There’s no end of awful things that researchers have pinned on suburban sprawl. Now there’s new research that finds high rates of home ownership – which tends to be a suburban phenomenon in the US – are associated with high levels of unemployment.

The paper, Does high home-ownership impair the labor market, is written by economists David Blanchflower and Andrew Oswald. They compared the long run change in home ownership rates in the US at state level with the long run change in unemployment rates.

They looked at the period 1950-2010 and found “a doubling of the rate of home-ownership in a US state is followed in the long-run by more than a doubling of the later unemployment rate”. That’s not because home owners themselves are disproportionately unemployed – they aren’t.

Rather, they say, it’s because rises in home-ownership impose negative externalities on the labour market through (i) lower levels of labour mobility, (ii) longer commuting times, and (iii) fewer new businesses.

As I interpret it, they’re reasoning is that home owners tend to move address less frequently than renters. Rather than move closer to new jobs and schools, they consequently commute further. That exacerbates traffic congestion, which makes local business less productive.

Owners also have a bigger stake in protecting the amenity of their neighbourhood than renters. They’re therefore more likely to oppose new businesses setting up, as well as resist new housing developments that would attract newcomers and strengthen the local economy.

Brad Plumer at The Washington Post notes that the findings go against some common views. For example, some economists contend that “people who own homes have denser local networks, which make it easier for them to find jobs in their local area”.

If Professors Blanchfield and Oswald are right, this is an important finding. Mortgage interest tax deductability costs the US government $70 billion p.a. Yet as I’ve noted before (Are high home-ownership countries wealthier?), the economic advantages of home ownership at the national level are over-stated.

The findings surprise some observers. Peter Gordon from USC is worried that state-level data can mask very big variations between urban and regional areas and between cities. When he saw the paper, he compared metropolitan area commuting rates with unemployment rates and found no correlation, albeit he only looked at one year.

The correlations that I found for the 43 areas for which I could get data for both variables were these: 2009 mean commute time (minutes, solo drivers) and 2012 unemployment -0.07; 2009 commute time variance and 2012 unemployment -0.12; 2009 mean commute time and 2012-2013 change in unemployment, -0.08; 2009 commute time variance and 2012-2013 change in unemployment -0.10. For the commuting-unemployment link, there is apparently not much there.

The paper also provoked Charlie Gardener at the Old Urbanist to crunch some related numbers. He looked at the change in median household income and home ownership between 1950 and 2010 and found a positive relationship between these two variables, with an R squared of 0.28.

The southern states, he says, experienced the largest increases in home ownership rates over the 60 years, as well as the biggest increases in incomes. This is also true when incomes are adjusted for housing costs.

Peter Gordon didn’t expressly look at home ownership and Charlie Gardner didn’t look at unemployment so their analyses are suggestive not definitive. Mr Gardner notes sagely that his analysis doesn’t alter “the pattern carefully discerned by the authors”. But it at least points to:

the complexity of the homeownership phenomenon, which is affected by numerous economic, demographic and political factors, and which benefits from being studied in the broadest possible context so as to avoid placing too much importance on any particular correlation.

I wonder if there might be some underlying factor that explains the association observed by Professor Blanchflower and Professor Oswald. For example, could it be that changes in the density of population and employment over the period explain why some states perform better on unemployment than others?

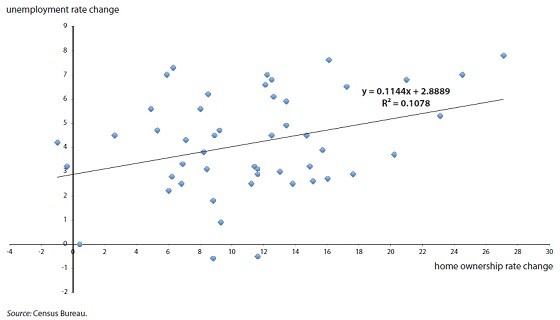

I also wonder if the relationship between home ownership and unemployment is even all that strong to begin with. As the exhibit shows (it’s taken from the paper), there is indeed a positive relationship between these variables, however the R squared is only 0.108.

I know statisticians emphasise that statistical measures need to be interpreted in their context, but that does seem a pretty unimpressive number. Remove one big city like New York from the regression on the grounds it’s an outlier and the relationship might vanish entirely.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.