Buying a home has never felt so out of reach for first-home buyers. But if you think a boost to the first-home owner grant will help you out then you should think again.

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness.”

The beginning of Charles Dickens’ classic A Tale of Two Cities appears a particularly apt description of Australia’s housing market. On one hand we have home owners and investors receiving high returns on capital gains and rents but on the other hand many prospective first-home buyers have given up the dream of owning their own home.

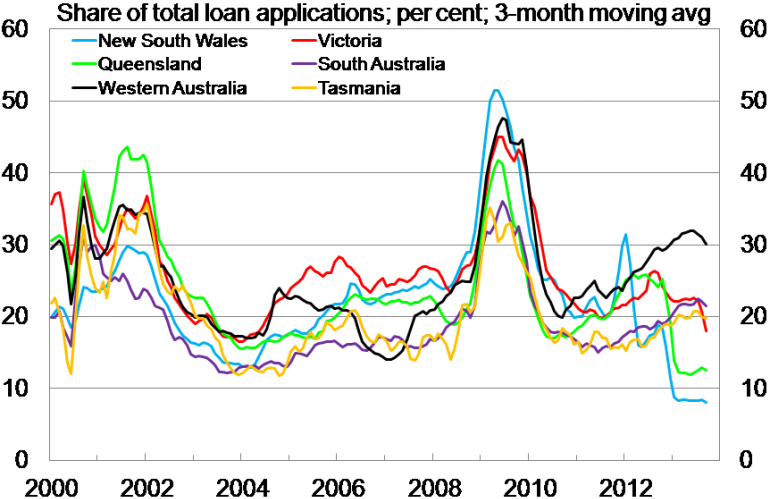

Data from the Australian Bureau of Statistics show that first-home buyer activity has never been slower in Australia’s three largest states. In New South Wales, first-home buyers accounted for just 7.2% of all loan applications in September on a seasonally-adjusted basis; well below the post-1999 average of 22.5%. The situation is not much better in Victoria (14.4%) or Queensland (11.5%). Nationally the share was at its lowest level in the series’ 22-year history.

With first-home buyers priced out of the market, housing affordability will become an increasingly hot topic for governments at the federal and state levels. Historically, this has always meant an increase to the first-home owner grant.

Earlier this week Tasmanian Premier Lara Giddings announced a doubling of Tasmania’s first-home owner grant to $30,000, or around 10% of the median dwelling price in Hobart. In Western Australia, the state government has increased the first-home owner grant for purchasing or constructing new homes, although they also reduced the first-home owner grant for purchasing established homes. The current trend for first-home owner grant is to direct first-home buyers towards new homes rather than established ones but that may change if first-home buyers continue to be cautious.

Unfortunately the first-home owner grant does not work. It is one of Australia’s greatest rorts. Rather than improve housing affordability, the benefits of the first-home owner grant accrue directly towards home owners and investors. Effectively it is a government mandated wealth redistribution vehicle that benefits the middle and upper-class.

A boost to the first-home owner grant does increase lending activity, with first-home buyers — rather than waiting — bringing forth their demand to take advantage of the higher grant before it is unwound. This is a good thing for the property industry but rarely works out so well for the first-home buyer.

The extra first-home buyer demand clashes with limited housing supply to drive up prices and reduce the realised benefit of the first-home owner grant. When the extra grant is unwound, first-home buyer demand is left depleted and non-first-home buyer demand tends to fall with it. The policy contributes to dwelling price volatility, a quick rise while it is in place followed by slow growth or falling prices after it is removed.

We saw this in full force during 2009 and 2010. First-home buyers were effectively tricked into entering the market due to unprecedented piles of free cash. After the boost was removed they found that the property they had always dreamed of was not worth what they thought it was.

If state and federal governments want to address housing affordability they should do so with a critical eye towards the middle and upper-class welfare that constitutes Australian housing policy. The Grattan Institute, in its recent Renovating Housing Policy report, found that owner-occupiers and investors received over 90% of government funding directed towards the housing market. Perhaps more importantly it found that these policies did nothing to increase home ownership rates.

Housing affordability for first-home buyers needs to be addressed but a fresh approach is required. Changes to the first-home owner grant will do nothing to improve housing affordability and readers should remember this when state and federal governments try to fool them otherwise.

*This article was originally published at Business Spectator

The first home owners grant helped give me the deposit to buy muy first house.

The article relies on a change of the definition of what has been taken for granted in Australia. Home ownership was something that was availble to most people who worked, Australia had higher home ownship rates than the rest of the world. Now the author is putting home owners and invetstors in the same box, the weatlthy. When I bought my first home, we had to watch every cent.

Now, home ownership rates are dropping, and investors are snapping up everything, becuase their subsidy is far more lucrative than a once off payment for people buying and occupying their first home. That is negative gearing and other tax dodges. The amount of money wasted on an industry that is studiously doing everything it can to make a loss is economics of the most bizzare nature. Then when these investors sell at a capital gain, we only tax them at 50% of the rate they should be charged. Factor in death duties, and you have the perfect taxation setup for systematiccaly moving wealth from the poorer to the richer people.

I now own my own home, but it really doesn’t help me as a family man. None of my children can afford to buy even a one bedroom flat in a decent location, (that is, out in the boondocks), without help from me.

Yet you will never get people to shut up about the first home ownders grant. Fix the real problem, the tax system that is configured to make easy money for those wealthy enough to play the tax system game for very easy pickings. Even when they lose, they win.

Spot on Merve, FHOG is petty cash compared with fiddles like low capital gains tax, negative gearing, offshoring of profits, domiciling, privatised punishment, ‘free trade’ zones and petrodollar wars.

There was no first home owners, when we bought a house, but how dies it help investors?

You can buy a new house, get the grants and its cheaper than renting anywhere in your general areas these days

Which suburbs are you referring to, SB@3? I bought a house this year, and the mortgage cost me now $500/month more than it did when I was paying rent, and added 15 minutes into my journey to work.

Also for Victoria, grants are available only to new homes being constructed (so I was lucky I made the cut when I bought resale before the end of the financial year). Should I have gone down that path though I would be living in one of those far outer suburbs and probably added another 30-40 minutes into my commute.

Also current tax laws encourage negative gearing which allows investors to write off their mortgage through tax deductions from running their investments.