Private industry figures show nursing homes more than doubled their profitability on average last year by cutting down on hours of care, particularly from trained nurses, and other costs per resident.

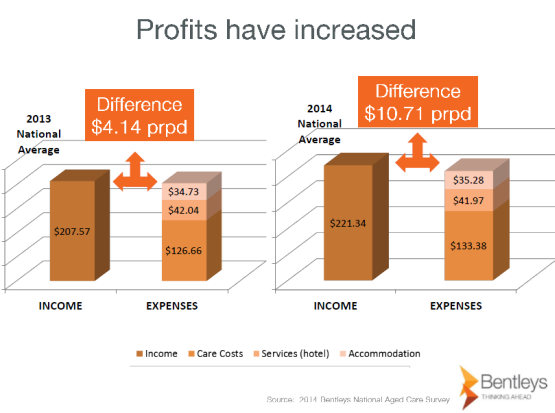

The annual survey by Bentleys Chartered Accountants was released in summary form late last year but a full copy of the survey has been provided to Crikey. The survey covers 179 nursing homes around the country, breaking down average income and expenses line-by-line, and shows that net profits jumped 159% last year, from $4.14 to $10.71 per resident per day.

Source: Bentley’s National Aged Care Survey

The rising profitability came as major aged-care players like Japara, Regius and Estia listed successfully on the stock exchange last year, as investors chase exposure to a growth industry underpinned by government subsidies and an ageing population. The investment boom comes amid widespread concerns about the standard of care being provided to the vulnerable residents of nursing homes, regulated by the Australian Aged Care Quality Agency (AACQA).

As ABC Radio National’s Background Briefing reported last September, coronial inquests into separate deaths at two nursing homes — BUPA Kempsey and Arcare Hampstead in Melbourne, both of which had been given AACQA accreditation scores of 100% — exposed inadequate care, mismanagement and cover-ups in response to complaints.

Bentleys National Aged Care survey has been conducted for 20 years and is used across the industry to benchmark profitability. The 2013-14 survey, which provides a detailed snapshot of industry performance just before the former Labor government’s legislated aged-care reforms came into effect on July 1, shows wide discrepancies between the profitability of the average operators and the top 25% of operators.

In a presentation given in Brisbane last October, Bentleys highlighted that while the average home spent $99 per resident per day on nursing and care (mostly wages, the biggest single expense) or 46% of their daily operating revenue, the top quartile of operators by profitability spent 6% less, just $92 per resident or 40% of revenues.

The presentation noted providers had been forced to find efficiencies in carer staffing profiles, particularly a steady trend away from reliance on nurses towards personal care assistants. A chart showed the long-term decline in the time spent on care by registered nurses, which fell from 5.9 hours per patient per fortnight in 2004, comprising 17% of total care staff hours, to 5.2 hours or 13% of total hours in 2014, while the amount of time spent by personal care assistants jumped from 11.4 hours in 2004 comprising 31% of total care staff hours, to 16.8 hours or 39% of total hours in 2014.

Charmaine Crowe, senior policy adviser for the Combined Pensioners and Superannuants Association, told Crikey:

“The clear modus operandi for the industry is to boost profits by cutting skilled staff. Registered nurses are being replaced by lower-skilled care workers at a time when older people are entering nursing homes sicker and frailer. Not only does this threaten the health and safety of residents, it risks increasing the burden on state health systems as more residents are shipped off to emergency departments because the nursing home doesn’t have appropriately skilled staff to look after them.”

The detailed figures throw up other surprises. For example, daily catering costs of $20.63 per resident on average comprise 21% of total operating revenues, and are made up of food costs of $10.80 and kitchen staff wages of $9.83. Meanwhile the amount spent on head office management charges is $10.73 per resident per day — about the same as food costs.

Crowe believes the increasing profitability of nursing homes is likely to have accelerated since the July reforms, which shifted more of the balance of funding from government to consumer and introduced the ability for residents to pay daily accommodation payments in place of expensive up-front accommodation bonds. Aged Care Financing Authority figures for July and August showed bonds continue to be the preferred payment method and that the industry doubled the amount it held in bonds from $403 million in July to $937 million in August. “Early days,” said Crowe, “but it suggests that the industry’s fear that everyone would be paying daily fees rather than bonds was unfounded.”

Bentleys is now conducting its first six-month survey, for the period ending December 31, to provide the industry with an early snapshot of the implementation of the reforms. Bentleys’ business development manager Jo Adams told Crikey the reforms were making aged care a “much more lucrative investment asset for capital investors”.

Having had two parents go through aged care homes and many friends in the same position, my advice to others considering aged care is always to choose a not-for-profit provider. They vary in quality as well but they are there usually because of a commitment to caring for people rather than making money

An interesting statistic would be a concise summary of how the Government and Private Nursing Homes compare on costs per capita to taxpayers.

This is not the type of industry that large corporates should be involved.The large not for profits can be just as bad

Small to medium size operators will keep the market competitive whilst no allowing no large player to have undue influence

The next scandal will be when somebody rips of millions of Accommodation Bonds and the Feds have to pay out compo

I thought that the charming Dr. Wooldridge had already been involved in something like that,although he didn’t get into too much trouble from memory.

Thanks Paddy, now for the Private Hospitals robbery of the Medicare system!