Even with optimistic economic and revenue forecasts for the later years of the budget cycle, the 2015 budget shows the government still racking up deficits for the foreseeable future. If Australia’s current economic slowdown continues, or there is a global economic event that sends us near or into recession, the return to surplus will be delayed into the very long term.

And yet, for reasons best known only to itself, the government continues to refuse to examine superannuation tax concessions, which even the super industry itself believes needs to be reviewed. While the government might insist that any overhaul of super tax concessions amounts to an increase in tax, the reality is one of taxation equity: the superannuation tax system enables high-income earners to pay far less tax on their income than lower-income earners. Moreover, the gap between what middle-income Australians pay via the tax system, and what wealthy superannuants pay is far in excess of what is required to encourage Australians to save for their retirement.

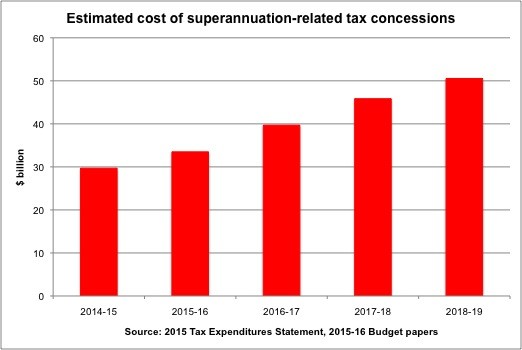

Last night’s budget papers demonstrate the scale of the problem super tax concessions represent. This is how much income tax we are losing to super:

This is a policy that will soon be costing us $50 billion a year in lost revenue. For a country that can’t see a way back to surplus any time soon, it’s a luxury we can’t afford.

Absolutely spot on, Crikey!

As I understand it, the super tax concessions will cost MORE than the aged pension in the next couple of years.

Ridiculous stance for this lunatic government to take.

At least the Labor Party has recognised this and begun to deal with it. Although there is lots more they could do as well.

Tax equity?

High income earners pay more tax than low income earners. Fact. They pay proportionately more tax on their income than low income earners.

I don’t know what level of income you define as “low” but if you are going to give a tax concession, the laws of mathematics mean that the benefits can only go to those who actually pay tax.

There are clear issues regarding changes to super. Number one in my view is how we have about $1.5 trillion saved but too many people are on the pension. I reckon that tax and financial advisors help people structure their finances to qualify for the pension.

The other problem with this article is that the scary graph is a dodgy guess. Treasury doesn’t actually know because by removing the concession, people are probably going to structure their finances differently and treasury doesn’t know what people will do.

But to lefties, it’s just a pot of money that can just be grabbed off the mythical rich.

You have the depth of insight of a talk back radio caller.

OneHand channelling F Scott Fitzgerald, “the rich are different” ergo they deserve extra special cossetting coz ..umm.. they’re rich.

How does one know that they’re rich? Coz they spend it so tax expenditure, as in an extra GST premium for certain goods – I’ve long advocated an erg tax.

As the ABS puts it, the more an item is “elaborately transformed,” then the more energy has been spent upon said transformation so tax it. Couldn’t be more stsaightforward.

As so often, an accurate statement being tendentiously mendacious – hence the old saw, “a truth told with bad intent is worse the all the lies one can invent” and none better to demonstrate this than our resident rightard though gNormless may yet bring his unique idiocy to the fore.

Dear Mr Hand,

Tax equity isn’t about everyone paying the same amount of tax. To everyone else, this is axiomatic, to you it needs to be explained.

If you earn more you pay more tax, that is tax equity. It is axiomatic that unless you have a regressive tax system then this should be the case.

But the fact is that up to a certain amount of income, people who earn more pay more, but once you pass that threshold you start to pay less, because you can start to enter into all manner of bogus schemes to avoid paying tax, and superannuation concessions is key to that.

By reports, not denied, up to 30 people who earned more than a million dollars last year paid no tax. No tax!

This is tax equity Mr Hand, where every citizen contributes tax according to what they have earned, based on tax scales determined by the government.

Of course people manage their retirement affairs so that they keep getting the pension, but that is a tiny proportion of the superannuation rort, the negative gearing rort, the capital gains tax rort.

And yes, people with millions in assets apart from their own home should not be allowed to get a pension.

At least we can agree on that, but lets remove the log before getting too worried about the splinters.