Government debt, as Australians were told relentlessly from 2009 to 2013, was the nation’s scourge. If it wasn’t spiralling out of control into a dire emergency for our children it was skyrocketing into a disastrous burden for our grandchildren. So in which two years of the last 10 did Australia’s Commonwealth debt rise most rapidly? Most punters would probably volunteer the early onset of the global financial crisis, which gave rise to Australia spending more stimulus money than any nation in the world, as a percentage of GDP. And to a frenzied anti-Labor fear campaign.

They would be wrong. The Australian Office of Financial Management (AOFM) has released debt figures for the full financial year 2014-15. We can now make comparisons back to 1983 — and dispel a few myths.

The AOFM’s net debt figures are defined as “net of internal Treasury bills and other Commonwealth holdings”. This is different from the monthly Finance Department figures. There, net debt is deposits held and other borrowings, “minus the sum of cash and deposits, advances paid, and investments, loans and placements”.

Staying with the AOFM, the first surprise is that the lowest debt in the last 33 years was in 1983, at $20.8 billion. Australia had extensive borrowings throughout the Howard/Costello years, despite Coalition claims. The lowest year was $53.25 billion in 2007 — high in historic terms.

Since then, debt has increased every year. But not by the same quantum. This table shows increments since 2007:

Clearly the greatest borrowing in recent years has been by the Abbott government, which has added a whopping $111.36 billion in just two years.

Three things should be noted regarding this. First, the global recovery is now well underway, enabling debt reduction in many well-managed economies. Thirteen wealthy countries in the Organisation for Economic Co-operation and Development (OECD) were in recession with widespread unemployment back in 2012 and 2013. They were Denmark, Finland, Germany, Austria, Italy, Greece, Belgium, Portugal, Spain, Slovenia, the Czech Republic, the Netherlands and Japan. Today only Finland is still in recession, and that is now quite shallow.

OECD countries now paying down debt racked up during the GFC include New Zealand, Ireland, Norway, Iceland, Hungary, Germany, Poland, the Czech Republic, South Korea and Turkey. So also are non-OECD economies Singapore, India, Vietnam, the Philippines, Hong Kong and Saudi Arabia. Australia is not among them.

Secondly, this is precisely the opposite of what was promised. As recalled here in February, Abbott told an industry group before the last election that the Coalition had “identified $50 billion of savings, for … a reduction of $30 billion in net debt”.

Thirdly, this is the opposite of what the government is loudly proclaiming it is delivering. Treasurer Joe Hockey repeats at every opportunity, “the debt and deficit mess we inherited was not of our making, but we have taken positive action that is delivering results”.

Not according the AOFM. Hockey’s latest actual results are an extra $4.1 billion in debt every month.

It is possible, of course, to note that the rise in the debt in 2015 — $49.25 billion — was not as steep as in 2014 — $62.11 billion. There was an “improvement” of $12.86 billion in the quantum of debt added.

Is this what Hockey means by delivering results?

An intriguing hypothetical exercise is to follow that trend in debt expansion for the last two years, and to do so for both governments.

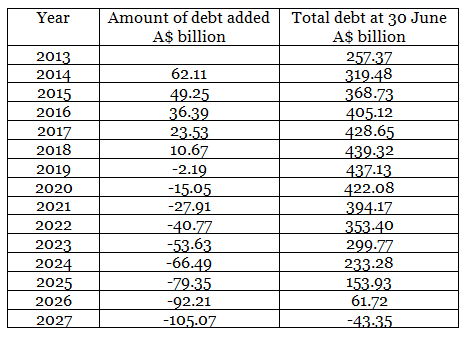

Under the Coalition, debt added in 2015 was $12.86 billion less than in 2014. Suppose that were to continue. Then, in 2016, the debt added would be only $36.38 billion [49.25-12.86]. And so on, as shown here:

Hence all the debt paid back by 2027. Not bad.

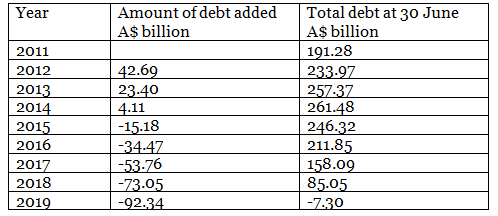

We can now do the same for the previous Labor government, noting a similar trend in decreasing expansion of the debt over its last two years. The debt grew by only $23.40 billion in 2013, which was a $19.29 billion improvement on 2012.

Now suppose that had been sustained and each year thereafter $19.29 billion was sliced off the debt expansion. That projection would have been:

Hence all the debt repaid by 2019.

This hypothetical makes too many assumptions to be the basis for firm predictions or conclusions. It is simply an extension of the trajectory of the debt under Labor versus that under the Coalition for the last two years.

But perhaps it suggests why no-one in the government or the pro-Coalition media is the least bit interested in discussing the latest figures.

Look over there! It’s the Unions, Labor, Bill Shorten, Legal Vigilantes, Visa dodging taxi drivers, the ABC and Fairfax!

No, what Hockey means by “we’re delivering results” is “we’re delivering the meaningless rhetorical propaganda that wins elections”, knowing that whatever he asserts will magically be so for the duration of the public’s attention span – which is way too brief for them to pay the slightest notice to the smartarse lefty expert about to debunk me with actual facts. By the time my puerile spin is exposed, whose even listening? Tax cuts anyone? Whey-hey look, a death cult!

Last paragraph: But perhaps it suggests why no-one in the government or the pro-Coalition media is the least bit interested in discussing the latest figures.

There can only be two reasons 1. The pro Coalition media is too stupid or the just don’t care, …after all the current game is to support a hopeless no talent government under any circumstances; or challenge and risk being labelled a jihadist media, as is the case of the Fairfax media.

@ Mick Ellis – Hockey’s ‘propaganda’ is working a treat, if the poll results of Essential in today’s Crikey are anything to go by!!

I have never understood how a credo, such as economics,manages to deny the very basis of its prognostications, numbers.

As Obama said of Climate Change, the facts are plain, all else is politics.