Australia’s Big Four banks and their regulators in the Abbott government are setting all sorts of strange records in 2015.

By the time Christmas comes around, shareholders in ANZ, NAB, Westpac and CBA will have stumped up perhaps as much as $20 billion in new capital for a sector that is profiting to the tune of almost $40 billion a year, before tax.

You would think that diving into the biggest capital raisings Australia has seen from a single sector would suggest that the companies concerned are in some sort of crisis.

But no — when trading closed last night, the Big Four banks were collectively valued at $423.3 billion.

This utterly confected and baseless capital shortfall comes at the same time as the Big Four will pay their 2 million-plus shareholders more than $20 billion in dividends in 2015.

So why aren’t the Big Four strengthening their balance sheets by reducing dividends, which represent capital outflow, until such time as the government regulators are satisfied they have capital ratios that are strong enough to support their lending profiles?

Good question. Could it be something to do with the executive bonus schemes at the Big Four, which are largely based on relative total shareholder return (TSR)?

Dividends are a key part of TSR, so if you lower the dividend you lower the overall shareholder return, particularly if investors also mark down the share price given the reducing yield.

This is where independent directors are meant to get involved because they are only paid a fixed cash fee and should not be driven by the perversities of equity incentive schemes.

These boards should be putting the conflicts of their executives on the table and then making clear-headed decisions, such as reducing dividend payouts until such time as everyone agrees there really is surplus capital that should be distributed to shareholders.

The recent NAB capital raising was more understandable than what ANZ served up yesterday because it involved shoring up its balance sheet to facilitate an expensive exit from its disastrous UK business.

And NAB was rightly commended, including in this Crikey piece, for fairly raising capital by treating all shareholders equally and in a pro-rata manner that respected their property rights.

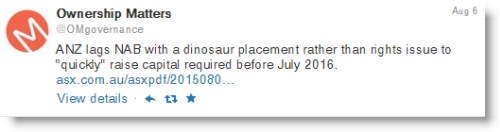

The same can’t for said for ANZ, which yesterday unveiled what powerful proxy adviser Ownership Matters described as follows on Twitter:

Indeed, institutional placements, which are illegal in the UK, are meant to be about emergency raisings where there is no time to do a conventional rights issue.

If Treasurer Joe Hockey’s public servants at Australian Prudential Regulation Authority (APRA) think ANZ needs a bigger capital buffer in 11 months’ time, there is plenty of time to cut the dividend, sell assets, raise equity or do a combination of all three.

But no, ANZ sprinted into an opaque and secretive placement where there is no disclosure as to whom has shelled out $2.5 billion for the new shares priced at $30.95.

The market was unimpressed, as ANZ shares tumbled more than 7% to $30.19 on the opening today, a slight discount to the institutional offer price.

The most persuasive rationale for the timing is that ANZ wanted to beat CBA to the punch, as it is also expected to announce a major capital raising with its full-year result next Wednesday.

But there was nothing stopping ANZ doing an accelerated pro-rata offer to the big end of town and then following through with a more orderly retail offer, just as NAB did earlier this year.

So what will CBA do? Our biggest bank has never done a pro-rata capital raising since it was floated by the Keating government in 1991.

With a market capitalisation of $135 billion, even a $5 billion raising would only amount to roughly 1-for-25 in pro-rata terms.

However, CBA has not been shy in doing institutional placements and has a history of shafting retail investors when it comes to the follow-up share purchase plan (SPP).

As the GFC unfolded, CBA did two separate $2 billion placements. The first didn’t have any retail component at all and the second at $26 made retail investors pay an effective 4.5% premium because the SPP applicants were not entitled to the $1.13 dividend, which went to institutional recipients of the placement. (See this letter published in the AFR at the time).

As a make-good to retail, if CBA really needs to raise capital next week they should announce a non-under-written $15,000 SPP priced a fixed-percentage discount to the market price of up to 5%.

That would bring in billions from existing retail investors and give no new shares to the big end of town — reversing the entrenched pattern of retail dilution which capital raisings normally deliver.

ANZ has gone the other way, raising $2.5 billion from institutions and then limiting the follow-up SPP to “around $500 million”, even though retail investors own almost 40% of the bank.

However, at least ANZ added a secondary SPP pricing method of 2% below the market price if ANZ shares remain below the $30.95 per share which the institutions agreed to pay last night.

Thanks for the ‘cut through’ info Mr. M. Appreciate your work.