The study the federal government is citing in its counter-attack against the mining industry’s claims about the impact of the RSPT is a wide-ranging international study by one of America’s most prominent economic research establishments.

And it demolishes the industry’s claims to already be paying high tax rates, instead showing that Australian mining companies are some of the lowest–taxed corporations in the world.

BHP has been peddling the claim that the mining industry would face an increase in its effective tax rate from 43% to 57% under the RSPT. Several commentators, including Paul Kelly and Peter Van Onselen, bought it. “Most economists agree it will tax the industry’s profits at an accumulated rate of around 57 per cent,” van Onselen tried to claim yesterday, without identifying any economists who agree with that.

It’s garbage. The average effective tax rate of mining multinationals in Australia is 13%. How do we know?

Last year two American tax economists, Douglas Shakelford and Kevin Markle, looked at effective tax rates faced by multinational and domestic companies around the world (the study is here, but you’ll have to buy it).

Andrew Robb claimed this was a “graduate paper”, which must come as a shock to Shakelford, who is Distinguished Professor of Taxation at the University of North Carolina and has worked on several similar studies over the past two decades. And a shock to the National Bureau of Economic Research, which published the paper.

The NBER is pretty much the ne plus ultra of American economic research institutions. It’s the outfit that determines when the US enters and leaves recessions.

The point of the study was to determine whether there was any truth to claims from progressive politicians that multinational companies enjoyed lower tax rates than domestic-only companies. Their conclusion was that multinationals faced pretty much the same effective tax rates as domestic companies. In demolishing the populist case for special taxation arrangements for multinational companies, Shakelford and Markle were hardly engaged in some left-wing frolic.

It’s the sort of study large transnational companies would cite in their defence against the charge that they don’t pay enough tax.

But Markle and Shakelford found some exceptions to the general case that multinationals pay the same level of tax, and we’ll get to those.

Along the way, they made some broad observations about effective tax rates faced by corporations. Japan was the highest-taxing country, and the US was above-average. Companies domiciled in tax havens (no kidding) and Asian countries had lower ETRs. ETRs had also fallen significantly pretty much across the board for companies in the past two decades, but slightly faster in Australia and Canada.

Their study was not about individual companies.

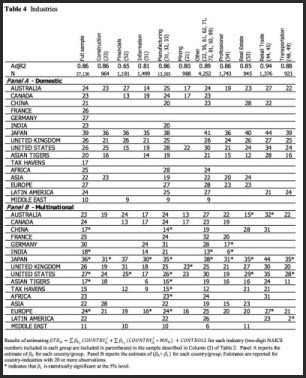

It aggregated data from the tax paid by, and profits before tax of, companies across countries and industries. It then compared ETRs faced by multinationals and domestic companies in different industries in different countries. It found mining multinationals faced an ETR in Australia of 13%, the lowest rate of any country studied, lower than Europe (16%) or Canada (17%), which is apparently poised to use the RSPT to steal mining investment from us.

And in fact this ETR rate was one of the lowest of ANY country for ANY industry (for the record, retailers face the highest ETRs in Australia, at 27%, and it’s a worldwide phenomenon that retail pays high ETRs).

(Click to enlarge)

It was also unusually and significantly lower than the ETR of our domestic miners, who on average pay 17%.

This study had nothing to do with the Henry Review (which quoted it), or for that matter Australia. It was entirely independent and unrelated.

The Minerals Council yesterday attacked the study as a “small American study”. How small would such a study have to be to be considered too small? One hundred companies? Five hundred companies? One thousand companies? The number of companies that form the basis of the study is more than 27,000. They were culled from a larger sample of 42,000 to improve accuracy. The final sample included more than 980 mining companies.

I asked the MCA yesterday if they had anything to show how the study was flawed, beyond being “small” (a small sample size of course could understate or overstate ETRs depending on the companies that ended up in the sample). They directed me to a Citigroup study released before the release of the Henry Review.

The study compared different royalty rates across the world and found that Australia had among the highest royalty rates. It also tried to assess the total tax burden faced by mining companies, but did this simply by adding royalties to the official corporate tax rate, without any adjustment for what tax breaks, concessions and deductions miners could claim.

The American study, in contrast, looked at actual tax paid by companies. Inconveniently for the MCA, the study also warned that Africa (another purported destination for capital driven away by the RSPT) was a big risk for mining companies due to rising taxes there.

It was also a Citigroup analysist who, after the Henry Review announcement, declared “that BHP, RIO and OZL may have been sold off too hard given the likely limited RSPT impact, we reiterate our BUYS on these stocks”.

This morning the Minerals Council changed tack and cited ATO data to claim that the industry faced the highest ETRs in the country. However, that data is based on net income, not profit before tax, as the US study is, and relies on ATO’s domestic data, rather than companies’ own reported tax and profit results across all their operations.

