I find the concept of a country going bankrupt difficult to get my head around. The world’s newspapers are full of stories of the risk of Greece, Ireland, and then Portugal, even Spain and Italy, all taking the knock because their governments cannot repay outstanding loans. But the stories generally stop well short of explaining what the consequences will be if it actually happens.

The one serious attempt at explanation I have come across is on the Calculated Risk blog site which earlier this year ran a series of posts on sovereign default risk. It is a comprehensive and detailed survey but this summary will give you the flavour of it.

How Large is the Outstanding Value of Sovereign Bonds?

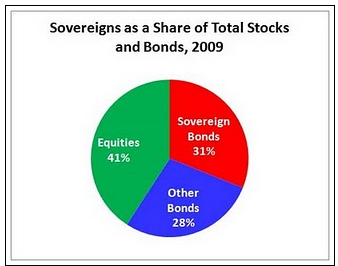

According to the Bank for International Settlements, at year end 2009 worldwide sovereign debt exceeded $34 trillion, and is greater than the amount of corporate bonds outstanding.

How often have sovereign countries defaulted in the past?

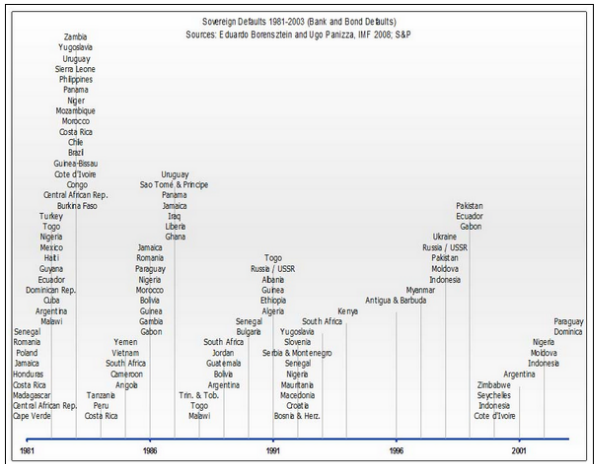

Sovereign bonds have been defaulting for almost as long as there have been sovereign bonds. The problems go back many centuries. A good overview created for the IMF is “The Costs of Sovereign Default” by Eduardo Borensztein and Ugo Panizza. Some countries are “serial defaulters”, with a long history of sovereign defaults. Many have defaulted on sovereign debt five times or more.

More on Historic Sovereign Default Research

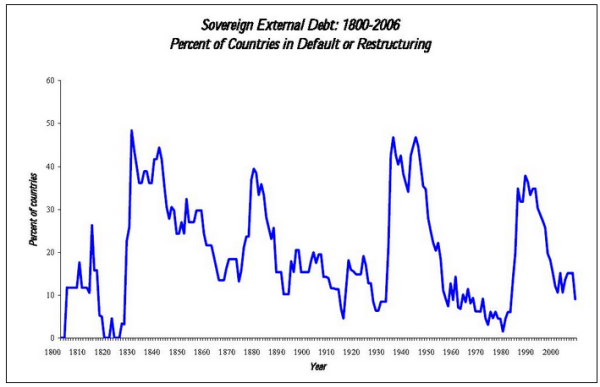

Historically, we will see that the average percent of sovereigns in default or restructuring have sometimes been quite large

What are the Market Estimates of the Probabilities of Default?

As of June 30, 2010, the weighted average expected default rate is 7.4%. When weighted by value of debt outstanding, CDS pricing worldwide points to 7.4% of it defaulting within 5 years. If the outstanding sovereign debt was still $34 trillion as reported at 12/31/09, that’s $2.5 trillion of defaulted debt. If the trend of increased borrowing has continued to $36 trillion at 6/30/10, it’s about $2.7 trillion of defaulted debt.

Before you run out and start shorting sovereigns or panic over your retirement, remember that bondholders seldom lose all of their money on defaulted bonds. Sometimes recovery rates are quite good. Others, not so much.

What are Total Estimated Losses on Sovereign Bonds Due to Default?

Moody’s has studied sovereign default recoveries in the past several decades (Source: Sovereign Default and Recovery Rates, 1983-2008). Recovery rates have ranged from 18% (Russia, 1998) to 95% (Dominican Republic, 2005), when measured on all debt from a particular sovereign at the time of default. The average recovery rate was 50% when each country was weighted equally, but only 31% when weighted by the face value of all outstanding bonds from all defaulting issuers.

Applying those recovery rates leads to expected losses of $1.3 to 1.8 trillion, or about 3.7 – 5.1% of outstanding sovereign debt at 12/31/09, and about $100 billion more at 6/30/10.

What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

So, out of the multitude of potential scenarios, I have settled upon one which is really bad, but doesn’t involve asteroids, mass extinctions, or apes taking over. It is consistent with prior bad episodes of sovereign debt default….

In the Really Bad scenario, 45% of the countries with large outstanding sovereign debts are in default within a 2-3 year period. …

The total debt in default reaches $15.3 trillion, and almost half of all outstanding sovereign debt is in default. The losses are $10.5 trillion at the low end recovery rate of 31%.

In our Really Bad scenario, there isn’t enough collateral to cover the gross market values. If collateral was required on all positions of all traders and the market values reached 3x their 2008 values, gross market value would be about $100 trillion dollars. That would exceed all sovereign debt, all corporate debt and all outstanding equities. However, even in a dysfunctional market, there is a lot of netting.

There might not be enough collateral even if netting. In recent years, the ratio of “gross credit exposure” to “gross market value” has been about 14-22% (BIS data). Let’s say that there is a need for a maximum of $20 trillion of collateral given the net positions. While there is probably enough collateral worldwide to cover $20 trillion, it would undoubtedly move market prices for acceptable assets. It would also be difficult to buy or borrow that much in a short time period.

… So far, we’re at $12.5 to 20.5 trillion of losses in the Really Bad scenario

Such large losses require that in addition to the sovereigns themselves, a number of large OTC traders would default. The largest traders include banks and other institutions which have already received government rescues or substantial additional capital from governments. The Really Bad scenario assumes that solvent governments do not cover, or cannot cover, many of those traders’ OTC losses.

Some Policy Options, Good and Bad

This section outlines some of the more common or reasonable options which are available to sovereigns who are in distress or at high risk of default. They include Dialing for Dollars as Greece recently did with the European Union and the IMF and printing money – a course of action not available to Ireland, Portugal and Spain because they use the Euro. And of course, do positive spin, even lie about financial condition.

In Banking Crises, an Equal Opportunity Menace, Reinhart and Rogoff show that the cost of banking crises are greater than has been commonly assumed. “Banking crises dramatically weaken fiscal positions…with government revenues invariably contracting, and fiscal expenditures often expanding sharply. Three years after a financial crisis central government debt increases, on average, by about 86 percent. Thus the fiscal burden of banking crisis extends far beyond the commonly cited cost of the bailouts.”

Given the typical timing of banking and sovereign crises, it would take about 1-2 years for the crisis to reach its peak, and about 3 more years for recovery.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.