The debate surrounding the Mid-Year Economic and Fiscal Outlook and whether Australia has a credible path back to a surplus should start by remembering how we got here.

If Scott Morrison had delivered much of Peter Costello’s taxation ratio, the budget would not be in deficit today.

This government has set a target ceiling for the country’s tax-to-GDP ratio of 23.9%. If Australia had that rate over the last decade, net government debt today would be zero and for the last year alone there would have been an additional $30 billion in revenue for the Treasurer.

These are the facts uncovered in an Australia Institute report — Taxing times: The impact of the GFC on tax revenue in Australia — from senior economist Matt Grudnoff, out today. Of course, it would not necessarily be sensible economic policy for Australian government debt to be zero in 2016. However, the absurdity of suggesting the budget can only be “fixed” via cuts to spending is laid bare by the startling fact that the current $329 billion net government debt would be wiped out if tax-to-GDP ratios delivered by Costello (and promised for the future by the current Treasurer) had been in place for the last eight years.

The Australia Institute’s modelling shows that if tax revenue had not remained so low after the global financial crisis (GFC) in 2008, then there would have been only two years where the budget was in deficit during the term of the previous Labor government. These deficits in the model are of course caused mainly by Wayne Swan’s stimulus spending, which staved off a recession. Remarkably if the 2016 financial year had delivered a tax-to-GDP ratio nearer to that of the last years of John Howard, there would have been an extra $30 billion in cash for Treasury, a similar amount in 2015, and closer to $40 billion in extra revenue in 2014.

The model also shows that the accumulated deficit, which is roughly equal to government debt, would have been effectively non-existent today had the tax to GDP ratio simply held at Costello-Howard levels. So the main factor leading to the post GFC deficits and the accumulation of government debt has been the remaining low tax revenue. The size of the accumulated deficit also gives an indication of what the low tax revenue has done to the size of the debt with the accumulated deficit in effect being the sum of all the deficits after the GFC.

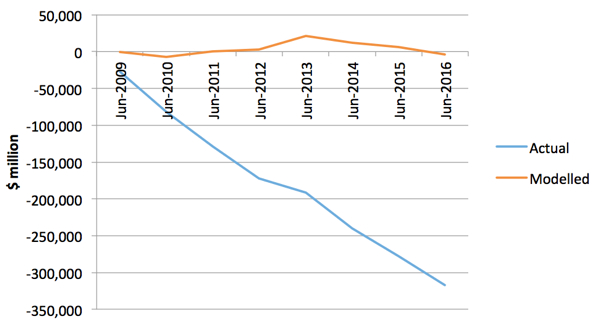

The graph below from today’s report shows the actual accumulated deficit (blue line) and the modelled accumulated deficit (red line). The actual accumulated deficit grows over the whole time period, but under the modelled scenario we see an initial deficit but this quickly vanishes with the final outcome almost in balance by 2015-16. This highlights that the current debt is mainly driven by the post-GFC low tax revenue. Put simply, because Australia did not have any net debt at the time of the GFC, if the tax-to-GDP ratio had stayed at 23.9% through to now, Australia debt would still be at zero.

Actual and modelled accumulative deficit 2009-2016

Effectively the blue line is the accumulated deficit accruing post-GFC (2008-09), while the red line is what the accumulated deficit would have been had the tax-to-GDP ratio remained constant.

Today wage growth is weak; the worst global economic downturn in 70 years is still fresh; Australia has just had an unexpected negative growth quarter. It is no time to be running fierce contractionary, austerity-style policies that either cuts spending or raises taxes too sharply in an attempt to wind back GFC-inspired deficits too quickly.

However, the recent history and projections for the overall taxation take are revealing. Australia sits as one of the lowest-taxing countries in the OECD. Our population is expanding rapidly, and our city infrastructure is failing to keep pace with that growth. The history of Australia and indeed every developed country is that of an expanding tax base to build a richer more prosperous nation. It is no accident that poorer developing nations have lower tax-to-GDP ratios. Such countries have worse infrastructure, worse services and poorer amenity. An educated workforce; healthcare for everyone; parks; energy networks; water on tap; a transport system fairly accessible to most, have all been built with an expanded tax base. It’s the price of civilisation.

Australia can increase its tax-to-GDP ratio modestly with no harm to our economy. In fact, the opposite will be the case. Building and funding the hard and soft infrastructure that the public craves will drive continuing prosperity. Alternatively we can bet against what the history of economic development has taught us and chase some arbitrarily low tax to GDP ratio.

And if you were the government with the budget well below even its tax-to-GDP ratio target of 23.9%, it makes no sense to pursue a $50 billion company tax cut that is as fiscally reckless as it is political toxic.

In fact Costello did much har, to the budget and still more to the economy by piddling away money in taxcuts during a boom, increasing inflation and spending no money on very important key areas like transport and science. I agree with the rest, but Costello was a goose and Howard a fiscal fool.

Not to mention instilling an addiction to middle-class welfare – and being a member of the government that took us to an expensive, hubristic war in Iraq?

Perhaps Morrison could raise some revenue by selling the remaining 80 tonnes of gold which Peter Costello decided not to flog off in 1997. Costello (in)famously sold 167 tonnes of the RBA’s gold when the price was low – before it soared. No doubt Costello’s admirers will spring to his defence by arguing what extraordinary foresight he had to retain 80 tonnes.

So, for this reason & those given above by fellow Crikey readers, Costello is no financial whizz. And Howard enabled him.

Ah yes! Good ol’ Crusty Trusty Pete – the wind beneath the Lying Rodent’s wings (or something to do with the Lying Rodent’s wind, at least.)

The Howard-Costello “Tax-cuts for electoral popularity” – what’s that done to revenue?

Who’s going to address that and turn it around.

They’ll happily subject us (especially those least able to go without) to service and infrastructure cuts long before they get to look at a necessary tax rise, even a modest one – and you can bet the worse-off will be first in line for that.

John Howard always took it in his strides!

Why should the federal government’s net financial position with respect to the domestic non-government sector be a surplus? That would mean that Australian households and firms as a whole would need to be in deficit with respect to the federal government. How would that be helpful to households and firms?

Someone who gets it. You only want to do this to slow the economy down, and when we’re teetering on the edge of recession its not the time to do this.