Far from the government preparing to cave in on the issue, as some hysterical commentators are trying to suggest, its resolve is hardening. Labor knows a backflip on the issue will be politically fatal to its credibility. It is prepared to negotiate aspects of the new regime, but it is also aware that different sections of the mining industry have different stakes in this — so far we’ve mainly heard from the big foreign companies, not smaller local companies that will benefit from the shift from a royalty to a profits-based regime.

But the government will be heartened that the business sector is saying the miners have wildly overreacted. Even the Fin Review today could no longer hide the views of senior business figures, including Roger Corbett, in support of the RSPT.

Maybe the American study is flawed. Maybe 26,000 companies is too small a sample, and the National Bureau of Economic Research hasn’t a clue. But neither the MCA nor the opposition have produced anything to show that.

The credibility gap between what the miners and their cheerleaders say and reality grows ever bigger. Don’t fall in, guys.

Beautiful work. Thanks for the two references. Perhaps a refernce to the Treasurer’s article published yesterday will complete the set of this afternoon’s required reading.

http://www.treasurer.gov.au/DisplayDocs.aspx?doc=economicnotes/2010/020.htm&pageID=012&min=wms&Year=&DocType=4

I’d expect the mining companies to push the line they are, given that their responsibility is return to shareholders, and f*ck anyone else, but it’s disappointing for the Coalition to be pushing the same line, if they expect us to consider them as alternatives in the next election.

Dr Harvey M Tarvydas

BK, wonderful young man, you have saved me a difficult search to find the true facts.

You give good advice to your readers and let me also inform them that the RS Tony Abbott illness is spreading. Andrew Robb, always highly respected, in total contradiction to his honest and decent application to politics came out claiming ‘the document’ was a student’s work with only accidental or uninvolved mention of the Australian mining scene. That the Government was reprehensible insulting the mining industry using such a ‘shitty’ document to claim laughably that the mining industry could possibly even think of being in the least dishonest much less lie.

Of course he was ‘used’ for his past reputation.

Interesting that you, Bernard, support the government’s case with the word “demolish” for what you say the American study does for the miners’ case. Allow me to doubt that I should treat that hearsay version of the debate as decisive.

If you want something to enliven your imagination about the possibilities for error when you are considering a foreign general study in relation to Australian matters by suggesting e.g. an account of the Pacific War which underplays and misrepresents the Australian part and performance – as, apparently, and quite surprisingly, Max Hastings recent work is said to do. And how many inventions are misattributed for another example.

Assuming, nonetheless, that there is a sense in which the multinational mining companies pay relatively low tax in and to Australia, that doesn’t take one very far without knowing a great amount of detail about timing of cash flows, depreciation rates, where the profits are made and so on.

Most important, none of that has anything to do with the basic argument against encouraging people to invest on one state of facts about the law and then changing the rules unilaterally. We may “own” the resources but that doesn’t give us the moral right to take back what we have sold (to use a shorthand term for the various aspects of the disposition) and demand a different price be paid. In this connection the blustering Hockey didn’t sound too smart in commending the State ability to be able to vary their royalties without suggesting there was any greater principle of restraint on their doing so than the miners ability to pay.

Taxation on the basis that I would like to pay less and others to pay more and I have the numbers is not principled and, if you don’t think it matters, then explain why the Canadian covering the flow on from the announcement of the new tax. It matters in that practical wastock market indexes have fallen so much less than the Australian over precisely the periody as well as to the superannuants and others who have heavily invested in the miners. (I say “that practical way” because the exchange rate is now strongly linked to the All Ordinaries and similar indexes for fairly obvious reasons. A point also worth making because it means that Rudd & Co are not only wrong about the fall in the stockmarket not being substantially related to their tax but wrong about the fall in the exchange rate not being also causally linked to the tax)

The incompetence of the government in its proposing and justifying the tax strongly suggest that it doesn’t know what it is doing and is led by the nose by the admirable but limited Ken Henry. What stopped them from simply relying on the precedent established for off-shore oil? Elementary one would have thought.

The title of this report is

“NBER Working Paper No. 15091*

Issued in June 2009”

This is a working paper. From the NBER site:-

“NBER Working Papers have not undergone the review accorded official NBER publications; in particular, they have not been submitted for approval by the Board of directors. They are intended to make results of NBER research available to other economists in preliminary form to encourage discussion and suggestions for revision before final publication. ”

In other words, its a draft paper, and hasn’t been published officially at all. Shouldn’t have be used by the Henry report.

In regards to the data in the report, it is a regression analysis based on data from 1988 to 2007, a twenty year period where the tax rates in this country have changed dramatically. Also they have grouped Australia and NZ together, which is nice (even though they have different tax laws)

Also, I’m more inclined to use the ATO figures as they show the amounts that the companies pay in domestic taxes (which at the end of the day is what we are interested here). The ato tax figures are based on Net Tax paid and Taxable income (so they exclude non-taxable items). Profit before tax doesn’t necessarily do that and so would alter the figures (as the Profits before tax are higher due to these non-taxable items being included)