As controversy continues to bubble over the latest big local farmland buy-up and what it means for food production, it’s worth looking to see where these foreign raiders are coming from, who’s backing them and how other countries are tightening their regulations to stop them.

New regulations were recently introduced in New Zealand which may potentially restrict who can buy agricultural land, after local farmers were repeatedly courted by foreign-controlled interests. The new provisions, introduced in January, require extra tests on overseas investment applications for “sensitive land” — which includes farmland.

Ministers are now able to consider whether New Zealand’s economic interests are being adequately promoted and safeguarded by any proposed purchase. “Large” purchases, which are 10 times the average farm size (ranging between 7.1 hectares for an olive farm to 443 hectares for a sheep farm), will also need to demonstrate a commitment to local involvement to get the minister’s approval.

To try and avoid companies acquiring land in dribs and drabs, the new tests say purchases will still need to be tested if they are bought in one transaction or in multiple purchases over time. China-based Shanghai Pengxin is currently providing the biggest test of the new laws, as it waits on approval from the Overseas Investment Office to buy 8000 hectares of dairy properties belonging to the Crafar family.

Latin America, another target for foreign raiders looking to buy up big blocks of farmland, has also looked to tighten ownership laws. Last August, Brazil’s attorney-general reinterpreted a 40-year-old law to make it significantly harder for foreigners to buy land in that country. Argentines followed suit last month, putting a law before its Congreso de la Nación to limit the size and concentration of rural land foreigners could own.

In Uruguay, the current government is also looking to restrict transfer of land to foreign ownership, after it failed to pass under the previous administration.

In Canada, where provinces are in charge of regulating how much farmland foreigners can buy and regulatory frameworks vary, the National Farmers Federation says the country is losing its grip on prime food-producing land. They say it’s sovereign wealth funds, backed by government money, which are buying up large swathes of agricultural land to capitalise on high food prices and avoid potential food shortages.

According to the Sovereign Wealth Fund Institute, more than $US4.41 trillion worth of assets are held by these funds, most of which has originated from the harvesting of oil or gas resources. Middle East oil states such as Saudi Arabia, United Arab Emirates and Qatar — together with China, Norway and Russia — have the largest sovereign wealth funds.

Recently, Crikey reported on the extent to which Qatar-based Hassad Foods had been buying up sheep grazing land in Queensland and Victoria’s Western District. Backed by the Qatar Investment Authority, a sovereign wealth fund with around $85 billion in assets, Hassad has invested more than $60 million in prime agricultural land — with a further $35 million in properties reportedly on the radar.

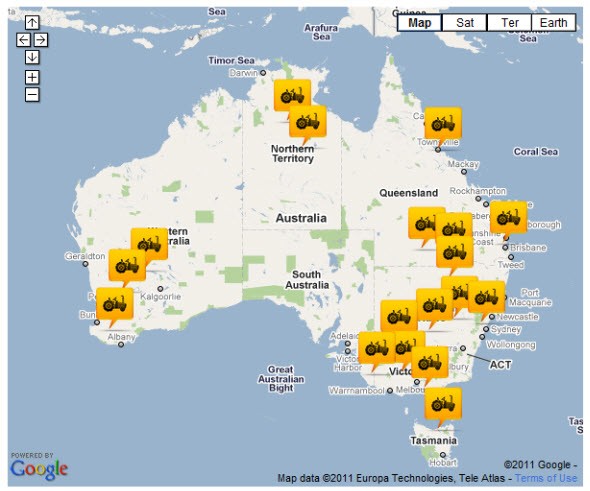

Crikey has begun mapping the recent purchases of prime Australian farmland by overseas interests (click the image to view the map)

Pension and supperannuation funds are also big players in the land grab, as investors seek to cash in on a record high UN Food Price Index. GRAIN, an international non-governmental organisation researching the sale of farmland across the globe, say these funds control around $US23 trillion in assets, of which some $US100 billion is invested in commodities. Of this, between $US5 and $US15 billion is set aside for farmland acquisitions — GRAIN thinks this will double by 2015.

And food isn’t the only target of the buy-up: foreign-owned companies are also eyeing off local energy resources, even those that sit on prime farmland. As The Australian reported recently, Chinese state-owned miner Shenhua Watermark Coal has purchased 43 properties over the last two years in the NSW Northern Tablelands for a total of $230 million.

The acquisitions are part of a 30-year resource project in the Liverpool Plain foodbowl, which saw the NSW government net $300 million for an exploration license from the company in 2006. None of Shenhua’s purchases required FIRB approval, as they all fell under the $231 million threshold.

