Central bankers are like football club chairmen. Central bankers and those other guardians of the world’s monetary system at the International Monetary Fund have one thing in common with the chairmen of football teams. History suggests that when they express complete confidence in a coach/country being written about as under pressure, drastic action is not far away.

Hence, my continuing interest in the travails of the Irish Government as the country struggles to survive bankruptcy because of the bills run up by the lending spree of its bankers that could not be paid when the global financial crisis struck. The big wigs of the European Central Bank and the IMF keep assuring investors that the harsh austerity measures they have forced upon Ireland are working and that there is no cause for concern.

Meanwhile, out in the market where opinions about Ireland and its future have to backed with Euros rather than words, the message is quite a different one.

Now what happens in Ireland alone is nothing more than a side-show for us in Australia but then so were those securitised housing loans in the United States when they started to unravel. It gets more troubling if Ireland, along with Greece, which already has been bailed out by the EU and the IMF but where the government is now talking about the terms of the demanded austerity measures being too tough, are but the first symptoms of a financial disease that is about to spread.

Those dreaded markets clearly think that contagion is a possibility. The cost of borrowing by the governments of Portugal and Spain is going up and the latest speculation is that the substantial Italian economy will soon join them on the endangered list.

Going up or down. Writing in the Medical Journal of Australia this month, Tanya N Chikritzhs, Steve J Allsop, A Rob Moodie and Wayne D Hall claimed to have made sense of “what had seemed until now the anomalous stability of alcohol consumption in the face of increased alcohol-related hospitalisations for injury and liver disease, as well as apparent increased community concern about alcohol-related problems.”

It was all the fault of the official figures from the Australian Bureau of Statistics being wrong.

“Until recently,” their paper said, “official national annual totals of PCC of alcohol were underestimated and led to the mistaken impression that levels of alcohol consumption had been stable since the early 1990s. In fact, Australia’s total PCC has been increasing significantly over time because of a gradual increase in the alcohol content and market share of wine and is now at one of its highest points since 1991–92. This new information is consistent with evidence of increasing alcohol-related harm and highlights the need for timely and accurate data on alcohol sales and harms across Australia.”

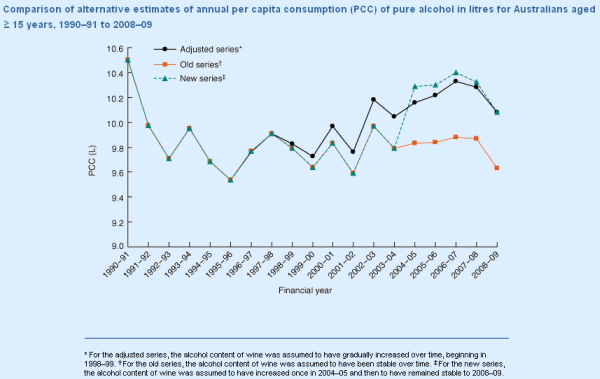

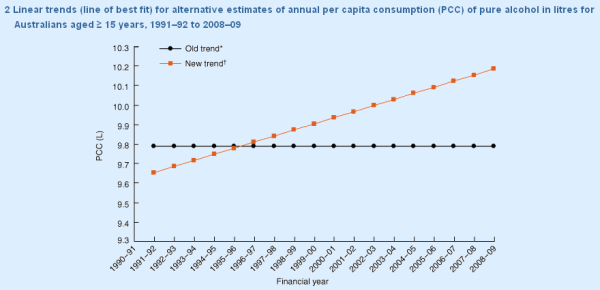

Having rejigged the figures according to their estimates of the true alcohol content of wine, the authors produced the following two graphs — one comparing alternative estimates and another showing trend lines based on the old official figures and their new ones:

There certainly are clear differences — the official figures showing a small but steady trend down and their revised ones showing an alarmingly steep increase.

Today the ABS has itself returned to the subject with some revised figures and acknowledging how the article Per capita alcohol consumption in Australia: will the real trend please step forward? published on November 1, 2010, in the Medical Journal of Australia “has generated interest in ABS alcohol statistics and the ways of measuring alcohol consumption in Australia over time.”

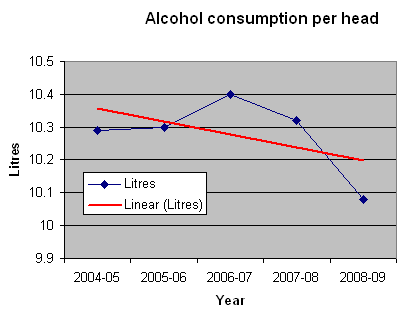

Initially, the bureau has revised consumption figures for 2004-05 to 2008-09 to take account of a review that “resulted in an increase of 1.9 percentage points for the average alcohol content of table wine, from 10.8% to 12.7% (12.2% and 13.4% for white and red table wines, respectively). The alcohol strength of sparkling and carbonated wine also increased while the alcohol content of vermouth decreased.” Later this year it will update figures further back in its time series.

I look forward to seeing what the statistician finally comes up with but, meanwhile, I have used the now officially available revised figures to prepare this little look at alcohol consumption over the past five years.

Do you think those figures show alcohol consumption galloping ahead? I don’t but then I’m an old wine merchant whose brother is now making some of those deliciously rich reds in the Barossa with a high alcohol content.

A bit rough on the cardinal. As a happy agnostic who veers on the atheist side, I carry no torch for Sydney’s Cardinal Pell but I thought Granny Herald’s report on his speech at an ethics-in-business lunch hosted by Notre Dame University was a bit rough.

Perhaps the headline was witty enough but the “Thou shalt gamble, thou shalt smoke and thou shalt sell arms, the country’s most senior Catholic cleric has decreed” was a gross distortion. More like the anti-Catholic jokes you could expect from someone with my beliefs than a fair report of an interesting address by a so-called serious paper.

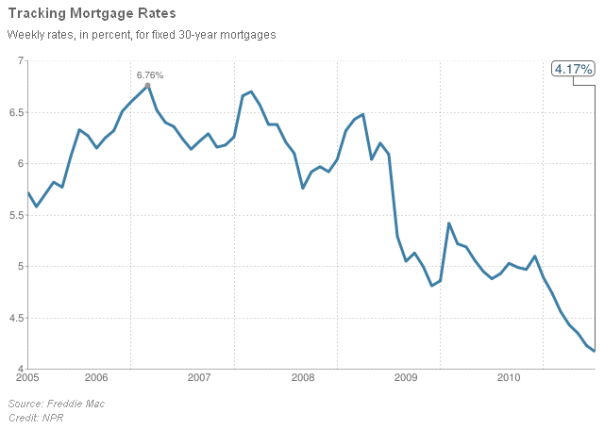

A 4.17% mortgage rate. And it is fixed for 30 years. Only trouble is you have to be in the United States to get it.

You would think US banks would be overjoyed to offer loans to a relatively safe Aussie market.