Twenty minutes into our interview, David Gonski makes a startling admission — he’s not sure why The Power Index even exists: “Frankly, I don’t know what power is … who’s to say if I’m less or more powerful than the man who turns on the lights to let me in the lift each morning?”

It’s a curious approach for Australia’s leading boardroom fixer, a “Mafia don” who surfs the upper echelons of Australian government and business life like some kind of beneficent deity. Renowned for his mad skills since being crowned a Freehills partner at 25, the Cape Town native insists his power — if it’s real — is symptomatic of his head-down attitude.

“My name is synonymous with hard work. That’s all I offer — hard work. I think that they expect me to work very hard in these roles and so I have to make sure I can. If you look at my background I haven’t been a CEO, I’m an immigrant … I’m hopefully someone who has some skills from experience,” he said.

In a rare, wide-ranging conversation, Gonski exudes torrents of humility given his genuine, far-reaching impact. A veteran of over 40 corporate and not-for-profit boards, he currently chairs Coca-Cola, Investec Bank, Therese Rein’s welfare-to-work operation Ingeus, the $80 billion federal government Future Fund and the Sydney Theatre Company, amid a swag of other senior gigs that, in his words, “round out” his life.

“All of us have to be rounded because when we come to the board or decision making we can bring experience from other sectors, we can get trust from those sectors and we can also use our contacts,” he explained.

Now 59, he may not command an ASX market capitalisation the size of Lindsay Maxsted or Michael Chaney, but he’s the undisputed go-to man for government and a sounding board for capital — and therefore No. 1 on The Power Index‘s business directors list. Slap his name at the front of a controversial report — like his recent review of education funding — and discover how his famed objectivity can work as a political wedge to turn bills into law.

The softly-spoken operator they call “Mr Networks” gives off the air of someone who’s seen and heard it all before, even if he never explicitly spells it out. And for someone whose views are taken seriously by most of the top political and business figures over the past 30 years, the “who, me?” schtick occasionally comes off as a bit humblebraggy.

Indeed, he’s in constant demand, but regularly turns roles down. “Of course I say no! I don’t want to big note myself but I say no often. I don’t just do what is given to me. I’m choosy, people don’t pick me because they think ‘you know we should have him on the board ‘cos he’s a good name’, they choose me for my advice,” he said.

(Gonski’s bulging CV boasts previous stints at the Takeovers Panel, ANZ, the Art Gallery of New South Wales, the Australia Council, the National Institute for Dramatic Arts and his alumnus Sydney Grammar. He’s also been adviser and confidante for the country’s biggest media honchos like Kerry Packer and Kerry Stokes.)

“I think it’s the same as brain surgeons who are asked regularly to do operations because they’re good, because they have the skills.”

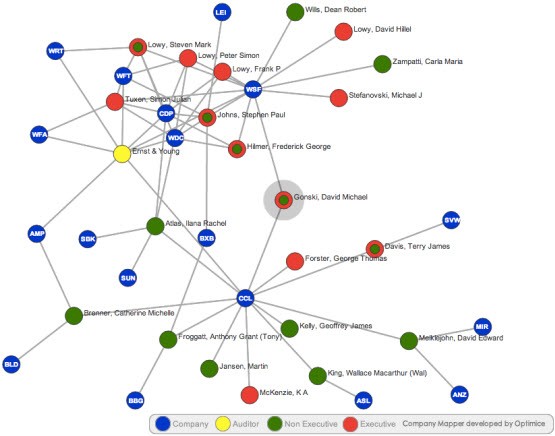

The semi-regular tennis player isn’t a total slouch when it comes to market cap. He may sit well down the Optimice Market Capitalisation Influence Index at No. 268 with oversight of $10 billion (and No. 87 on the MCII connectedness index at $284 billion — see a graphical representation below), but throw in the Future Fund and he’d be well inside the top 20.

Just like his coy approach to power, Gonski is circumspect when quizzed about the existence of a “directors’ club” — a group he’s sometimes considered near the centre of. “I don’t really know what a directors’ club is. There are lot of people who are asked quite regularly to go on boards. But I think it’s the same as brain surgeons who are asked regularly to do operations because they’re good, because they have the skills,” he said.

What about networks, the formal and informal channels that enable elites to co-ordinate their actions? Eschewing Castells, Gonski isn’t convinced of their special status either.

“I don’t know about informal conversations. The reason that people gravitate to people they already know is because they trust them and they know their strength and expertise. It’s very natural, if you look at any professions or business or any sporting thing, people tend to choose people they can trust because they know what they can do. The outsider, the person they don’t know, has to prove themselves … sometimes that works, sometimes that doesn’t,” he said.