Michael Clift, a sixth-generation farmer who has so far resisted the temptation to sell, now says he might soon have no choice. “If there’s a massive big coal mine right at my back door, my family can’t live like that,” he told The Australian.

The Shenhua and Hassad deals provoked reaction from Liberals Josh Frydenberg and Bill Heffernan, as well as the Greens and independents Nick Xenophon and Tony Windsor.

When quizzed on ABC Radio about the Shenhua buy-up, Prime Minister Julia Gillard tasked Assistant Treasurer Bill Shorten with assessing the “total picture” of land ownership across the country. It marks the first political move on the issue since shadow minister John Cobb put forward a motion earlier this year asking the ABS to obtain a snapshot of foreign agricultural ownership.

But political capital may only reach so far. A Senate economics committee recently quashed a proposal by Nick Xenophon and Greens deputy leader Christine Milne which would require Treasury approval for any purchase of farmland over five hectares. A Treasury submission said foreign investment brought additional capital and jobs to the sector.

And as Nationals leader Barnaby Joyce and entrepreneur Dick Smith told Crikey recently, regardless of what any count reveals, it will be difficult to retrieve prime agricultural land when it’s gone.

In fact, the Shenhua buy-up was flagged almost a year ago, when local farmers expressed their fears that the mining giant’s exploratory missions could contaminate the aquifer beneath the rich black-soil of the plains.

And regardless of how the Shenhua deal pans out — and miners have promised to leave no trace of their extraction — it’s not the first time prime agricultural land has made way for the interests of miners. Last year, Sino Iron — a joint venture between Hong Kong-based Citic Pacific and China’s state-owned Metallurgical Group Corporation — acquired the rights from resource magnate Clive Palmer to mine Mardie Station in WA. At 632,000 hectares, it is one of the biggest cattle farms in the state.

In 2008, Greens leader Bob Brown joined a farmers’ blockade against partly foreign-owned mining giant BHP Billiton, which was looking to make exploratory efforts near the farming town of Caroona. Santos has also been in the area looking to drill for coal seam gas, prompting further community concern.

When i heard this am that the Government could not say what percentage of land was owned by foreign Corporations, I nearly choked on my porridge.

What sort of shonky business is operating in Canberra that our Government can’t even keep track of the farm, of which bits are no longer ours.

I despair of the competency of our elected representatives on both sides.

Thank God for the Greens- at least they are questioning the wisdom of our current – Flog it off and don’t ask about the consequences approach to our children’s future.

So what is new ? The same thing is happening in the resource sector. Andrew Liveris the CEO of Dow Chemicals in the USA is from a local Darwin family; recently he was in Darwin and while there he complained about the lack of downstream production in the gas industry in Australia and more particularly in Darwin. Saying among other things that Dow would like to be here if there was a guaranteed supply of gas for chemical production. It looks like all going to Japan and elsewhere though. Nice work ! we will end up with some large holes in the ground and little else.

The FIRB threshhold needs very urgently to be revised downwards. $231 million is absurdly generous to foreigners. Just try buying land in Japan for instance.

Nevertheless it just shows you how slack everything is here in good ol’ Oz. What was that about being a quarry for the rest of the world?

Bill Shorten on Radio National this morning was quick to blame state governments.

This situation beggars belief. We deserve what we get out of all of this. We voted these animals in to the parliament after all. Sorry, I am giving animals a bad name,.

Why are Australia’s prime food and livestock parcels of land being snatched up by forward thinking foreign investors? Other fertile areas around the globe are also being acquired at a frenetic pace. The answer is blinding obvious: climate change is real and the astute buyers’ lands are unproductive or soon will be while their populations show no sign of decreasing. Food security will make the war on terror look like a sad side show. And the 3 ring circus goes on and on.

For example, the aussie battler is bitchin’ to get more middle class welfare and in a frenzy of denial over climate change. We listened to Abbott and failed to look over the horizon. Don’t expect any favours from foreigners or our political folk to feed future families! (Enough f words – we all know where that’s heading.)

With Queensland set to sell sugar to the US military as bio fuel the pill will surely be a bitter swallow.

Over in the other circus tent there is a righteous sigh as aussie beef is humanely slaughtered somewhere overseas. Meanwhile truly low income people in Australia are wondering if they’ll ever be able to afford a beef roast again in their lifetime.

Diversion, denial and a diet of drivel. Who’s the biggest loser now?

(((A Treasury submission said foreign investment brought additional capital and jobs to the sector.)))

Tired of hearing this same old lame excuse put out by these faceless bureaucrats, as they sell our soul to foreign interests. Food producing rural properties are keynote to the health of any nation and to sell it off under existing conditions is TREASONOUS!!!

Australia is becoming a whore who refuses to close her legs.