New site for clean technology buffs to bookmark. RenewEconomy, a new online publication created by former Climate Spectator editor Giles Parkinson, launched yesterday. The site aims to cover clean technology and a green economy, with new articles appearing daily and a free email newsletter available.

Prior to Climate Spectator, Parkinson served as business editor and deputy editor at The Australian Financial Review and penned columns for The Australian and The Bulletin. There’ll be more of a focus on technology over the politics of climate policy in this new venture, Parkinson tells us.

The site is funded by private investors — who Parkinson declines to name — but is expected to operate on an advertising model. “We’re pretty confident that’s going to work,” he said. — Amber Jamieson (read the full story at Rooted)

Shoebridge quits press for Ten spin. The Ten Network has raised eyebrows by hiring Neil Shoebridge, The Australian Financial Review‘s media and marketing editor of the past nine years. Shoebridge will fill a new role as the network’s director of corporate and public communications, reporting to new CEO James Warburton.

Shoebridge starts with Ten on February 20, so will The AFR allow him to write media and marketing stories when the Monday pages he normally fills return next week? The reason the appointment has raised eyebrows is that Shoebridge has no experience in the corporate relations and public communications areas at all, except as a recipient of spin. One former person in this area at Ten said that they had seen a lot in TV and nothing much surprised them these days about events in the industry, but the Shoebridge appointment was certainly a big surprise.

The other interesting point is that the appointment confirms Warburton was one of Shoebridge’s important TV industry contacts while he was at Seven as sales chief and CEO in waiting. — Glenn Dyer

Compare the document to the story. The Fairfax websites today are reporting:

“The International Monetary Fund has called on Australia’s biggest banks to bolster their levels of capital even further, warning the sector may not be able to withstand the dual shock of a residential property downturn and losses on corporate lending.

“The finding follows a stress test of Australia’s banking system run by the IMF late last year which modelled the impact of an Irish-style economic crunch taking place locally.

“The findings come as Australian banks are already pushing ahead to meet tougher global banking rules known as Basel III.

“While the IMF findings have no direct impact on the running of Australia’s banking sector, the conclusions will be taken seriously by regulators and politicians. However, they are expected to be strongly resisted by bank executives who have already been critical of Basel III.

“They argued by putting aside more funds to protect the balance sheet would increase the cost and reduce the amount of funds available for lending.

“‘Stress tests calibrated on the Irish crisis experience show that the [Australian] banks could withstand sizeable shocks to their exposure to residential mortgages,’ the IMF said in its study titled Bank Capital Adequacy in Australia.”

But on the first page of the document on the IMF website that the article is referring to is this rather important disclaimer:

“Disclaimer: This Working Paper should not be reported as representing the views of the IMF. The views expressed in this Working Paper are those of the author(s) and do not necessarily represent those of the IMF or IMF policy. Working Papers describe research in progress by the author(s) and are published to elicit comments and to further debate”

And the summary of the working paper, also on the front page, has a rather different flavour:

“The paper finds that, given Australia’s conservative approach in implementing the Basel II framework, Australian banks’ headline capital ratios underestimate their capital strengths. Given their high capital quality and the progress in their funding profiles since the global financial crisis, the Australian banks are making good progress toward meeting the Basel III requirements, including the new liquidity standards.

“Stress tests calibrated on the Irish crisis experience show that the banks could withstand sizable shocks to their exposure to residential mortgages. However, combining residential mortgage shocks with corporate losses expected at the peak of the global financial crisis would put more pressure on Australian banks’ capital. Therefore, it would be useful to consider the merits of higher capital requirements for systemically important domestic banks.”

That is a rather supportive endorsement of the capital strength of the Australian banks and not quite the story being reported on the Fairfax websites. — Glenn Dyer

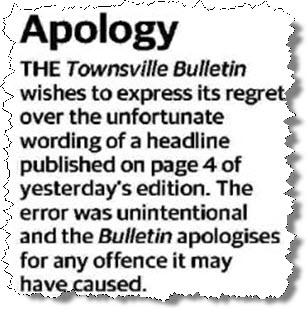

Department of Corrections. An odd apology in today’s Townsville Bulletin …

What could it be referring to? How about a joke headline on an article discussing the recent stroke of the former CEO of Townsville City Council:

More from the Ministry of Inappropriate Headlines. From today’s Courier Mail:

And over at today’s NT News we found this little number:

Front page of the day. Croatian daily newspaper Vecernji List celebrates — “Croatia voted for the EU!” — that country’s resounding yes vote to become the 28th member of the European Union in 2013.

Watson: Times should face hacking inquiry

“The MP Tom Watson has called on police to investigate email computer hacking by staff at the Times. This follows the disclosure that a Times reporter broke into the email of an award-winning police blogger, who wrote under the name Nightjack, and subsequently published an article revealing the blogger’s identity.” — The Guardian

After 71 years paper stops election endorsements

“What we will not do is endorse candidates. We have come to doubt the value of candidate endorsements by this newspaper or any newspaper, especially in a day when a multitude of information sources allow even a casual voter to be better informed than ever before.” — Chicago Sun-Times

Chase Carey, Murdoch’s trusted 2IC

“The question of succession at News Corporation is a delicate one. Most senior executives declined to comment on the record about Mr. Carey, expressing concern that any positive observations might appear as a slight to James Murdoch. Mr. Carey declined to comment.” — The New York Times

Lara Logan speaks about her assault in Egypt

“Lara Logan is back on the air, she’s got nine stories in the works at 60 Minutes and a new show set to launch — but she still battles the demons of a horrific gang sexual assault, even sometimes while she puts her young daughter to bed” — NY Daily News

Broadcaster gets into publishing

“NBC News is getting into the publishing business with a new imprint called NBC Publishing, which will focus on digital publishing and eBooks with videos.” — Media Bistro

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.