Aaron Bertinetti, a senior adviser at proxy advisers CGI Glass Lewis, says Gonski is certainly no outsider. In fact, through formal and informal channels, he’s an established gatekeeper. “He’s the one that controls the decision making and obviously that’s about who gets into the directors’ club in any meaningful way and who doesn’t.”

Bob Every, the chair of Australia’s biggest private sector employer in Wesfarmers, who worked with Gonski at the University of NSW (he’s Chancellor), concurs. “He touches so many sections of the society … David’s got an influence all the way through … I’m often asked why and I just think David is an outstanding listener,” he said.

And the Australian Shareholders’ Association remarks simply that he’s “highly regarded by all, with a superior ability to deal with shareholders, even if it is to convince them that they are not right”.

There’s no doubt that when the bespectacled oracle opens his mouth, people listen. When he recently rejected the government’s current “two strikes” rule for serving board members — arguing the threshold should be increased to 50% — and slapped down proposals on executive “clawbacks”, it made front-page news. And despite speaking out alongside Catherine Livingstone over the issue of women on boards, he doesn’t back legislated quotas, explaining “we’ve just got to keep the pressure on” through existing channels for change “to happen”.

Speaking on board diversity at the Association of Superannuation Funds of Australia conference earlier this month, Gonski noted wryly that a “board with only people like him on it would be a nightmare”.

And he’s keen to expand his definition of power too, offering The Power Index some of his famous advice for free: “If you ever have a quiet period, Andrew, you should analyse what power is. You may well find that there are very powerful people that are never on your lists.”

But based on the current evidence, it’s safe to assume whatever slant is taken, whatever metric is employed, the country’s premier corporate whisperer will reside somewhere near the top.

David Gonski’s directorships:

- Corporate: Coca-Cola Amatil (chair), Investec (chair), Ingeus (chair), Swiss Re Health, Life Australia (chair)

- Not-for-profit/government: Future Fund (chair), Chancellor of the University of NSW, UNSW Foundation Limited (chair), National E-Health Transition Authority (chair), Sydney Theatre Company (chair), Infrastructure NSW

- Previous: Expert Advisory Panel of the Commonwealth review of school funding (chair), Australian Securities Exchange (chair), Takeovers Panel, Singapore Airlines, Art Gallery of NSW (president), Sydney Grammar School board of trustees (chair), ANZ Bank, ING Australia, Australia Council for the Arts (chair), National Institute for Dramatic Art (chair), Film Australia (chair), Westfield, Fairfax Media, Consolidated Media, St Vincent’s Hospital Sydney, Bundanon Trust, Philanthropy Australia, the Australia-Israel Chamber of Commerce, adviser to Frank Lowy, Kerry Packer (co-executor of will), Rupert Murdoch, Izzy Asper, Kerry Stokes

David Gonski’s ASX connections — click to enlarge

Coca cola eh, so no different to a cigarette salesman. Wonder if he looked at the Butterfly Foundation funded report by Deloitte Access Economics, he would be proud of what coca cola and the junk food corporations have achieved I am sure.

“But I think it’s the same as brain surgeons who are asked regularly to do operations because they’re good, because they have the skills,” This is self serving nonsense. I have a _choice_ of which brain surgeon to go to. Because of the directors club, I don’t get a choice. The only names ever put forward are those the existing directors approve of.

If the club of brain surgeon had the incredibly patchy track record of many of these directors, then the club would change pdq.

If this groups of directors are so good, how is that, for example BHP has wasted _hundreds_ of millions of dollars in the last few years on abortive takeovers. Nice work I’m sure for the legion of lawyers, bankers and other corporate leeches. (Not withstanding Ross Gittins comment in his column today that most M&A activity is not beneficial for shareholders).

There needs to a broom put through corporate Australia. A mandatory 50% quota of female directors would be a start. Before anyone says that wouldn’t work, try this next time you’re in a meeting with a bunch of bankers, lawyers or other type A personalities (and the A doesn’t stand for Alpha). Almost certainly they will be all males, maybe a token female or two. Ask the question “Which of you _wouldn’t_ be here if it wasn’t for the fact your’re male”. The notion that only males are qualified is ludicrous. (Oh, and I’m a male BTW).

We should also follow the German example and have a mandatory number of union or employee representatives on boards.

This is a bit off topic but one of the fascinating features of this listing has been the graphic networks of these directors. I’m assuming there’s software to do this- if so, could you tell me how I could get hold of it? I’m also interested in finding out the interconnections between companies…which is a subsidiary of which…hope you can help me.

Hocus pocus Gonski. If he’s so powerful how come he couldn’t swing the ANZ chair?