Most voters would rather the federal government delay its back to black strategy and extend the deficit to stave off service cuts and tax hikes.

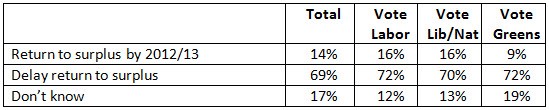

While new polling from Essential Research found growing concerns about the state of the economy, more than two-thirds of voters say the government should abandon its plans to return the budget to surplus by 2012/13. Just 14% of those surveyed support the surplus push, while 69% — a similar number across party support lines — advocate a delay.

Most voters (49%) say the government should maintain spending programs, while 15% advocate increased spending and 22% say more cuts should be made. Support for spending cuts was strongest among Liberal/National voters (31% compared to 14% among Labor-aligned respondents).

The weekly phone poll of 1000-plus voters found confidence in the local economy compared to other nations, with 69% rating our accounts “good” compared to just 7% who said they were “poor”. But confidence going forward seems to have wavered: just 27% say the economy will pick up over the next 12 months, down from 40% when the same question was asked in October. A third of voters believe the economy will worsen over the next year, the strongest show of concern since June 2009.

Yet there appears to be little movement in the state of individual budgets: roughly a third of voters (32%) believe their personal financial situation will get better over the next 12 months, a similar number (31%) to those who fear their bank accounts will drain. Job insecurity remains high, with 42% “concerned” they might lose their job, up 3% since October.

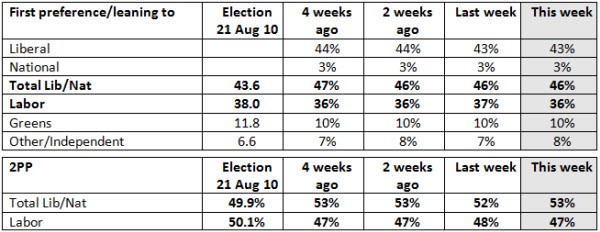

Essential finds no spike in support for the government, which is still languishing 10 points behind the Coalition in primary vote support. At 36% Labor has lost a point to the independent vote this week, with the Coalition maintaining its emphatic 46% support while the Greens sit on 10%.

That wipes a point from Labor in the two-party preferred stakes, now trailing the Coalition 47% to 53%.

Most voters are abysmally ignorant in relation to the deficit financing currently being used by the Australian government, and what the return to surplus actually means. The Federal government is engaged in a profligate spending spree increasing public sector borrowings from $17 billion when Costello handed over the reins of Treasury to a projected $170 billion by 2014, at which point the rate of expenditure by government will equal its income in that period(balanced budget before return to surplus), but the headache will be the interest bill of something in the vicinity of $10 billion per annum or $500 forevery man woman and child in the country, or approximately $1000 per taxpayer. Julia’s flood levy at $1.8 billion was a political stunt only and represents approximately 3 weeks delay in returning the budget to surplus. The 400 kg (800 pound) gorilla in the room is the heroic assumption that once the budget is returned to surplus, the ongoing surpluses will be about $40 billion per annum or $2000 per taxpayer per annum. This is of course before the carbon tax which will add another thousand dollars or so to every tax bill. So funding the surplus to pay off the Rudd/Gillard/Swan massive deficit funded spending spree will cost the average household the average taxpayer about $3000 per annum before carbon taxes, with presumably increased carbon taxes offsetting the benefits of reduced interest income.

I can just see the murdoch rags and shock jocks if the surplus isn’t part of next years budget – the screams will be deafening! When Howard produced his surpluses it was at our expense. The surplus was brought about with too many things suffering – health, education, infrastructure and of course the still awful situation re mental health. But wait, there’s more ……

@Liz45 I suggest that you take off your pink glasses and have a good close look at Swan’s budget papers. You will see that deficits in the order of $30 billion are projected for the next three years raising Australia’s federal government borrowings to about $170 billion, and that then your “poster boy” Treasurer is projecting $40 billion surpluses for the next four yearsto fund accumulated deficit. Before you go criticising responsible government for maintenance of balanced budgets, requiring years of surplus to offset years of deficit you should obtain a better understanding of public finance. In the long run governments should balance budgets in nominal terms, so whatever you spend over receipts in one year (deficit) you have to borrow and ultimately repay in following periods (surplus applied to debt redemption) unless you wish to follow the example of Weimar Republic or Zimbabwe and just keep printing money and robbing people who save. Of course that is the modus operandi of armchair socialists who want to consume at someone else’s expense.

@GREG ANGELO – You can’t help yourself can you? Such a nasty little person. Does it make you feel superior being so rude.

Then how about this?

Liberals broke debt records . SMH July 10 ’09.

“Before a desperate Malcolm Turnbull starts driving his new Liberal Party debt truck, he should own up about the last one. (Politicians hit the road with a truckload of rhetoric, July 8).

When John Howard launched it while campaigning for election in 1996, he said nothing better sumbolised the failure of Labor’s economic management than the fact, that Australia “owed the rest of the world $180 billion” in net foreign debt. When the Liberals lost office in 2007, Australia “owed the world” $550 billion. In 1996, the total national debt was $700 billion. By 2007 it had grown to $3.4 trillion. The Liberal Party’s real record on debt is appalling.

Phil Teece.

If what you say is true, don’t you think the head of the Reserve Bank or Treasury would have something to say? Their criticism is deafening! What about the economists we see on our TV each evening? ABC I’m referring to. The bloke on there doesn’t work for the ABC. He’s under no obligation to the current govt or the last one for that matter.

Try and restrain yourself when you feel the need to be childishly nasty. I don’t have ‘pin up boys’ over the age of 25 – they’re my grandsons! The youngest is 10 and drop dead gorgeous!