While today’s November retail sales data from the ABS will be spun in accordance with the current narrative that retail is a disaster area, in fact they confirm exactly what we already knew: department stores, clothing and footwear are struggling, but sectors such as food are doing well.

The media will continue to feed us the whingeing of the likes of Gerry Harvey as though he represents Australian retail — when he’s not even a retailer, but a property owner and ticket-clipper — and miss the bigger story: not merely has there been a secular change in the amount Australians save (that much has made it through into the media coverage), but what we’re buying has changed. We’re not just buying things such as clothes and footwear online from overseas, we’re buying fewer goods and more services, we’re buying more food, including eating out, and less of department store items, we’re buying more cars and fewer personal goods like books (at least locally).

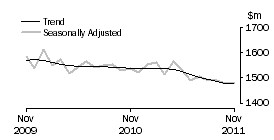

This is reflected again in today’s figures from November: department stores down 0.2% in trend terms and clothing, footwear and accessories down 0.1% (books and newspapers were down 0.9%). Both, of course, have had terrible years. This is department stores:

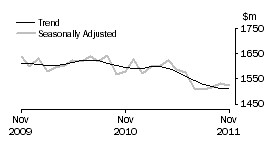

And you can see from clothing, footwear and accessories that, like department stores, things worsened substantially after mid-2011.

That might suggest that the rolling waves of bad news from Europe, and maybe the incessant claims that the carbon pricing package would destroy the economy, started to affect consumers, but that’s the only basis on which the likes of DJs and Gerry Harvey can complain fairly. Otherwise, they’re facing a long-term decline.

In contrast, food retailing rose 0.4% in November in trend terms after a strong year (despite the food manufacturing lobby claiming it’s under siege); cafés and restaurants rose 0.6%. And household goods grew as well in trend terms — up 0.6%, although it was flat in seasonally adjusted terms. That included electrical goods (0.7%), suggesting Gerry Harvey should stop whingeing about thrifty consumers and work out why his franchisees are losing market share, and items such as hardware.

In short, for all the gloom and doom from commentators, big retailers and the journalists who give them coverage, retail in Australia is surprisingly healthy. But it’s changing to reflect changes in consumer preferences, and not in a way that suits the dinosaurs of the industry.

I can tell you why HN is losing out. It’s too expensive compared to the nearby discounters. Even stuff like inkjet printer cartridges are $10 /item cheaper at the local newsagent.

And ay least one other clothing retailer I keep an eye on is doing some very creative marketing of high quality goods.