Steady growth continues. Australians might be prudently paying down their credit cards a little (see yesterday’s chunky bits) but they have not completely stopped spending.

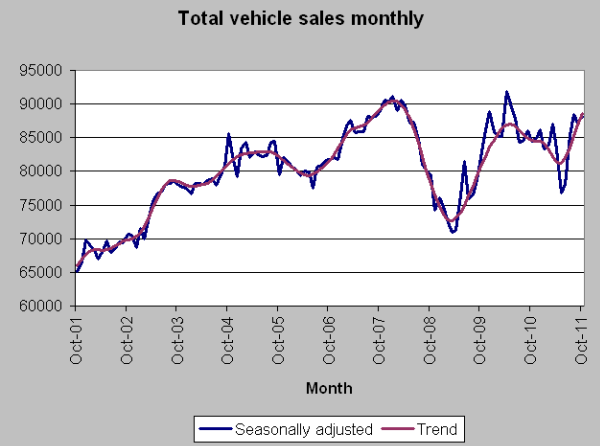

Motor vehicle sales figures from the Australian Bureau of Statistics show continuing steady growth. The October 2011 seasonally adjusted estimate for new motor vehicle sales (88 182) increased by 1.1% when compared with September with the trend estimate increasing by 1.8%.

It is yet another economic indicator pointing to Australia continuing to do better than the rest of the developed world.

Not so encouraging. Figures that are not so hopeful are today’s from the Economic Research Department of the Federal Reserve Bank of San Francisco. The bank’s research boffins have studied their tea leaves and determined that the odds are greater than 50% that the USA will experience a recession sometime early in 2012.

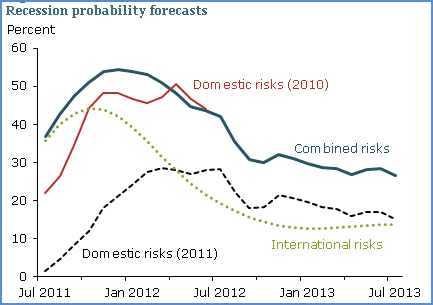

The graph above illustrates the bank’s updated recession probability forecasts. The thin red line shows the LEI-based predictions based on the leading economic indicator index (LEI) calculated in 2010, which run until 2012. The black dashed line shows the LEI-based predictions using data through August 2011 and extends until mid-2013.

The dotted green line shows the predictions based on composite leading indicators (CLI) index data from the OECD released through July 2011. The thick blue line displays the odds of recession based on combining the lines based on domestic and international factors.

So what does that all mean?:

“To interpret these predictions, think about an experiment in which two coins are flipped, with heads representing recession and tails expansion. One coin represents the recession odds from domestic factors, the other coin from international factors.[The figure] shows the probabilities of flipping heads with the domestic and international coins. The overall probability of recession is reflected in the thick blue line.

In the next few months, the odds of recession due to domestic factors appear reasonably contained. Those odds increase gradually and reach about 30% in the second half of 2012, after which they decline. However, the curve reflecting the international odds suggests more imminent danger to the economy, although this threat is harder to calibrate using historical data and only indirectly reflects the health of the European financial system. Recession odds based on international factors peak at about 45% toward the end of 2011, but decline rapidly thereafter.

The combination of these two recession coins, shown in the combined risks line of {the Figure], is quite disconcerting. It indicates that the odds are greater than 50% that we will experience a recession sometime early in 2012. Because the international odds of recession are more imprecisely estimated, one must be careful with a strict interpretation of this result. But the message is clear. Prudence suggests that the fragile state of the U.S. economy would not easily withstand turbulence coming across the Atlantic.

A European sovereign debt default may well sink the United States back into recession. However, if we navigate the storm through the second half of 2012, it appears that danger will recede rapidly in 2013.”

“Quite disconcerting”? Downright worrying when you consider what the OECD has had to say overnight.

The OECD sees gloomy outlook. Composite leading indicators (CLIs) for September 2011, designed to anticipate turning points in economic activity relative to trend, continue pointing to a slowdown in economic activity in most OECD countries and major non-member economies. Compared to last month’s assessment, the CLIs point more strongly to slowdowns in all major economies.

In Japan, Russia and the United States the CLIs point to slowdowns in growth towards long term trends. In Canada, France, Germany, Italy, the United Kingdom, Brazil, China, India and the Euro area, the CLIs point to economic activity falling below long term trend.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.