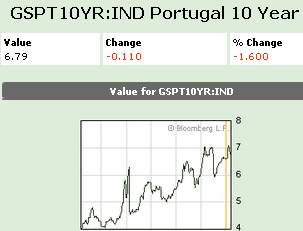

The efforts of the European Central Bank in buying Portuguese bonds this week enabled a successful auction last night (Australian time) of a new issue by the Lisbon Government. Yields on the 10 year bonds sold averaged 6.716 percent down from 6.806 percent at its last auction.

Despite this success, skepticism remains with the Financial Times of London quoting Howard Wheeldon, senior strategist at BGC Partners, saying: “Even though the government managed to get the latest bond auction away does not mean that this problem is in any way solved.”

For Paul Krugman it says something about the sheer desperation of the European situation that Portugal’s ability to sell 10-year bonds at an interest rate of “only” 6.7 percent is considered a success.

If you think about the debt dynamics here — the burden of growing interest payments on an economy that is likely to face years of grinding debt deflation — an interest rate that high is little short of ruinous. But it is, indeed, not as bad as people were expecting last week; hence, success.

A few more successes and the European periphery will be destroyed.

According to Reuters, who quoted Germany’s Finance Minister, major euro zone states now are working on a comprehensive medium-term package to solve the bloc’s debt crisis and could reach agreement in the next two months.

Wolfgang Schaeuble’s disclosure came as the European Union’s executive called for greater emergency lending power to underpin the euro zone, and Portugal, widely seen as the next candidate for a bailout, successfully sold its first debt of the year.

Schaeuble said talks on a package of measures were under way with France, Italy and the head of the International Monetary Fund. He did not say whether the package would include expanding the euro zone rescue fund.

“We have to solve the problems not only in the short-term — when there are short-term problems — but also in the medium-term,” Schaeuble told reporters in Berlin.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.