Ross Garnaut has confronted Labor and the multiparty climate change committee with the reality of trying to do too many things with a limited pot of carbon price revenue, by proposing cuts to transfer payments from levels proposed under the CPRS and adjusting tax thresholds or taxation rates to ensure high income earners don’t benefit from the tax cuts he proposes.

In the final report of a series of updates of his 2008-09 work on responding to climate change, Garnaut has proposed a set of compensation and governance arrangements for the transition to an emissions trading scheme over the next decade.

Under governance, Garnaut proposes an array of bodies (most of them flagged previously) independent of government to oversee both the scheme and overall policy direction:

- a UK-style independent committee to assess “national targets and scheme caps; progress towards meeting targets; the switch to a floating price; and expanding coverage of the scheme”, with the intention that the committee makes recommendations to government — for example on strengthening the national emissions target — and government being required to explain why it will not carry out the recommendations. Its first review would be to consider what target Australia should adopt after the initial phase of the scheme is completed; until then, Garnaut says the current target of 5% by 2020 or higher, depending on international agreement, should remain in place;

- an independent economic consulting agency to assess the level of compensation for trade-exposed, emissions-intensive industry, intended to be like the Productivity Commission or form part of the PC;

- a specialised Carbon Bank to independently operate the scheme;

- an Energy Security Council (which Garnaut recommends regardless of the move to a carbon pricing scheme) to oversee the introduction of a carbon price in the electricity generation sector;

- a Low Emissions Innovation Council to oversee research, development and commercialisation of low emissions technology.

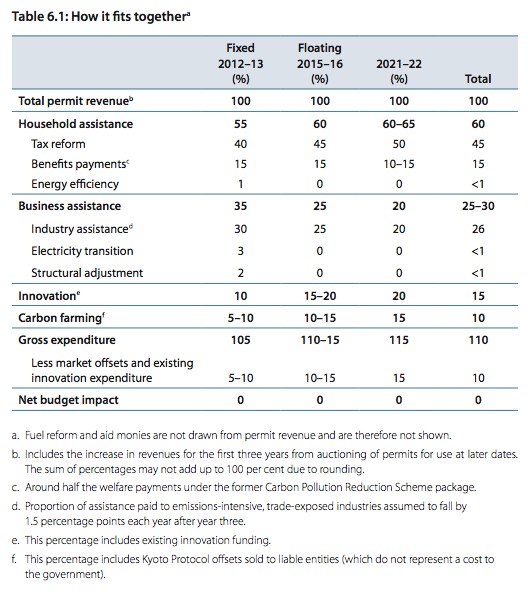

However, it is in relation to compensation that Garnaut’s final report will create the most difficulties for the government. He proposes the following split of revenue from the scheme (a $26 a tonne price would initially yield $11.5 billion in revenue, he says):

Garnaut suggests a one-off cut in petrol excise to offset the impact of a carbon price on the price of petrol, to be funded through reductions in the favourable Fringe Benefits Tax treatment of private vehicles, or other pro-fossil fuel subsidies, including the option of cutting FBT on cars and parking altogether. The report proposes that household compensation be primarily delivered by tax reform through a substantial lifting of the tax free threshold to $25,000 (a marked departure from the CPRS, which mainly relied on compensation via family payments), partially offset by politically unpalatable changes to thresholds or rises in taxation rates for higher-income earners to offset the cost of lifting the tax-free threshold for all earners.

Garnaut also throws in another political hand grenade by suggesting a significant reduction in transfer payment compensation to groups such as pensioners over what was proposed in the CPRS, to reflect the pension increase since then, and the fact that welfare recipients were over-compensated under the CPRS.

However, under the new Garnaut model, household compensation would rise significantly as a proportion of overall revenue, particularly driven by the cost of tax cuts, but also by the reduction in industry compensation. Under the CPRS, industry compensation rose as a proportion of revenue into the 2020s. Garnaut proposes CPRS Mark I-level compensation for emissions-intensive trade-exposed industries but scaled back significantly on the recommendations of the independent agency/PC responsible for determining industry compensation levels after the initial period of the scheme. Garnaut also sets aside about $1 billion as provision for loan guarantees for electricity generators and about the same for “structural assistance” for regions and sectors particularly affected by the carbon price transition. Innovation funding and overseas aid commitment related to climate change would mainly be funded by existing budget items, and not funded by carbon price revenue.

Garnaut’s recommendations around compensation will meet with a mixed reception on the Multi-Party Climate Change Committee. His logic on overcompensation for pensioners is impeccable, particularly given the increase in pension rates by Kevin Rudd two years ago, but his suggestion that compensation for them be halved from that proposed in the CPRS is ripe for exploitation by the Coalition. Labor also clearly preferred using the Family Tax Benefits system and specific offsets to deliver compensation under the CPRS, but Garnaut relies almost entirely on a huge system-wide tax cut, delivered by increasing the universal tax-free threshold, to be offset by tax rises for higher-income earners to ensure they don’t benefit from the tax cut. Given the hopeless inability of Labor to sell even simple positive policies, this, too, would present splendid opportunities for the opposition to harp on its theme of a great big new tax, despite the intention being that high-income earners won’t be out of pocket from the taxation arrangements and the apparent selling point of a big tax cut for the rest.

Still, that’s the problem with a fixed pot of revenue and almost unlimited uses and good causes to which it could be put, especially when the fiscal situation is as tight as that the government has created for itself. Garnaut has shown a rigour that so far has eluded the politicians.

Here we go, Garnaut recommends that compensation only goes to lower middle income earners (below $150k), so it is wealth redistribution

If the Govt is at all worried about changing thresholds they could esily achieve a similar effect by increasing the low income tax rebate.

They clearly won’t want to impact pensioners but that can be easily solve by shifting a bit from here and a bit from there in other area’s.

Overall I can’t see this causing to many problems for anyone on the MPCCC but it might make it hard for Abbott to keep banging on about the average Australian being worse off.

Astro – You callit wealth redistribution others would say it is shifting the tax burden off low income earners and on to polluters.

@Jimmy

So how do low / middle income earners polute less? We are talking about individuals here, not companies

[Here we go, Garnaut recommends that compensation only goes to lower middle income earners (below $150k), so it is wealth redistribution]

Worse then that.

Not only is it wealth distribution but we can see that 0% of the money from the breathing-tax will go towards “energy effeciency” or in other words, renewable energy for homes.

How in the holy lords name will this tax cut CO2 emmissions if it’s all just for compensating everyone for paying the tax? Sounds like the biggest bueracratic money bin in the history of Australia.

Money goes in, filters through a few dozen well paid public servants(just what we need) suckling the tit of taxpayers, and then anything left you get back again, assuming of course you aren’t successful in which case someone else gets your share.

You’d think something called a Carbon Tax would actually aim to reducing carbon polution via way of rewarding cutting your CO2 emmissions… but no, of course not, we get this load of horse crap.

BTW, the science is in. Australia doesn’t make 2 tenths of stuff all difference to global emmissions, so we could cut back 100% of emissions, go back to the stone age like the tree-huggers want and we’d still have the same warming as we do now.

If the supporters of this tax can’t tell us how much less the Earth will warm by Australia cutting CO2 emissions, they’ve already lost the argument.