What would happen if Australia stopped approving new coal mines?

Firstly, the Minerals Council would go berserk, screaming “COAL IS AMAZING!”.

Secondly, Tony Abbott would declare it a bad day for humanity and mutter about poor people in India.

But then what?

Nothing.

Well, almost nothing. In the year 2040 our Gross Domestic Product (GDP) would be about 0.6% lower, the value of our exports would be 1% lower and employment would be affected by 0.008%.

That’s the estimate from the first detailed attempt to model a phase-out of the coal industry in Australia.

The Australia Institute and the Centre of Policy Studies at Victoria University looked at forecasts of future coal production, worked out how much coal production has already been approved and modelled the difference to the economy if we just stopped approving new mines and major expansions to existing mines.

The difference to the economy is very small for several reasons. Firstly, the coal industry is small in Australia. It employs only 0.4% of the Australian workforce (Table 6), makes up only 1.2% of GDP and accounts for 2% of revenue for the budgets of Australia’s two main coal-producing states (NSW and Queensland).

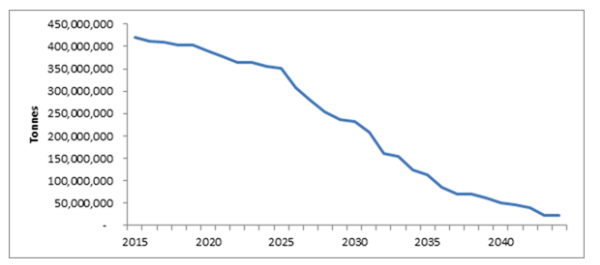

Secondly, the phase-out would be slow. NSW and Queensland have already given the green light for hundreds of millions of tonnes of coal production for decades to come, as shown in the graph below:

Queensland and NSW approved coal production

Sources: TAI analysis, NSW Division of Resource and Energy (2014) Coal Industry Profile; Queensland Department of Natural Resources and Mines (2015) Queensland coal — mines and advanced projects

The chart shows that Australia currently produces over 400 million tonnes of coal per year and we have committed to this level of production to 2020. We have already given permission to mainly foreign-owned coal companies to dig up over 300 million tonnes per year for the next decade.

Beyond 2026 we have approved less production, although still tens of millions of tonnes per year into the 2040s.

So a policy of approving no new coal mines would make little difference to the industry over the near term, while over the longer term other industries are able to employ the workers, capital and other resources currently being used by the coal industry.

Certain regions would need complimentary policies to develop other opportunities and ensure a just transition for employees and their communities.

This doesn’t happen at the moment. Instead, the industry and local communities are subject to the violent ups and downs of the commodity market. The industry has shed nearly 20,000 jobs, or a third of its workforce, since it peaked at 60,000 people in 2012 (See table 6). There was no planning for this.

By contrast, a policy of approving no new coal mines gives more time and greater certainty to existing coal workers and coal communities. In fact, by restricting new supply and putting upward pressure on coal prices a moratorium on new coal mines would assist existing coal and lengthen their productive life. Put simply, by preventing the construction of the new capacity that a post-Paris Agreement world simply doesn’t need, a moratorium on new coal mines gives workers, communities and governments more time to plan for a just transition.

Because Australia is a large supplier of coal, we have an impact on coal prices. In fact, we have a greater share of the traded coal market (24.6%, see Tables 47-50 here) than Saudi Arabia has of the traded oil market (19.5%, see page 11 here).

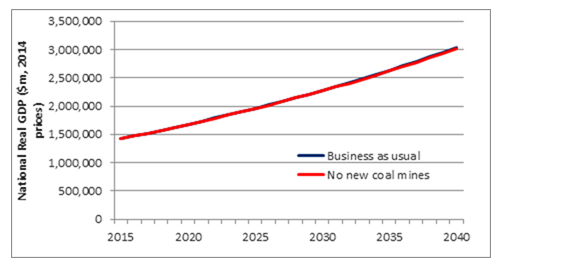

Returning to the modelled results, with or without a policy of approving no new coal mines Australia’s GDP is expected to increase from around $1.5 trillion in 2015 to over $3 trillion in 2040, as shown in the chart below:

Impact on GDP from introducing a moratorium on new coal mines

Source: CoPS model

If you look closely, there are two lines on this chart: one estimating GDP if we continue to approve coal mines along the forecasts of the International Energy Agency (here page 282), the other with no new coal mines. As said earlier, the difference is 0.6% in 2040, or around $20 billion out of $3 trillion.

For context, this is like someone who earns $100,000 per year today seeing their salary grow to $210,393 in 2040 instead of $211,694.

But wait, there’s less difference. None of this modelling includes the coal industry’s effects on human health or the environment, and the social and economic costs associated with such impacts. Economists who have tried to account for this usually conclude that coal’s costs outweigh its benefits. (For example the American Economic Association.)

A policy of approving no new coal mines is hardly radical. Such moratoriums are already in place China, the USA and Indonesia, the first, second and fifth largest coal producers in the world (page 4 here). The leaders of Pacific Island countries have called for a global moratorium on coal.

Australia could phase out our coal industry at minimal economic cost and considerable environmental benefit.

Or we could keep telling ourselves that coal is amazing, good for humanity and our moral obligation.

*Rod Campbell is Director of Research at The Australia Institute, a leading Australian think-tank based in the capital, Canberra. Twitter: @R_o_d_C

Amazing indeed. Now let’s have Crikey bring us a similar condemnation of gas. That is methane, natural gas, coal seam gas, shale gas, LNG, but more simply known among the merchants of carbon as “gas”. It’s the same stuff, methane, made worse than coal by its leakages.

The COP21 agreement requires us to eliminate our useage of gas by 2100, not just “reduce” it. The greenhouse cannot tolerate any rate of fossil carbon emissions at all, so we must convert entirely to non-carbon energy. But except for coal, we are dragging our feet.

TRUTH REALLY, REALLY HURTS! (Rod could lose his passport over this revelation).

I agree that leaking gas wells is a problem. A carefully Queensland 2011 report on an audit of leaking wells gives an indication of the extent of the problem

https://www.dnrm.qld.gov.au/__data/assets/pdf_file/0007/126934/coal-seam-gas-well-head-inspection.pdf