We present this graph as an to addendum today’s Mid-Year-Economic Fiscal Outlook.

Each December, MYEFO is a chance for the government to take another look at the May budget and make adjustments based on the state of the economy. These are usually in the form of cuts based on a slump in predicted revenue — and today’s MYEFO is no different.

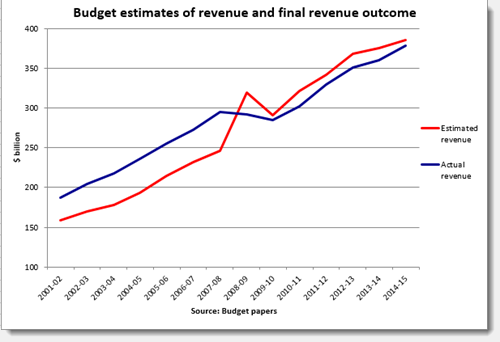

For several years now, Treasury has been anticipating a far more rapid post-global financial crisis revenue recovery than has actually eventuated. As the graph shows, since 2008, Treasury’s revenue forecasts have far exceeded actual revenue.

Treasury needs to accept responsibility for the role it has played in what is now many years of poor forecasting, and start offering a more realistic forecast window for treasurers. Otherwise Scott Morrison won’t be the last to have to stand up and explain why the budget deficit has blown out — yet again.

“Otherwise Scott Morrison won’t be the last to have to stand up and explain why the budget deficit has blown out — yet again.”

Since when has any Treasurer stood up and given us an honest explanation for a budget blow-out? They blame their predecessor and stupidly promise that we will be back in surplus in no time – both claims that we all know to be absurd.

The word treasurer is fast becoming a synonym for fool, dissembler, blame shifter, self-deceiver. I did not think we could do worse than Hockey but …

I wouldn’t have thought that even economists believe their own claptrap, else they’d be off making BigBuk$.

Why are they, as a species, even fed?

Has anyone ever know a forecast to be accurate?

With all these so called budget problems, has anyone actually worked out how much more tax we should pay to correct the problem, inc. medicare?

Lets dig a bit deeper in the meantime and pay a bit more.

Changing the tax base does not mean we will pay less tax as we are told, (maybe less wages tax).

It’s noteworthy that the Treasury forecasts increased clearly at the exact moment that revenue actually declined. Damned looks like general fighting the last war, and that is not a good look for people who are supposed to be some of the top dogs in the game.

But then again, who knows how much Treasury’s honest assessments get massaged by politicians on the way out the door. I’m not sure that Treasury is solely to blame, but Bernard may know better on that.