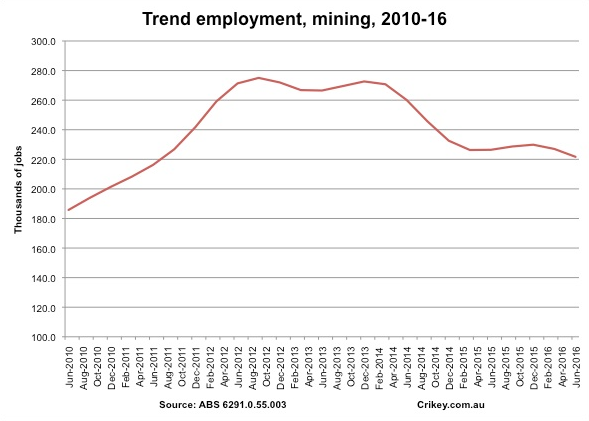

In the three months to August, according to recent data released by the Australian Bureau of Statistics, the mining industry fell to its lowest level of employment, in trend terms, since late 2010/early 2011. That’s hardly surprising given the end of the mining boom, of course. Recent capital expenditure data also showed mining investment hitting its lowest level since late 2010.

Back then, federal politics was dominated by Labor’s mining tax and its plans for a carbon price. Tony Abbott relentlessly demonised both as disastrous for mining jobs and investment, and promised to get rid of them. The mining tax had caused mining and resources companies like Santos, he warned before the 2010 election, to “put major projects on hold … billions of dollars worth of investment is at risk … hundreds, maybe even thousands, of jobs are in jeopardy.”

He maintained that hard line right up to the 2013 election. “We’ll abolish the mining tax so investment and employment will go up,” he promised in his campaign launch speech, and promised that the mining boom would come again under “a government which gets it … which abolishes all these other unnecessary taxes.”

Abbott of course wasn’t the only one attacking the mining tax and the carbon price. Chanting “sovereign risk”, the Minerals Council of Australia (MCA) fervently opposed both, and ran a highly successful campaign against the mining tax. When the carbon price legislation was passed, the MCA said it would cut jobs growth and impose huge, uncompetitive cost burdens on mining companies. Another loud opponent was Clive Palmer. When the tax was finally repealed on the vote of Palmer’s own party, he declared it had caused “a slow-down in the economy, a loss of jobs, a downturn in construction and a decline in exports.’’

So, did the mining tax and the carbon price cause job losses? According to ABS data, mining jobs reached a record level of over 270,000 in the quarter after the introduction of the taxes, more than 80,000 higher than when the the mining tax was announced in 2010. Then again, the mining workforce did fall after that — to just over 265,000, throughout the rest of 2012 and into 2013, before rising again at the end of 2013. When the taxes were abolished, in mid-2014, the mining workforce fell 15,000, then went on losing workers every quarter, until it’s now done to just 215,000.

What about mining investment? According to capital expenditure data from the ABS, that reached $25 billion in the June 2012 quarter, then dropped 6% the following quarter, after the start of the taxes. Except it then reached a new record of $26 billion at the end of 2012, and racked up three successive quarters of investment of $24 billion. Then it began falling, When the mining tax and carbon price were abolished, mining investment fell to just above $20 billion. Now it’s just below $11 billion.

And exports? In the second year of the mining tax and carbon price, iron ore exports peaked at $74 billion. The year after they were repealed, exports dropped $54 billion. As for Santos, its shares traded between $10 and $15 all those years, until they fell off a cliff in 2014, just weeks after Tony Abbott and a swathe of colleagues ridiculed Australian National University for divesting it. Yesterday they fell to just $3.41.

Of course, none of those dramatic falls in employment, investment and exports were caused by the repeal of carbon price or the mining tax. Instead, it was the fall in commodities price that saw investment, jobs and export revenue fall away — in the case of iron ore, a fall caused by the dramatic ramp-up in production capacity created by the mining boom that occurred under Labor. So, in a funny way, Labor really was responsible for a collapse in mining employment, investment and exports, long after they left office. If only they really had adopted policies that would have slowed the boom down …

“If only they really had adopted policies that would have slowed the boom down”

This seems to me a critical role of governments in various development areas: moderating booms. The market price rises then all sort of players and bandits pile in.

Boom to bust to boom. Does this produce an efficient allocation of labour and capital?

On the other hand, managing booms takes talent.

Labour did not impose the carbon tax on diesel used by the miners and their explorers. Indeed, all forms of primary industry in Australia are heavy consumers of diesel and none of it has been carbon-taxed. Carbon tax would certainly motivate miners to choose a non-carbon alternative to diesel when there is one, as it is quite feasible to completely electrify a minesite. However, neither side of Parliament is doing much about providing or facilitating alternative energy sources to carbon. Lifting the federal ban on nuclear energy would be a good start – if anything shouts to the world that we are hostile to replacing carbon, it is that one.

What policies would work? I remember thinking at the time that something needed to be done to help manufacturing and other parts of the economy cope with the high dollar which I presume was caused by the mining boom, and of course the GFC.

What power over spot prices of iron ore did the Government have over BHP when that Multinational saw a long time trend and decided to gouge China for super profits while it had market dominance.

BHP Billiton went for the jugular. It ramped up prices so high so fast that it created a run by the other mining giants to cash in on the feeding frenzy of the Chinese economic boom. And of course the new local boys (and girl) predictably joined in on the feeding too.

Miners think and plan the long game and they knew that there was a finite window for taking profits. And they knew the consequences.

They also planned and and prepared for developing infrastructure with super profits (and super CEO bonuses) to maximum output before the inevitable glut caused by their take no prisoners marketing created a bubble with competitors running with high production costs. The inevitable price crash was bound to take the late developers down with it.

Gina borrowed US$10 Billion to get off the ground just as prices started to crash. The interest bill is the only certainty.

Now Bernard, you must concede politicians have the planning span of a goldfish compared with those of the mining Gnomes of BHP Billiton, a multinational company with a “Zero” National Interest Empathy factor.

That “Labour did it ” has “truthiness” for The Australian readers.

They won’t see the irony, you really need to spell out “just kidding “