Spare a sympathetic thought for Wayne. The Australian economy, as Treasurer Wayne Swan keeps reminding us, is doing better than that of any developed country in the world yet the pollsters tell us the people just don’t care. It all seems rather unjust in a way but his frustration is not unique.

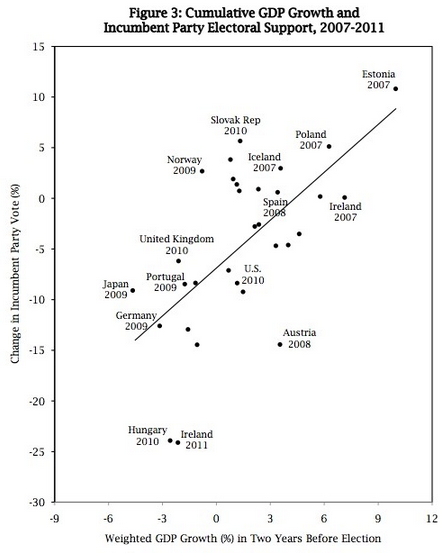

Washington Post blogger Ezra Klein draws attention to a paper by Vanderbilt political scientist Larry Bartels that finds there is no evidence that voters are at all interested in whether their economies are performing better relative to other economies in other countries. The only thing that interests them is the absolute performance of their economy. And that, notes Klein, influences them a lot.

Bartels looked at elections in many places and came up with this summary:

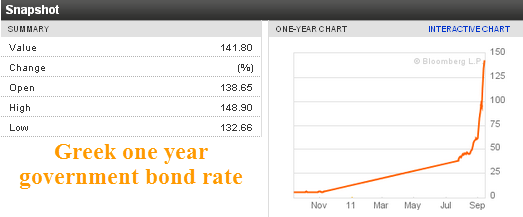

Talk is cheap but the interest’s high. We that’s that settled then. French President Nicolas Sarkozy and German Chancellor Angela Merkel have had a chat with Greece’s George Papandreou and declared they are “convinced” Greece will stay in the euro area. All will be for the best in the best of all possible Europes.

So how about lending the Greeks a Euro while the bail out plans materialize? The going interest rate on a one year Greek government bond is only a modest 141.8%. That’s a sign of confidence for you.

Kill ’em older. It would have seemed a good idea at the time; put restrictions on the youngest drivers, the ones that proportionally die most in accidents. Prohibit them taking to the road during the more dangerous nighttime and limit the number of passengers these driving beginners can carry. The United States led the way with these graduated drivers license (GDL) programs and the idea continually bobs up in Australia.

And sure enough a recent study shows that stronger GDL programs are associated with lower incidence of fatal crashes for 16-year-old drivers, compared with programs having none of the key GDL elements. The findings are published in this week’s Journal of the American Medical Association (access to the free abstract available here with a story based on the journal article on the NPR website).

Yet the figures in the US show that fatal crash incidence among teen drivers increased with age, from 28.2 per 100 000 person-years (16-year-old drivers) to 36.9 per 100 000 (17-year-olds), before reaching a plateau of 46.2 per 100 000 (18-year-olds) and 44.0 per 100 000 (19-year-olds).

And the conclusion of the authors?

In the United States, stronger GDL programs with restrictions on nighttime driving as well as allowed passengers, relative to programs with none of the key GDL elements, were associated with substantially lower fatal crash incidence for 16-year-old drivers but somewhat higher fatal crash incidence for 18-year-old drivers. Future studies should seek to determine what accounts for the increase among 18-year-old drivers and whether refinements in GDL programs can reduce this association.

The Los Angeles Times is somewhat more forthright in its interpretation:

For more than a decade, California and other states have kept their newest teen drivers on a tight leash, restricting the hours when they can get behind the wheel and whom they can bring along as passengers. Public officials were confident that their get-tough policies were saving lives.

Now, though, a nationwide analysis of crash data suggests that the restrictions may have backfired: While the number of fatal crashes among 16- and 17-year-old drivers has fallen, deadly accidents among 18-to-19-year-olds have risen by an almost equal amount. In effect, experts say, the programs that dole out driving privileges in stages, however well-intentioned, have merely shifted the ranks of inexperienced drivers from younger to older teens.

Retiring at starting age. As the population gets older the politicians seem to get young. Maybe it’s just that I’m of pensionable age but I can’t help thinking that there’s something wrong when a 49 year old retires while pointing to the need for renewal in his party’s ranks.

The latest to do so is Queensland’s Deputy Premier Paul Lucas who will retreat to the backbench on Friday to serve out the few remaining months of his term before standing down altogether. By my reckoning he is just approaching the age when he might have enough wisdom to contribute something. If Labor hangs on to his seat at the forthcoming election, no doubt he will be replaced by another young Labor up and comer with real life experience approaching zero.

Barry gets it though. New South Wales Premier Barry O’Farrell understands the aging thing. He’s announced that his state will have an annual Grand Parents Day on the last Sunday of October each year in recognition of the “invaluable role” grandparents play in families.

“Grandparents are the unsung heroes in our community, and it’s only appropriate they are recognised with a day in their honour,” Mr O’Farrell said.

What a wise fellow.

Health care leads the way. Jobs in mining might get all the publicity but it is health care and social assistance where the growth in the workforce is really happening. From the Labour Force, Australia, Detailed, Quarterly, Aug 2011 report out today from the Australian Bureau of Statistics:

Hi Richard, some semantics re: Greece, I believe you are referencing a yield, not an interest rate.

Another way to express it would be to say that the bonds are currently trading in the secondary market for roughly 41c in the dollar.

re driving deaths in US; maybe the older teens have easier access to alcohol? Is there any correlation between fatalities and drink driving (as there is everywhere else) – which might show up more in older (young) drivers?

Brett

The drinking age has been 21 almost everywhere in the US since Ronald Reagan tied federal road fund grants to the states to them increasing the age from 18 to 21 so the drink should not account for an increase in the number of deaths in the 18+ category and the reduction in those for 16 year olds.

Rickpike

I take your point. Yield is the appropriate word.

I must confess to being a bit confused about the 141.8% yield. Why is it right that the bonds are currently trading in the secondary market for roughly 41c in the dollar? I thought it would have to be much less than that.

Is this the right sum:

Principal amount $100

Interest rate (say) 4%

Interest received $4

Yield 4%

100 of principal bought for $2.84

Interest rate 4% of $100

Interest amount $4

Yield 141%

Hi Richard,

Your sums are almost correct, what you are missing is factoring in that the principal amount also gets repaid at the end of the bond period.

So for $41 you are buying the “chance” of receiving $100 in 1 years time. You might also get a coupon payment which would slightly change the metric, but I would expect a 1yr note to be “Zero Coupon”.

Importantly, these prices being referenced are in the secondary market, which is potentially very lightly traded. The Greek government itself isn’t having to pay such a high amount on its debt, it is probably offering much longer dated notes with some sort of GR/FR/UK guarantee (although you wont be able to prove that!).

This is a nifty tool for figuring out the current bond price for any given yield.

http://www.moneychimp.com/calculator/bond_yield_calculator.htm

Best,

RP