The idea that demographically we’re becoming a nation of downsizers is somewhat debatable.

Certainly, affordability constraints are having an effect on the property choice for young home-buying couples, but it doesn’t stop the flow of regular articles suggesting “families are increasingly flocking to high-rise apartments” — and commentators assuring readers we’re becoming a nation of “happy strata dwellers”.

While there’s no doubt we’ll see a future shift into apartment living as density in the capital cities continues to increase, the demographic most are concentrated on is the elderly. This is the great “tsunami” many expect will tip not only the Australian property market over the edge with a flood of supply, but also that of the United Kingdom and the United States — marring any recovery they’ve had to date.

We’re told our baby boomer retirees will all be downsizing en masse — so it’s worth investigating if this is correct and, if so, asking if the relative boom of inner-city apartment stock currently being constructed in our inner-suburban localities — the majority of which consist of four stories or more, principally located in both Melbourne and Sydney — is going to suit their needs?

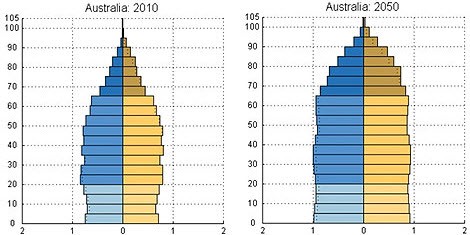

Proportionally we’re growing older as a nation — census data tells us the number of 20- to 44-year-olds has expanded on average by 4.6% per year in the five-year period leading up to the census — however, by 2020 it’s expected to slow to 1.2% per annum (a trend clearly demonstrated by the United Nations World Population pyramid, which extrapolates the data out to 2050).

By the time we get to 2051 the over-65s population will have doubled from the figures recorded in 2004, and the number of those over 85 will have quadrupled. These are the “baby boomers” who hold roughly half of Australia’s housing stock — a mix of owner-occupied dwellings and investments.

The first group of 65-year-old “baby boomers” started their retirement in 2011, and over the next 20 years, the others will follow suit. It’s broadly assumed most will be looking to downsize. With unit and apartment approvals running at an all-time high it’s taken for granted that our elderly downsizers will increasingly migrate towards these inner-city developments, becoming part of the “happy strata dwellers”.

While moving to a smaller dwelling is what most assume as the definition of downsizing, it can equally encapsulate the demographic that simply locate into cheaper accommodation — perhaps not negotiating on interior space, but moving to an area where they can purchase a similar sized home for less expense. The only commonality between the two seems to be land size — few are able to maintain lavish gardens and therefore opt for “low maintenance”.

Late last year the Australian Housing and Urban Research Institute produced the paper Downsizing amongst older Australians. From the ABS data available it’s clear increasing numbers are leaning towards lower density dwellings as they move into their twilight years, and evidence to suggest most retirees who moved in the five-year census interim stayed in the same area. But without deeper analysis — and better data — there’s little to suggest apartment living is the preferable option.

From the 2815 “older people” surveyed, only 43% had “downsized”. While it’s generally assumed the predominant reason for downsizing would be monetary, the AHURI survey reveals the biggest motivation is a “life event” (illness, children leaving home, etc). Financial gain as a motivator lagged behind “death of a partner”.

With this in mind, it’s no surprise the preliminary research also outlines a common trend for older residents to “stay put” — many don’t want to move if they can avoid it. Downsizing from a four-bedroom house to a two-bedroom unit, for example, would not just compromise living space, but also force the mover to “downsize” their possessions.

From those who had downsized, there was certainly evidence of a proportional move into apartments — albeit, the larger proportion continue to reside in a separate house.

From those who did downsize, the predominant difficulty seemed to be sourcing appropriate accommodation. Inner-city suburbs lack the space; outer suburban localities often lack public transport and adequate infrastructure. It’s clear the property needs of home buyers must be addressed by urban planners if we’re to free up the market stagnation which will increasingly affect city dwellers as the population expands.

*This article was originally published at Property Observer

This “boomer” effect on prices was predicted, fourteen years ago, in the press, to be happening about now.

Very critical to the general economy, considering that the unneeded middle class welfare of the Howard era showed up as “asset price inflation” i.e. a housing bubble, the cause overseas of The GFC.

Now, the change of government mooted for later this year will ensure that the austerity policies of the Eastcoast states will be applied nationally, and put downward pressure on the ability of mortgagees to maintain their loan repayments.

New Treasurer Joe Hockey’s flagging of fifty year, or three generation mortgages might stave off this difficulty by extending and reducing existing payments.

But this may not be enough if the “selfish” Baby Boomers rush to cash in their homes and thus further depress the market prices.

Will this Baby Boomer “Boom” bring in the GFC which the Labor party’s exemplary economic actions, in tandem with the RBA, have done so much to avoid?

A return of the Gillard Government with a working majority can continue to provide that anti-GFC insurance and perhaps just ameliorate the baby Boomer saturation of an already overpriced housing market.

But an Abbott victory is tanatamount to national economic suicide, with the Global Financial crisis finally visiting Australia, ensuring business collapses, job losses and a general decay into a “South Timor” scenario of extended, pious poverty. Pope Francis might applaud.

Perhaps it is the only way that people will learn.

They will have the excuse that they were not warned because articles such as this have been very few and far between in the MSM.

As a Boomer and according to so many I’m selfish and uncaring I will be selling up and moving into a Unit of some kind. Smaller, less maintainance, no garden except my vegies that I can grow in pots.

My kids have all growed up and I have finished paying for their University educations, bought them cars, assisted with the deposit on their own homes now its me time.

I started work well before the superannuation contribution was around and wanting a decent retirement I invested in property. That is my retirement fund. Yes I will ,ake a nice “profit” better than I planned. Did I know this at the time I bought – NO. I took a chance.

I will pay tax on the investment properties unlike others who will not pay tax on their superannuation or whinge and complain about paying 15% on earnings in super over $100,000.