Gina Rinehart’s stunningly inept intervention last week blaming the envious poor for their own stasis may have drawn international ridicule, but many of her assertions were also plain wrong.

In the latest incarnation of Crikey‘s Get Fact series, we decided to test the billionaire mining heiress’ central premise borrowed from the American GOP pulpit — that it is “business and investment”, not “high-tax socialist policies” that create jobs. Take it away, Gina:

“… those who hurt the most when investments are killed off by taxes, green tape and socialist policies that are not friendly to business or conducive to investment are those who usually vote for the anti-business socialist parties. And for them, the price is very high. It’s a job lost, when they have few savings, a mortgage to meet and children to clothe and feed.”

First, let’s start with her central claim: that Australia has “high taxes”. As Wayne Swan has repeatedly pointed out, our tax to GDP ratio is lower than almost all OECD countries, falling from 24.2% before the 2007 election to 20.1% in 2010-11.

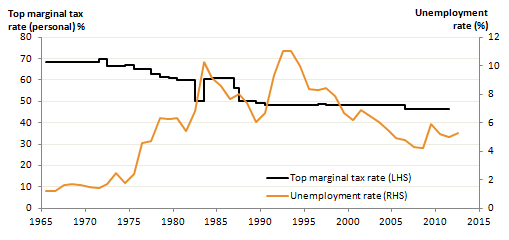

During the 1950s, ’60s and early ’70s — with the top marginal tax rate (or MTR) well over 60% — unemployment oscillated between 1% and 2%. That’s full employment by anyone’s definition, as the following graph starkly illustrates.

Historical marginal tax rates from the AFTS Review; unemployment rate from ABS 6202 from 1978 (Source: ACTU; unemployment rates prior to 1978 are from Butlin 1977)

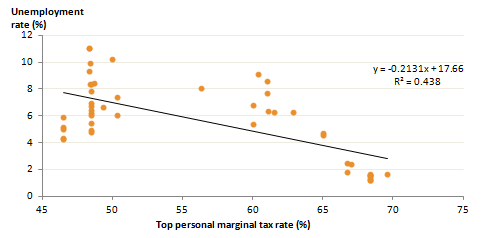

In fact, despite a number of variables being in play, the years with a higher MTR actually tended to equate to a lower unemployment rate (the dots represent a year between 1965 and 2011):

Historical marginal tax rates from the AFTS Review; unemployment rate from ABS 6202 from 1978, source ACTU

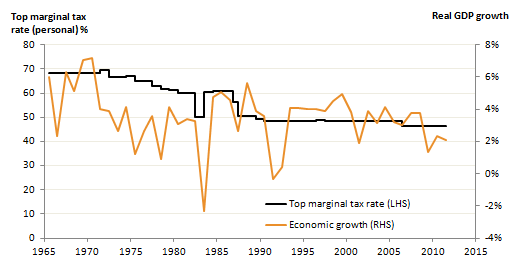

What about Rinehart’s claim that economic growth is apparently being held to ransom by “the socialist path of high taxes and excessive regulation”? As the following graph shows, higher top marginal tax rates didn’t seem to prove an impediment to economic growth either:

Historical marginal tax rates from the AFTS Review; real GDP data from ABS 5204; source ACTU

The Hancock Prospecting scion’s claims don’t even make sense in the country where her rhetoric is drawn from. In the US, recent data has debunked the link between high taxes and high unemployment. The New York Times‘ Economix blog earlier this year quoted from a new OECD study demonstrating that despite the US being a low tax country with a correspondingly low “tax wedge” (“the difference between the cost to an employer of employing a worker and the after-tax reward that the employee receives”), its unemployment rate remains bulbous.

Author Bruce Bartlett showed that federal revenues will sit at 15.8% of GDP this year against a postwar average of about 18.5%. Taxes, Bartlett reports, “averaged 18.2% during the Reagan administration; indeed, at their lowest point in 1984, federal revenues were 1.5% of GDP higher than they are now.”And when spending is taken into account, the economic footprint of the Australian government as a share of the economy seems even smaller. Only Switzerland and South Korea have both lower government revenue and lower expenditure as a proportion of GDP of all the OECD countries:

So what would a Rinetopia look like? As Crikey discovered last year, the world’s richest woman used Australian Resources & Investment to back the development of a Shenzhen-style northern economic zone that would let her import cheap labour and avoid taxes.

An exemplar of how to run an economy was apparently the former West Germany. Post-War FRG finance minister Ludwig Erhard, she reckoned, “believed in the potential of a citizenry freed from the burden of government planners and allowed to build wealth for themselves”.

In January 1990, the unemployment rate in the GDR was 0.1% — but reunification meant that by early 1992 one out of three East German workers had lost their jobs as the Treuhand ran rampant. While the FRG’s unemployment rate dipped under 1% in the 1960s, by 1989 it had reached 7.1% — a big discrepancy, even though unemployment in the GDR was illegal and the rate was almost certainly massaged. Of course, employment in West Germany was arguably bolstered by the “Rhineist” tax-and-spend policies Rinehart derides.

As James Thomson documents elsewhere in today’s Crikey, Gina might have seen her wealth erode $9 billion as the iron ore spot price declines amid waning Chinese demand. In other words, it’s the inability of the Chinese government to engineer a broad demand-driven middle class — not the Australian government’s “socialism” — that will be the biggest break on her profits. And Australia’s unemployment rate is a different matter entirely.

Accordingly, we rate Rinehart’s claims about class warfare, taxes and unemployment as utter bollocks.

Surprised? People believe what they want to believe. None of us let facts get in the way of a good theory, especially if our theory is that everybody else has got it wrong, and if they’d just implement our good idea then the whole world would be a better place… Gina might be completely balmy, but is anybody seriously surprised that she holds these views?

I’ve written about it a little bit here: http://logicisstupid.blogspot.com.au/2012/09/fudging-facts.html

Well, we all knew it was utter bollocks, even without the facts!!!

I like Gina – she proves money can’t buy everything – especially intelligence.

Like (her) money – either you’re born with it or you’re not.

Ahh, Gina, bless. Class warfare? Surely one needs to display some class. Looks like you might have lost that particular war.

Never ceases to amaze me how the ‘millionaires and billionaires’ can trot out these oh so inspirational stories about working hard and walking miles and miles, and, against all odds ending up owning the company. Awww.

Strangely, never a word about all the many others who’ve worked hard but never managed to make it to ‘millionaire or billionaire’ status simply because the economy is not set up to accommodate it. I mean who would clean your house Gina, if everybody else in Aus was a millionaire/billionaire?

BTW. I’m in Victoria, so may have missed seeing the legislation pass, but when did Western Australia change its name?

I think that these arguments about taxation being too high are self-serving. Gina gets what’s left over from the revenue generated by her holdings after paying for her inputs, including her employees’ labour. She doesn’t want to pay any more for these than she has to and will use whatever influence she has to keep these down.