The government’s small business budget has been a big success, it seems. It got positive headlines about the budget being stimulatory, and now some polls show the Prime Minister’s approval rating on the rise.

It’s a PR success. And a lot of that is due to attention lavished on the $20,000 tax write-off for small business.

It’s “phenomenal”, apparently.

Get ready for a lot more asset write-off announcements in future. Because they buy the government a lot more headlines than they deserve.

You wouldn’t know this from reading about it, but the “$20,000″ asset write-off is worth only about $1000.

Here’s why:

The $20,000 is not taken off the tax bill of a small business. Instead it’s a deduction from income — same as when an individual gives to charity. After a small business takes $20,000 off its income, it saves the 28.5% of tax it would have paid on it. 28.5% of $20,000 is $5700.

That’s the actual value of being able to instantly write off a car or machine from your tax this year.

But here’s the thing. Businesses could always write off asset purchases against their income. They just had to do it more slowly.

Using a depreciation schedule from the ATO website, I calculated how much a small business would have been able to save off its tax under the old rules.

It’s $5700.

The only advantage is that under the new policy, a business can claim all that $5700 in this tax year, instead of claiming it in dribs and drabs over the next decade.

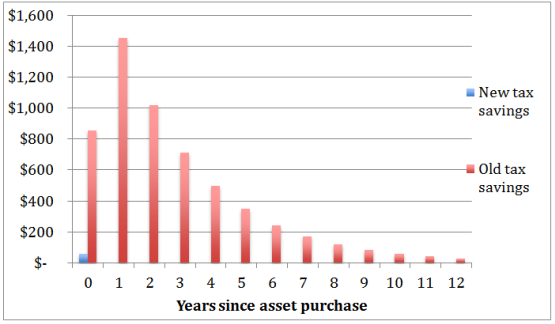

Here’s a graph for how your depreciation works under instant write-off versus slow depreciation.

We can measure how much benefit instant access to the write-off provides. All we need to do is make an assumption about how small business values money over time. We do that with a discount rate. Let’s assume a discount rate of 8% (a hypothetical figure at the higher end of the realistic discount rate spectrum).

If that is the case, the net present value (NPV) of the flow of money is $4660. Only $1040 less than the value of the money right now.

(If you assume small business is even more patient, the value of the instant write-off is even less. At a 2% discount rate — a figure much lower than the average discount rate for small business — the NPV is $5350, and the net value of the new policy is a mere $350.)

In summary, the government is getting great value from this policy in media coverage terms.

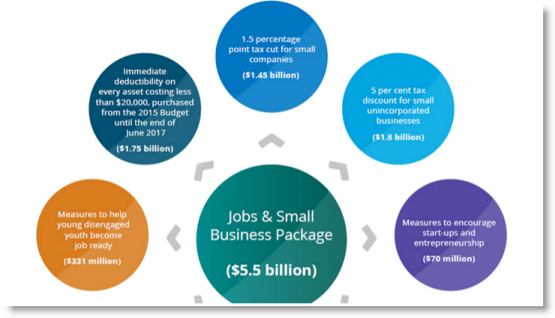

Compare it to another tax break the Coalition gave small business in the budget — a 5% tax cut for unincorporated businesses. You probably haven’t seen mention of that anywhere.

But this 5% tax cut (full disclosure, I run an unincorporated business!) is worth even more to the budget bottom line. That’s it in the blue bubble on the right side — worth $1.8 billion. This graphic was in the glossy brochures journalists got in the budget lock-up.

It’s one of the most expensive measures in the budget. And it has barely got a headline. The government will not make that mistake again.

Expect asset write-off thresholds to be even higher in the next budget as governments seek a headline that says something like $100,000 Asset Tax Bonus for Small Business.

*This article was originally published at Jason Murphy’s blog, Thomas the Think Engine

Your basic calculations are correct, although the benefits of the write-off are higher for sole traders who pay a marginal tax rate of 40%+ not the 28.5% for incorporated small businesses. The same sole traders who are getting the 5% tax cut.

The other thing to be considered is that often the full value of the write-off was not realised because the business went bust first (“most small businesses don’t last three years”). This tax break will assist businesses to survive another year when their short-to-medium-term prospects are bleak. Probably not the stimulus angle they are looking to publicise.

The 5% tax cut for unincorporated businesses is a complete furphy. It is a REBATE on the tax payable – and never EVER equates anywhere near a 1.5% ‘equivalent cut.

For use within our accounting firm I prepared a table of taxable income levels, assuming no other income for the taxpayer, to determine the actual tax saving from this rebate – see below. With the $1,000 cap on the rebate, it cuts out at $86,632, after which the effective rebate value reduces. So, it is NOT more beneficial for those on a higher marginal tax rate.

At best, it equates to a 1.154% tax cut. Not exactly as promised to all and sundry!

This is not a small business supporting budget. It is a pre-election smokescreen.

The small business tax rebate for unincorporated entities

not including Medicare levy

tax 2015 adjusted tax

Income level payable rebate tax payable saving %

30,000.00 2,241.81 112.09 2,129.72 0.374%

40,000.00 4,546.49 227.32 4,319.17 0.568%

50,000.00 7,796.49 389.82 7,406.67 0.780%

60,000.00 11,046.49 552.32 10,494.17 0.921%

70,000.00 14,296.49 714.82 13,581.67 1.021%

80,000.00 17,546.49 877.32 16,669.17 1.097%

90,000.00 21,246.12 1,000.00 20,246.12 1.111%

100,000.00 24,946.12 1,000.00 23,946.12 1.000%

110,000.00 30,846.12 1,000.00 29,846.12 0.909%

120,000.00 32,346.12 1,000.00 31,346.12 0.833%

130,000.00 36,046.12 1,000.00 35,046.12 0.769%

140,000.00 39,746.12 1,000.00 38,746.12 0.714%

150,000.00 43,446.12 1,000.00 42,446.12 0.667%

86,632.00 20,000.00 1,000.00 19,000.00 1.154%

In summary, the government is getting great value from this policy in media coverage terms. But then again the MSM stenographers posing as churnalists are always easily fooled. Its said that some of the people can be fooled some of the time, but not all the people all of the time, except for most MSM churnalists, the LNP politicians know this so well. Just ask Joe Cigar and Tony rAbbott, their survival relies on this undisputed fact. Yes Veronica, you can fool all, all of the time, it just depends on what they do for a living.

Another point worth making is that the main reason small businesses go bust within three years is not tax. It is cash flow. Cash flow is always tight as a business is expanding, usually from scratch. In the small business world, cash flow is King. Now imagine what is going to happen when many small business owners rush out to spend up to $20,000 of their valuable cash flow, they will run short of cash and go bust even quicker.

Perhaps a perceived benefit is that an instant write-off will be scrutinised once, whereas a depreciating one is potentially looked at for years. We’re basically relying on the suburban accountant-policeman here. What is the NPV of the tax office audit risk, given yet more cuts?

Home office kitchen, anyone? Massive 4k panel “for the shop”??