People understand what a retailer is: it’s where you go to buy and collect stuff — shoes, clothes, groceries, petrol and other items. They are the points of sale between the manufacturers and wholesalers, and the consumers.

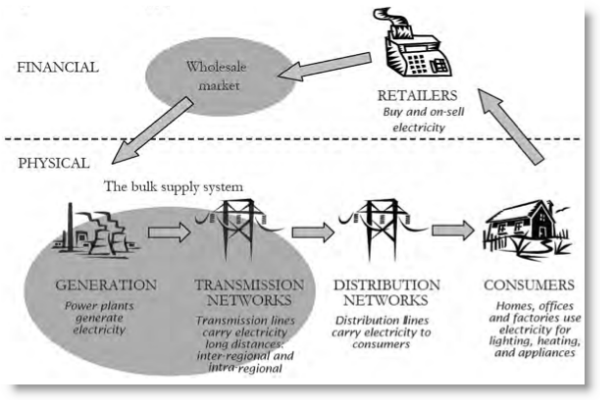

But what about electricity retailers? Is that where you go to buy and collect electricity? Well, actually, no. Electricity retailers don’t actually deliver you any electricity at all. As the diagram below — taken from a presentation by UNSW electricity expert Hugh Outhred — will tell you, that comes straight from the generators via the transmission network and the distributors. And now, some of you will get electricity from solar PV modules on your roof.

The electricity retailers are simply competing for the right to send you a bill, to package up a range of tariffs and lock you into a contract. They are the archetypal middle-man, and the question that is now being put is: are they of any use?

The question arises because retailers have long been part of an economic model that relies on consumers buying more electricity. That means that retailers can sell more contracts, generators can build more power stations and distributors can build more poles and wires to transport the electrons. But that business model is now changing — demand is falling, energy efficiency is at a premium, more and more consumers (residential and business) are producing their own energy — and the retailers, like some of the other parts of the value chain — are getting in the way.

One of the biggest problems for retailers is a basic one — they aren’t very good at what they do. They find it almost impossible to hold on to customers. Last year, the major electricity retailers reported that the “churn” rate for 2010-11 was nearly 25%. That means, they lost nearly one in four of their clients, and then they had to go and pay to get them back again, and then bill you for it.

It may have something to do with the long-run inability of retailers to engage with their clients. International surveys show that electricity retailers have the worst relationship with their customers of just about any customer-facing group — their relationships are fleeting, and usually coloured by complaints about price hikes and connection problems.

Still, they make a profit. According to the most recent annual accounts for 2010-11 for the biggest retailers, their gross margin — the difference between the cost of electricity they pay the distributors and generators, and the cost of packaging up you bill and collecting money from customers — was between $150 to $200 per customer. The overall cost of retailers equates to about 15% of your electricity bill, or about $350 a year, depending were you live. That’s nearly half the cost of generation.

But that’s not the end of it. Retailers are now being accused of pocketing hundreds of millions of dollars in profits from schemes that have supported the introduction of technologies such as rooftop solar. For instance, they are allowed by pricing regulators — with the exception of the ACT — to charge customers $40 for each small-scale technology certificates (STCs), when the market price has rarely risen about $26. And there are about 45 million STCs washing around the system this year. That has grossly inflated the cost of the schemes, and the returns to retailers, even with their carrying costs.

And electricity retailers are also accused of picking up more profits from exports of excess electricity back to the grid from rooftop solar systems — for which they pay 6c/kWh (and in some cases nothing at all) and then sell it to the houses in the same street for up to five times as much. The retailers can do this because have managed to convince the pricing regulators that the difference is made up with fixed grid, billing and other costs. But the solar industry reckons they are profiting handsomely — hence the push for a “fair value” of solar.

One thing they do achieve is to manage pricing risk, and the rapid and often steep swings in wholesale electricity prices. They do this through a range of hedging policies and by being “vertically integrated”. That means they also own generators, so when the price moves one way, they make it up by increasing profits elsewhere. Unfortunately for customers, this has meant that few have enjoyed the benefits of the lowest wholesale electricity markets since the start of the NEM. Like banks, electricity retailers are slow to pass on the benefits of falling costs, but quicker to act when prices (or rates) go up.

So what would happen if we got rid of retailers? The biggest challenge would be managing the wholesale price risk — electricity is one of the biggest traded markets, bigger by a long shot than carbon. We would need interval metering throughout and, to provide financial risk management, we would also need a carefully designed derivatives market accessible to small players. Such a market was envisaged in the 1990s, but banks and other financial market players argued that this could have been a constraint on competition.

Outhred says perhaps the best answer is to turn them into service providers. “We need energy service companies instead of retailers,” he says. “Because of the way they operate, energy retailers mess up efficient management of uncertainty and deter end-users from energy efficiency improvements, as well as pocket a fee for doing so.”

Evolving into a service provider, however, would require a massive cultural change. But it may be one that is forced upon them. If the electricity retailing business is about collecting data (metering) and sending out bills, then there is a host of competing organisations that are specialists in data management and IT that can take that role, and offer snappy new devices that offer in-house monitoring and controls. If it is about customer management, there are a host of customer service specialists that can do that better too; and now there are a host of technology providers that can offer alternatives to sourcing electricity from the grid. And now these specialists are recognising their are opportunities to work together.

The best chance the retailers have of surviving — apart from regulatory protection — is to strike up some alliances or their own, and to get out of the way of progress. The sooner the better.

*This article was first published at RenewEconomy

For once, Parkinson is right

Retailers are important so that the public maintains the delusion that there is competition in what is really a privatised monopoly. Silly!

Remote Mine Site electicity supply company PowerCorp has a device called PowerStore which aids in the mangement of supply and demand. They have a web site and have recently merged with another power company.

The concept of storage is the key to solving some of the problems in the article, especially for the

energy service groups now getting together.

PowerCorp is/was an energy service company of the sort postulated in the article.

Do not see why their operations cannot be applied to slices of the grid of similar size to their remote mine site operations. And almost immediately, considering their long history of operation.

Something similar to this established energy service business could knock the retailers off their pedestal.

But don’t monopolies protect themselves by denying the very existence of competition.

Remote area mine site energy provision? Suely nothing at all happens outside the Grid?

All those mining ans electrical engineers? What would they know about energy? Ridiculous!

But don’t monopolies protect themselves by deying the very existence of competition?

What happens at remote area mine sites beyond the Grid.

Is someone already servicing their energy needs?

Are mining and electrical engineers involved? What would they know about energy and how to use it?

Better not ask Eh?

“Last year, the major electricity retailers reported that the “churn” rate for 2010-11 was nearly 25%”

Rather than a bad sign, that’s good as it’s usually a sign that the level of competition is high.

Competition is the key to lower prices. You remove the retailers, you get less competition as the cost barriers of becoming a (serious) supplier of energy are too high (the solar distributed model is not quite there yet). Becoming a retailer, on the other hand, isn’t as difficult and they can concentrate on contract management efficiencies, leaving power generation and distribution to the big boys.