It’s not surprising that climate denialists have reacted to Friday’s Finkel energy review by complaining about the maths behind it.

“Creative assumptions”, Senator Eric Abetz insisted. Another usual suspect, Craig Kelly, wants the numbers done again because he didn’t like the results in the review. Those results show a Clean Energy Target produces lower prices for both residential consumers and industry than an Emissions Intensity Scheme or if the current “business as usual” scenario continues.

There are numerically challenged complaints from other quarters, too. One of the country’s top rent-seekers, the Minerals Council, complained about the lack of consideration of nuclear power in the review. Presumably, Minerals Council CEO Brendan Pearson et al want Australia to copy Finland, where the first western European nuclear power plant in 15 years will open at the end of next year — nearly a decade late and at 2.6 times its budgeted cost. In the intervening decade, investors have abandoned the project in droves an the French builder asked for a bailout from the French government. The new reactor being built by that company in France has tripled in cost — though it’s only six years behind schedule.

Japanese giant Toshiba is also facing massive writedowns because of the construction of two new nuclear power plants in the US, which are — you guessed it — massively delayed and over budget. The various parties can’t even agree on who is responsible for the blowouts.

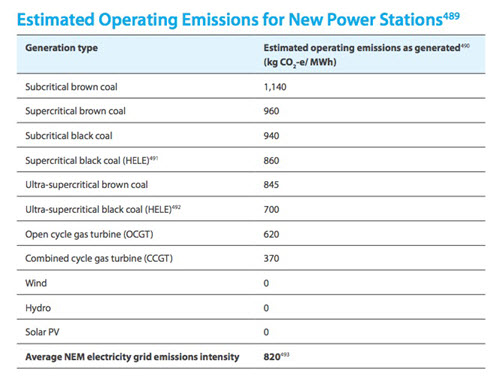

But the Minerals Council’s nuclear fantasies aside, the real fight with denialists will be how to allow coal-fired power to be deemed “clean energy”. The Finkel Review helpfully lists technology in order of emissions intensity.

It shows why coal fetishists want the threshold for the Clean Energy Target to be set as high as 850 kgs, in order to allow high-efficiency coal-fired plants to fit under the threshold.

The problem, however, lies with investors, not the threshold: they don’t want to invest in coal-fired power in Australia, no matter how many glamorous prefixes you put in front of it. As with nuclear power, any serious consideration of building new coal-fired power stations in Australia starts with the need for government subsidies — probably very large ones — because the market won’t provide the funding for them.

Tony Abbott and his denialist friends are no strangers to ignoring the market and preferring big-government, big-spending solutions on climate action — he repealed a successful market-based carbon pricing mechanism and substituted an expensive handout program. But for coal-fired power, the handouts would have to be an order of magnitude larger than the funding for Greg Hunt’s Soil Magic fund, likely tens of billions of dollars — the 600 MW John W. Turk Jr ultra-supercritical plant in Arkansas alone cost US$1.8 billion five years ago.

So here’s the challenge for the coal fetishists, nuclear power fans and climate denialists: identify the budget savings you’ll use to fund power plants given the need for government-funded construction. Because it doesn’t matter where the CET threshold is set, investors prefer renewable energy and gas-fired power.

Thanks for this nicely argued piece.

I heard an LNP guy yesterday on radio in Brisbane ask if renewable sourced electricity was cheaper than fossil fuel powered. (Meaning that it wasn’t.) I took this as a rhetorical piece of FUD y’see. But that is the level that this has descended to now.

The capital cost of power stations is a subject most people don’t think about.

Using Dr Finkel’s figures, setting the clean criterion at 700 g/kWh immediately gets rid of all coal generators. Lowering it past 620 g/kWh gets rid of solo OCGT, leaving only CCGT and wind+OCGT to power the grid.

Since wind only contributes 35%, wind+OCGT emits 0.65*620= 403 g/kWh, which is more than CCGT alone. So there is no further reduction available from expanding wind generation.

We had better order those nukes soon, there might be a long queue.

Roger I’ll help you with those last few lines on the chart – the next one after wind is hydro, and if you add that one up you will see that wind+hydro is 0+0=0. That should be an adequate target…and will allow another 1GW for Tassie so that they can be drought proofed and 100% renewable and allow 1.5GW of pumped hydro in SA to allow them to be 100% renewable. You’ll notice the last two lines also add up to zero, so Qld can add 3GW of pumped hydro and 5GW of solar to be 100% renewable. I love how maths works!

Mike, storage needs to be calculated in GWh, not GW. In pumped storage, a single GWh would require a 3.6 km2 sheet of water one metre deep, to be suspended 100 m above its outlet. For the contingency of say 8 days of non-windy weather, SA (at 1.5 GW) would need ~290 GWh of reserve as water held high in the SA mountains. But does SA really have 1000 km2 of Alpine valleys to drown? Just for energy storage?

In hundred-fold contrast, a fresh load of fuel for about 3 gigawatt-years production from a classic nuke, could be stored hanging up in a shed out back of the reactor.

