Nine floats a Plan B in AFR. The Australian Financial Review has given us yet another exclusive on a possible float of the Nine Network this morning. In 2011 and 2012 the paper produced a stream of stories that a float was being contemplated (as it was) then not contemplated because of the flop in the market and Nine’s weakening earnings and revenue position. Then we had the debt for equity swap that saw previous owners CVC eliminated and the US hedge funds, Apollo and Oaktree, emerge as the owners.

The latest story came at the end of a flat week for the market which should have raised warning signals at the paper about the likelihood of a float happening this year. But there was no sign of that and the story’s authors (one of whom is Nabila Ahmed, who will be working on the new Sunday morning business program to be produced with Nine) who blithely told us six investment banks had bid for Nine and its US hedge fund owners, with the value put at around $3 billion. There was no breakdown of that value, but the story claimed Nine had no debt — it does, around $700 million according to media reports in January. Given the problems of the Ten Network and the weakness in the ad market (falling, not growing), it would be a brave investment bank that took Nine to market.

Seven West Media’s Seven Network and its regional affiliate Prime are among the healthiest TV operators in the country — Southern Cross Austereo, Nine’s putative merger partner, has seen earnings from its regional link-up with Ten slump, along with revenues. It wants this situation to change, but has the Austereo commercial radio businesses to keep earnings ticking over while it sorts out its TV deals. That this report has been allowed to leak out tells us Nine is looking for insurance because its $4 billion merger with Southern Cross Austereo is not going to happen (although Nine is still lobbying federal politicians for the 75% rule to be relaxed to allow that deal to happen). This story this morning should be seen as part of that process. — Glenn Dyer

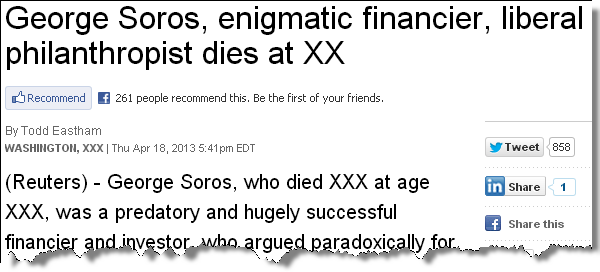

Reports of Soros’ demise greatly exaggerated. It must have been a strange thing indeed for financier George Soros to have awoken to find he had died at XX this morning, as reported by Reuters. For George hadn’t died (he’s 82 and very much alive), something it took Reuters two hours to work out. But they left up the report of his death, giving us (and him) a look at how he’s likely to be memorialised in death.

If the Reuters obit is anything to go by, Soros will be remembered as a man who “[helped] trigger the Asian financial crisis of 1997” and “broke the Bank of England”. He’ll also be remembered as a major backer of progressive political and social groups — a man “who argued paradoxically for years against the same sort of free-wheeling capitalism that made him billions”. — Crikey intern Kylar Loussikian

Too biased too ignore. Sydney’s Daily Telegraph today continues its campaign in support of small business — inspired by an advertising blitz by the sector. The ad blitz, led by the Australian Chamber for Commerce and Industry, is based on the theme “Small Business — Too Big to Ignore”. The Tele‘s campaign is running under the tagline “Small business — Too big to ignore.” After taking aim at penalty rates yesterday, the paper today blasts that legendary Aussie tradition: chucking a sickie.

Front page of the day. What a week it’s been for the New York Post, the loss-making News Corp tabloid edited by former Daily Telegraph supremo Col Allan. When almost every other media outlet was reporting a death toll of two from the Boston bombings, the Post went with the erroneous figure of 12. The paper then reported that police had taken a Saudi national into custody as a suspect (they hadn’t).

Yesterday, the Post ran an image on its front page of two spectators near the Boston Marathon finish line under the headline: “Bag men: Feds seek these two pictured at Boston Marathon”. Within hours the paper admitted investigators had cleared the men after determining they had no information about or role in the attacks.

Col Allan defended the coverage, saying: “We stand by our story. The image was emailed to law enforcement agencies yesterday afternoon seeking information about these men, as our story reported. We did not identify them as suspects.” In a satirical piece headlined “Is the New York Post edited by a bigoted drunk who f-cks pigs?”, US site Gawker described Allan’s statement as “legalistic horseshit”.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.