The Australian Securities and Investments Commission’s commendable move yesterday to tackle glossy retail prospectuses (prospecti?) inspired Crikey to examine some of the more egregious examples of fluff and bubble when corporates lean on middle Australia for cash.

ASIC commissioner Belinda Gibson has branded “sales and marketing statements – and the extensive use of promotional photography” as “secondary” to the purpose of the documents to inform investors. “The consultation paper raises for discussion the proper balance that we should achieve,” she said without fingering any company in particular. The first six or seven pages, usually plastered in glossy spin, were crucial because retail chumps rarely got any further, the regulator said.

So, which prospecti clearly tipped the scales in favour of the ridiculous when it came to enticing everyday investors? The focus so far has been on Myer’s 2009 shocker which splashed with heaps of photos of Jen Hawkins and Danni Minogue’s baby daddy but also a faux-bonhomie setup of Crikey‘s ex-Myer Doncaster colleague Zoran Tosev discussing strategy with CEO Bernie Brookes.

While the Myer share price has tumbled, last year’s QR National float has gone the other way, despite an offer document featuring a train plastered with the words “be part of something big” and randomly bolded text like drive profitability and experienced. The Anna Bligh-backed investment has proved a sure bet, as the privatised behemoth sacks staff to improve its bottom line with shares hovering at about $3.42, a 39% increase on the $2.55 offer price. It seems this employee-turned-model could see the blue skies ahead.

Meanwhile, the Nathan Tinkler vehicle Aston Resources floated with a $1.2 billion bang last year and is counting on its NSW Maules Creek coal project to eventually bring in the bikkies. Aston’s chairman, former Deputy Prime Minister Mark Vaille, is doing a top job bending the ears of locals concerned about the environmental impact of more mining but those same protesters might have been better off had they been enticed by the neon lights of this prospectus last August.

A disclaimer down the bottom states that Aston doesn’t actually own Hong Kong and that Maules Creek is still a long way from completion.

Or what about camping supply company Kathmandu’s 2009 effort, in which the company’s “attractive and stable margins” were coupled with breathtaking vistas of backpackers sprawled on rocks? Far from Aston’s bonanza, the shares started at a low $1.70 and temporarily tumbled into one of the document’s picturesque crevasses before recovering their footing on a solid first half profit result a few weeks back.

But the champion of prospectus debacles has to be the nearly-collapsed RAMS Home Loans, which floated in 2007 just before the global financial crisis netting hundreds of millions for founder John Kinghorn. The document, slammed by the Australian Shareholders’ Association at the time for misleading investors on risk and funding sources, also contained some cuddly graphics of first home buyers savouring their new found freedom.

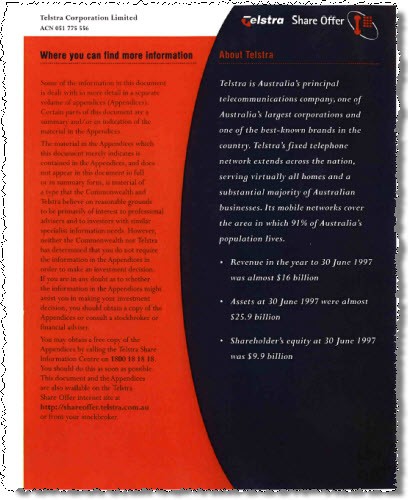

Perhaps ASIC should point companies back to the good old late 1990s and the initial Telstra float in which a few dour photos of phone boxes were counterposed with hard data on the company’s prospects — which in the pre-NBN era looked very rosy indeed.

*Seen any shocking examples of fluff-filled prospectuses? Email boss@crikey.com.au and we’ll keep a running tally.

In our company’s shareholding club, as a bit of fun, we estimate the value of a share based on the amount of heavy earth-moving equipment on a company’s website and prospectus.