Foreign Affairs Department travel warnings! Does our Prime Minister have no shame at all? Surely the Foreign Minister Stephen Smith could be trusted to tell the Australian people that it is dangerous to travel to Bangkok.

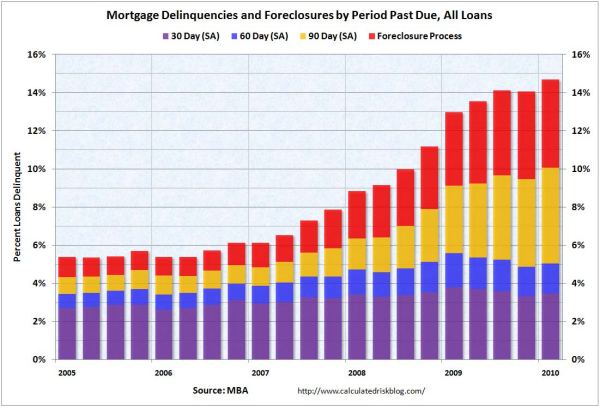

US not out of trouble yet. The problems United States banks have with housing loans are far from over. Figures overnight from the Mortgage Banker’s Association show home owners in arrears still at record high levels.

The Calculated Risk website reports the MBA’s Chief Economist Jay Brinkmann saying that the largest category of delinquent loans are fixed rate prime loans. Thirty four states and the District of Columbia have total delinquency rates over 10% making it a widespread problem.

re: The real fear of mining companies emerges.

The fear is world government — the devil is in the detail.

“the would-be Treasurer trotted out that old Howard favourite, which can never be tested, that interest rates would always be lower under the Coalition than under Labor”…

Can never be tested? The cash rate when the Coalition left office was 6.75%; it’s 4.5% now. Australia’s current mortagage rates are below the average for the entire Howard era.

Ah, Phil, the Coalition would say that the cash rate would be even lower than it is now cos the Coalition would have spent far less on economic stimulus which ‘crowds out’ the private market. I’m even willing to concede that despite the fact that there was so much slack in the economy there has been nothing to crowd out, but I would argue that the unemployment rate would therefore have been much higher under the Coalition. In a contest between low interest rates and low unemployment rates I’m preferring low unemployment rates every time.

I believe the Foreign Minister Stephen Smith is currently overseas which may have made his announcing the new travel advisory a bit tricky. Still, it could have been done by a parliamentary secretary in the portfolio such as Bob McMullan who seems eminently competent.

Ditto Gavin, re Stephen Smith, to quote the words of Meatloaf “You took the words right out of my Mouth.”

Ken Henry single-handedly trashed the share market and the Aussie dollar.