Women company directors control twice as much capital as their overall representation on ASX companies would indicate, suggesting the fight for boardroom equality is closer to being won than first thought.

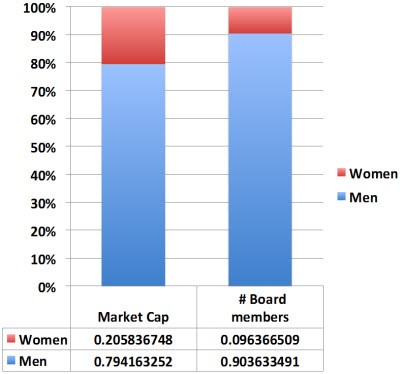

Data compiled exclusively for The Power Index by leading number crunchers Optimice shows that women, despite representing just 9.6% of overall ASX board positions, oversee 20.5% of the index’s total market capitalisation of $1.3 trillion.

The trend is confirmed by analysis of the 72 company directors that control $50 billion or more, of which 16 — or 22% — are women. In turn, that figure is higher than the 13.3% of women on ASX 200 boards — suggesting leading women are more prevalent among the country’s biggest firms.

The sentiment is further enshirned by the Optimice Market Capitalisation Influence Index “connectedness” ranking, which measures the market cap of a director’s first-hand contacts. Of the top 50 most-connected directors, 15 are women. The data, sourced from Thomson Reuters on October 26, shows both the “most connected” woman and the woman that controls the most shareholder wealth is Carolyn Hewson, director of BHP Billiton, Stockland and BT.

But on other measures, female representation — notwithstanding a slow improvement in recent years — remains dire. Women make up just 9.2% of directors on the ASX 500; half of all boards don’t have any women at all. In some traditionally “male” sectors like mining the situation is even grimmer — the federal government’s Equal Opportunity for Women in the Workplace Agency revealed earlier this month that of ASX 500 females, just 5.2% worked for ”materials” companies.

Another barrier to equality is a distinct lack of women chairs — which is arguably where the most power is channelled through the boardroom. Aaron Bertinetti of proxy advisers CGI Glass Lewis has identified a group of female directors that, while they narrowly missed The Power Index‘s top 10 directors’ list (mostly due to their lack of chairs), could well knock off the blokes in the years to come. All serve on at least three boards but lack current chairmanships.

Bertinetti nominates gun directors including Paula Dwyer (Tabcorp, ANZ, Leighton Holdings, Lion), Jane Hemstritch (CBA, Lend Lease, Santos, Tabcorp), Nora Scheinkestel (Pacific Brands, AMP, Orica Ltd, Telstra), Illana Atlas (Suncorp, Coca‑Cola Amatil, Westfield), Nerolie Withnall (ALS, PanAust, Alchemia, Computershare), Anne Brennan (Myer, Nufarm Charter Hall, Cuscal, Argo Investments, Rabobank), Rebecca McGrath (Oz Minerals, Incitec Pivot, CSR, Goodman Group), Sandra McPhee (AGL, Fairfax Media, Westfield Retail Trust, Kathmandu Holdings) and Irene Lee (QBE, Cathay Pacific, Noble Group, Hysan Development Company, Keybridge Capital) as female flag bearers. However, only Dwyer holds a major chair (Tabcorp).

There are several strategies currently bubbling away to get more women on boards. Telstra chairman Catherine Livingstone, who came it at No. 2 on the directors’ list, is involved with the Gillard government’s BoardLinks program to secure female executive talent for public and private sector boards. Labor has committed to a 40% target for government boards by 2015 — female representation currently sits at 35.3%.

A common refrain among male chairs interviewed by The Power Index‘s was that directors should be appointed on talent — and that if boards were forced to tap executive women in greater numbers through legislated quotas, then underqualified boards would result. Some, like NAB chair Michael Chaney, called for the pipeline of women to be enriched first.

But Stockland director Carol Schwartz, who is founding chair of the Women’s Leadership Institute Australia, told The Power Index that she would “love it” if the government immediately legislated for quotas in the manner of the Eurozone, where Justice Commissioner Viviane Reding has proposed that women make up 40% of directors on the boards of big listed companies by 2020.

“The government needs to move to quotas now … the false argument is that there actually aren’t enough women in executive ranks, so by bringing them on board too early we’re depleting executive ranks,” Schwartz says.

“But we’re thinking too narrowly. Why do we need everyone around a board table having been a CEO or a CFO? There are women that run government departments, there are women who run very large and complex professional services firms.”

Next year’s ASX gender breakdown will be eagerly awaited. Despite the gains at the top end, if improvement remains glacial than calls for immediate action may reach critical mass.

(Once more with feeling!) I remember some years ago, Gail Kelly, at the time CEO of St. George Bank,was being interviewed by Alan Kohler on Inside Business, after she had won an award for excellence in banking or some such. He said “Before I ask about that, you’re a successful business woman, how have you coped with the “boys club” and the glass ceiling for women in businiss?” Her reply, as I recall was, “Alan I’ve been in business for 20 years, and I’ve never experienced either of them”. (This is just my memory – to be accurate, check with Alan or Gail). The point is, I think, if you want more women in the top echelons, the way is not to ask for more handouts, but to study women like Gail Kelly.

Boys club. Girls club. We the people continue to pay our taxes in good faith. Some of us invest here and there, in the naive hope our judgment will provide us a greater benefit than that of the proletariat. Meanwhile those with their hands on the controls governments and banks just continue to feed their long lengths into us! How many of you actually enjoy it ? Edward James