Fill up now! Oil prices continued their big run overnight, taking the rise in the past four trading days to 19% for US West Texas type (around US$52.50 a barrel this morning) and Brent crude oils (around US$58 a barrel), the two main “marker” oil types for global traders. Prices are rising because many in the markets (traders, not producers) believe the big falls have stopped and the price is steadying in the range of US$50 to US$60. The so-called rig count in the US industry has fallen sharply, meaning exploration and production is falling, and therefore future production will start falling.

Although US production is continuing to rise at the moment (we will know more tonight, when the weekly US figures are released) due to recent discoveries, traders reckon the day is rapidly approaching when US production will start falling because of the billions of dollars of cuts to exploration and development work in the past two months. But it looks as though these same traders are already trying to get in on this price rise — hence the 19% jump in the past four trading days.

The word from Saudi Prince Al-Waleed bin Talal is that oil won’t be bothering the US$100 a barrel mark for some time.

“If supply stays where it is, and demand remains weak, you better believe [the price of oil] is gonna go down more. But if some supply is taken off the market, and there is some growth in demand, prices may go up. But I’m sure we’re never going to see $100 anymore,” he said in an interview in USA Today.

US$50 to US$60 a barrel looks likely to continue for the moment, but big price falls always seem to unwind eventually. Remember that a year ago no one thought oil prices would fall, let alone as sharply as they did from mid-June onwards. So if they didn’t pick the fall, how can they now so confidently assume the price won’t rise back to the US$100 a barrel level, especially if supplies start falling? A bit of madness from Islamic State in Iraq or Libya, or Putin in Ukraine, could cause an enormous price spike and make a Saudi Prince change his tune very quickly. — Glenn Dyer

Scouting party. Bestselling author Harper Lee reveals she has written a follow-up to To Kill A Mockingbird, one of the greatest books in American literature. Go Set A Watchman is set to be published in the northern summer, 55 years after Mockingbird was released. The central character is a grown-up Scout, the young heroine of the Pulitzer-winning 1960 book, looking back on the events that took place around her father, Southern lawyer Atticus Finch. But in a great irony, Lee says the follow-up was written before Mockingbird and sat untouched and unremembered for those 55 years (which is a bit hard to believe). HarperCollins will publish the book in North America (its biggest market by far) and in the UK by Penguin Random House (owned by Pearson and Bertelsmann of Germany), under the William Heinemann imprint. Additionally, the sequel to Catcher in the Rye and at least four other books by JD Salinger will be published posthumously later this year. — Glenn Dyer

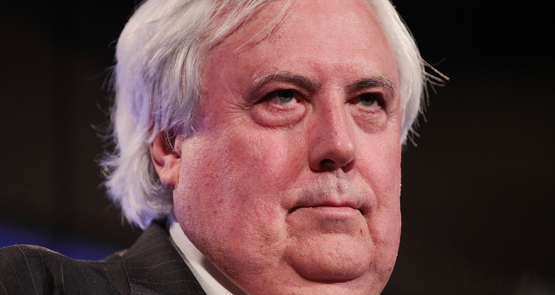

Clive’s dwindling fortunes. According to donations data released on Monday, Clive Palmer spent $26 million getting himself and three senators elected in the 2013 election. It’s a huge figure, but if recent wealth estimates of the mogul are any estimate, that’s not exactly small change for the millionaire.

Forbes‘ annual Asian wealth list, released last week, dropped 40% off Palmer’s fortunes in just a year, pegging his wealth at just $631.75 million. That’s on top of another fall last year — since January 2013, Forbes reckons Palmer’s fortunes have nearly halved. BRW‘s also been counting Palmer down in recent years. Despite always being willing to ascribe Palmer far more than Forbes, it dropped his wealth estimate from $2.2 billion to $1.22 billion in June last year. In fact, the last time rich-watchers thought Palmer’s net worth had risen was in 2011, when BRW boosted his alleged fortune from $3.92 billion to $5.05 billion.

Falling resource prices, particularly for nickel, have had a part to play in Palmer’s shrinking fortunes, as have royalty disputes with some of his Chinese business partners. If his wealth keeps shrinking at anything like the rate it’s believed to have done, it’s not clear how many more elections Palmer can bankroll in the same manner. — Myriam Robin

Fat Duck, or Flat Pluck. Who says hospitality doesn’t pay? Celebrity chef Heston Blumenthal’s short-lived Melbourne branch of famed London restaurant Fat Duck opened yesterday, and industry insiders are tipping he’ll bag at least $9.2 million in revenues once his six-month Australian stint is done.

Diners applied by ballot for a seat at the table, with Crown Melbourne confirming the ballot sold out with 14,000 diners paying $525 (excluding drinks) for the 13-course meal. That’s a significant price bump on the 220 pounds ($424) a head Blumenthal charges for the Fat Duck in the United Kingdom. And at $525 a head, The Fat Duck Melbourne is set to turn over $7.3 million for the food bill alone.

The typical spend at a restaurant is 75% food and 25% on drinks, according to the Restaurant & Catering Association. So this suggests diners at The Fat Duck should factor in $131 a head in spending on drinks, adding an additional $1.8 million to Blumenthal’s turnover. This is a conservative estimate given the high pricing of the Fat Duck’s wine list and the likely celebratory attitude of those dining there, but it brings the total restaurant turnover to $9.2 million. Blumenthal’s London operation is closed for renovations for six months. Most restaurants would take a hit for that, but Blumenthal’s found a way to make it pay. — Cara Waters (adapted from SmartCompany)

Tatts scrubbed as removalists get Inc. As a form of long-term disfigurement, tattoos are a pretty hideous way of decorating your body (sorry, Crikey readers). Employers don’t necessarily like or want them, lovers change over time as those names inside Cupid’s hearts pale, and as a person ages, the desire grows to emulate Lady Macbeth and out that “damned spot”.

According to figures from the US (where there are an estimated 8000 tattoo parlours), revenue for those specialising in removing those “spots” is up 440% to US$75.5 million. Research firm IBISWorld says spending on tattoo removal will reach an estimated US$83.2 million in 2018 — a fraction of the estimated US$3.4 billion spent on tatts by consumers in 2014.

Tatt removals looks like a small but perhaps lucrative growth industry in the years to come as tattooees age and fall out of lurve with their skins and with each other — or suddenly become successful and discover a need to be “clean”. There are plenty of “reality” TV shows built around tattooing, but will we ever see a program built around removals? Plastic surgeons have a lock on that gig.

Some advice from one of those in a story on Marketwatch.com:

“Most tattoo removals are performed on people in their 30s and 40s, says Michael Kulick, a San Francisco-based plastic surgeon. ‘What was attractive in your 20s is not so attractive in your 30s,’ he says. Costs range from $500 up, depending on the color and depth of the ink in the skin. The ideal color for removal is black, because that tattoo will be at the same depth in the skin and the same wavelength for the laser to remove the ink. ‘Now it’s very fashionable to have pastels and yellow, which is very difficult to remove,’ he says.” — Glenn Dyer

I regard tattoos to be the same as religion. Something that’s very painful and time consuming, and only undergone so to show adherence to a group. And something that’s regretted in later life, unless the person has cognitive dissonance.