All the religions!

John Richardson writes: Re. “Snubbed Muslims respond to Freedom Boy’s religious freedom shindig” (Friday). While I understand Guy Rundle and Joshua Ribaricht being concerned at the lack of representation afforded to Muslim organisations at the Religious Freedom Roundtable held last week, perhaps they should also spare a thought for the other religious organisations who didn’t warrant a ticket. While George Brandis might have felt that managing the 29 organisations offered the special privilege of an invitation by the so-called Human Rights Commissioner Tim Wilson was a bit like herding cats, just imagine how impressed he would have been if representatives of all 130 religious organisations recognised under the Commonwealth Marriage Act had scored an invitation? They certainly would have needed a bigger meeting room & maybe a few extra loaves and fishes for lunch as well!

On raising the GST

Ken Lambert writes: Re. “Forget broadening GST, it’s time to close tax breaks for the rich” (Friday). There is one simple tax measure which can reap significant cash with minimal political cost: axe foreign based companies with related party transactions on turnover or profit. That will render ineffective the transfer pricing schemes to lower tax jurisdictions. Settle the rate on an estimate of real profits based on a simple high-medium-low based on published worldwide accounts. eg; High 7.5%, Medium 5%, Low 2.5%. They still have the obligation of doing the existing 30% of profit method — whichever yield is greater to the ATO.

For example: Apple sold $6 billion of product in Oz with expenses of $5.7 billion. Profit $300 million, Company Tax (30%) yields under $90 million. Why? because their expenses were pumped up with costs generated by related companies in low tax overseas countries. So a prima facie 5% company tax on Apple’s turnover ($6 billion) would have yielded $300 million tax instead of $90 million. You might call it the Apple turnover tax. Imagine doing this with the top 200 foreign owned corporations like Google, Apple, Coke, Big Miners, Big Oil, Big Pharma, Big Tech etc. We need $50 billion to plug the revenue hole — that’s $250 million each and the political cost is zero. They have been playing games with our tax office forever and will continue to do so.

Roy Ramage writes: Re. “More ideas on GST reform” (Friday). You are correct, John Richardson, I should have included some figures. The following are from the Bank of International Settlements (BIS). According to BIS the Australian figure for 2014 was AUD$69 trillion. However, the Australian Financial Markets Report (AFMR) figure has it as AUD$135.2 trillion. This is some 95% larger than the BIS figure. When both sets of data are compared there appears to be little duplication.

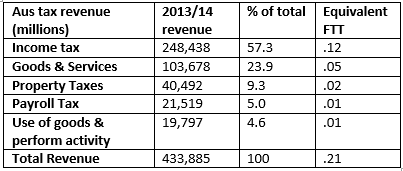

The BIS data comes from card payments, credit transfers, direct debits, and cheques. The AFMR data does not appear to cover these areas except possibly the Reserve Bank Info. and Trading System. Given the risk of double counting the annual figure approximates AUD$204 trillion! The ABS total tax figure for 2013/14 is 433.9 million. Transaction data is in billions not millions as is the ABS data. The suggestion is that a 0.21% universal transaction tax on 204 trillion dollars could replace Australia’s entire tax system. I hope the numbers below clarify the line of thought.

Since for most Crikey subscribers discussing this topic is about as informative as tadpoles discussing dam construction, there seems to now be as much on this thread as is needed.

“axe foreign based companies with related party transactions on turnover or profit.”

No Crikey editor…..I really wrote “Tax foreign based companies with related party transactions on turnover NOT profit.”

Makes sense of the rest Yes??

Like Ken Lambert’s idea. But I am wondering where the TPP will leave us on such a proposal. Will the ISDS clauses allow companies such as Apple to later sue the Australian government for any changes made to the tax law?

MJM – Your question is very relevant, and the answer is YES!

The TPP is the elephant in the room. Everyone seems to be ignoring the obvious. If we ratify that agreement, then we lose our sovereignty and the right to make laws on ANY issue where corporations lose money.

Be aware that the ISDS clauses in the TPP do not specify HOW that money is being/was lost, and the ‘judges’ to any such challenge will be arbitrators appointed by the corporations in a non-legal tribunal – NOT a court of law.

How any member of the Australian parliament could vote in favour of such a wholesale jettisoning of the Rule of Law is beyond me. IMHO, that is trea+on!

CML

I agree that a Taxation measure which applies to all companies in a defined category eg; Foreign owned with related party transactions MUST be excluded from any part of the TPP.

Corporate rights under the TPP should only cover an arbitrary action by Govt which targets an individual company with some sort of contractural relationship with Govt.