AGL has just released another of its Applied Economic and Policy Research Working Papers, illustrating a rather counter-intuitive result: that abolishing or substantially reducing the Renewable Energy Target might actually increase overall costs to consumers.

On face value, this doesn’t seem to make much sense because reducing the RET would mean consumers would save a large amount of money from having to pay for Renewable Energy Certificates (referred to as LGCs). However, AGL’s paper suggests there is a counter effect from substantially changing the RET — it causes the finance sector to become more nervous about lending to the power generation sector more generally.

Based on AGL’s survey of project finance professionals, the bankers see changes to the RET not just as an issue about renewable energy, but something that reflects more generally on government’s willingness to change the regulatory goalposts in the power sector. They figure that while it might be renewables getting punished today, it might be a gas or coal power plant tomorrow.

Therefore to cover this perception of higher regulatory risk, financiers will charge higher interest rates to finance fossil-fuel plant, as well as renewables. These higher finance charges only make a small difference to the cost of getting power from a new baseload gas power plant, increasing the cost per megawatt-hour by $0.73. But this then flows through to the cost of all electricity purchased in the wholesale market as it ultimately sets the market-clearing price. This is in contrast to the RET, which only increases costs for about 10% of supply while depressing prices in the overall wholesale electricity market.

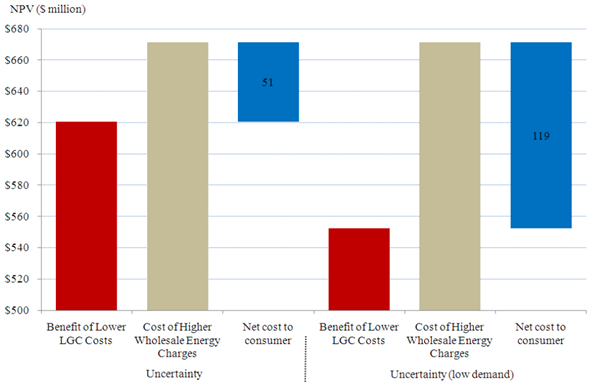

The chart below provides a summary of AGL’s ultimate findings. There are two scenarios shown. The one on the left is where the large-scale RET is completely abolished, while the one on the right is if the large-scale RET was reduced to 27,000 gigawatt-hours as Origin has proposed.

In both scenarios there is a large saving illustrated by the red bar in not having to buy LGCs to support new wind and other large-scale renewable energy projects. But because of the increase in debt premiums affecting the overall energy market, this causes increases in wholesale energy costs (the grey bars). The end result is that consumers may potentially end-up worse off because changes to the RET increase perceptions of regulatory risk more generally.

Net cost to consumers from savings in reducing the RET versus increased costs from financing uncertainty (source: AGL Applied Economic and Policy Research 2012)

In chatting with one of the authors of the paper, Tim Nelson, he explained that reductions in electricity demand could be used as a justification by government for a range of retrospective regulatory changes that extend well beyond the RET. These might save consumers money in the short-term but at the expense of greater perceptions of investment risk.

Now of course you’d expect this from AGL as they have one of the better renewable energy project portfolios. But if you look rather closely at the AGL paper, it appears to suggest that this is what TRUenergy also believed only a few months ago. The paper not only surveyed project financiers, but also 11 companies involved in electricity retailing and renewable energy project development. Ten of these respondents stated that no amendments to the LRET should be made through the upcoming RET review, with just one responding that amendments should be made to reduce the target.

While the paper does not explicitly mention Origin and TRUenergy as respondents, it is obvious they participated. I don’t have much doubt that Origin would have been the one arguing for amendments, leaving TRU siding with the other 10 that no amendments should be made.

Also it’s interesting that TRUenergy made a remarkably similar argument to AGL’s paper in its own submission to government on January 28, 2010. The submission stated in relation to the RET:

“… a stable policy framework is the single most important policy-related determinant of a participants ability to manage risk and invest efficiently.”

The submission then went on to explain:

“It is imperative that policy-makers are sensitive to the fact that unpredictable changes to the policy framework impose regulatory risk on market participants and ultimately a cost on energy consumers and the economy more broadly. This cost manifests not only in the form of loss making positions of some market participants which have to be recovered, at least in part, via increased energy prices, but also in form of a rational reluctance of market participants to take longer term positions in the market in the future. That is, market participants are more inclined to take a short term view and tolerate greater volatility over the long term simply because policy settings cannot be relied upon as robust investment signals. Unnecessary volatility comes at a cost to energy consumers and the economy more broadly.”

*This article was first published at Climate Spectator

Well since the states and Feds have been stuffing about with regulation in the Renewable energy industry since 2004, I would say that regulatory/political risk is already priced into the costs of project financing.

Adjusting the RET can only benefit consumers in my opinion and should not increase the risk premium by any significant amount (if any)

What is more it is not beyond the wit of homo politicus to choose to undo the adverse effects on financing by sufficiently watertight legal guarantees. It certainly sounds as though AGL is issuing propaganda which will support its competitive position and the bonuses of its senior executives.

Pricing in the power industry is already a tangled, arcane mess, ideal for rent-seekers and chancers. MRET made it worse. Get rid of it.

It should be clear by now that it makes no significant difference to emissions.