No Roger, storage in GWh covers long term firming, which can also be covered by management of diversity in supply and demand. 8 days of no sun and no wind would be extraordinarily exception, the sort of exception that leads to failure of any system. Mind you, we saw thermal systems fail in SA recently in much less exceptional circumstances, so it depends on how much “exceptionality” people are prepared to pay for.

Mostly storage is needed for intraday load shifting and reliability, and in that guise GW are the key element. There is 1-1.5GW of pumped hydro readily and economically available in and around Adelaide, some on existing reservoirs, some not. Coupled with more management of demand, behind the meter battery and solar, large scale wind and solar, home and commercial thermal storage for heating and cooling, SA will reach 100% renewables with greater reliability than today I would think within the next 5y. No nukes required, other than the one 93million miles away.

Even better and far more cost effective is to use gas to cover the rare exceptions, then you can scale down your renewable backup reserve capacities enormously. Still no nukes required and a very small increase in emissions (because hardly ever used) with none of the risks or costs of nuclear.

Game = Set = Match. (Estimated Operating Emissions for New Power Stations)

The LNP ignored Stern’s warnings back in late 70’s; that by doing nothing, the world would have chosen the most expensive available option with which to address Climate Change.

Finkel has offered the final warning.

Australia is on cusp of a new decade fraught with multiple threats or opportunities. Our ruling class of course has the means to mediate impacts of doing nothing. But for working families, aged, unemployed and youth; no such means exist. As for future generations . . . their voices along with choices, buried deep, engraved as “Inheritance(s).”

I have often wondered what a denialist is- is there spectrum of denialism -or is it digital either 0 [no] or 1 [yes]?

Aside of the increasing cost of building a nuclear power plant, there’s the cleanup cost. In England the cleanup bill for 11 mothballed nuclear power stations is in excess of UK£70b (NOA report Jan08) and of the 23 or so still operating, half were shut down at the time for repairs or maintenance (guardian.co.uk). So much for cheap and reliable! I actually don’t have an issue with coal if they can really make it clean, maybe there’s a 17 year old genius out there who will hit on a new process, but I’m damned if I want to pay billions to greedy coal companies for ‘research’. I’d rather have the govt pay more toward my home solar/battery system, now there’s an idea…

I see the usual suspects at the oz are at it again, miraculously most of the letter writers were anti-Finkel and Judith Sloan still blames renewables for the ludicrous rise in power bills. Actually Judith, the rot set in after privatisation of the system with next to no regulation on pricing and supply.

Clean coal is an oxymoron – coal is dirty no matter what you do with it. Capture and storage of Co2 is the same dangerous waste being shoved under the bed for future generations to guard and protect for eternity. The miners, shareholders and politicians who have made and are making profit from coal are not going to contribute to solving the waste problem. They will take the money and run. The politicians who say we should be faithful to coal because it has served us well in the past are irrational. Sea movement, hydro and geo thermal are waiting for us to utilise their potential. We do not need coal and there are jobs waiting for workers in the renewable industry.

Marion, where are these “job’s” in renewable industries? as currently all the Solar panels, wind turbines are manufactured in China, Europe and assemble in Oz. Also we shut down all the coal mines as you suggest and our exports go through the floor never mind the hundreds of people employed in coal mining, power stations, maybe we could use them to assemble wind farms and solar arrays. I have to laugh at the comments that “Electricity prices will fall” with the use of clean energy. Do you know that gullible is not in the dictionary look it up.

David, I’m more of a ‘glass half full’ guy. There’s been a very large growth in the renewables workforce over the last decade, both in manufacturing and installation. If the govt hadn’t destroyed our solar panel and windmill industry there would be even more. At the same time there have been great job losses in the coal mining industry due to automation and robot trucks.

Even if the world doesn’t build anymore coal power stations, we would still have a coal export industry for the next 50 years or more.

In future the only way to get your power bill down is to go off grid. I’ll be doing so within the next couple of years when the price comes down to about $5-8K for a 10Kw solar/battery system

I see David that the title of the article may also apply to you! Try googling just how many jobs there are in the mining and power sectors, and you will see that all the employees could fit into a smallish regional city. The big numbers are during construction, and now that we have grossly overbuilt our mines, our FF power stations and the transmission to suit them, employment has dropped to a small fraction of the construction workforce.

Meanwhile in the real world, the 10s of GW of renewables that will be built over the next decade or so are and will employ large numbers of people – try googling the number of panels in a modest sized solar farm and you will get the picture. There are millions of homes adding rooftop solar and now batteries. EVs have just kicked off, so there is the infrastructure for those, and the gradual decommissioning of 10s of thousands of contaminated petrol stations.

With a bit of patience and a good google finger all will be revealed and you can leave the clutch of maths illiterates desperately trying to hold back the future.

Hear, hear.

I read with interest your comments and I am currently working on a solar farm in W.A. and soon to be one in Queensland and all the panels are coming from China as there was know supplier in Australia that could meet the requirements to supply these panels. Also the solar farm in W.A. will be 50Hta in size and will supply 20,000 homes and will only keep them supplied for two hours when the sun dose not shine, not exactly what you want. Bref I see you say in your reply “the only way to get your power prices down is to go off the grid” according to Finkel power prices are coming down with this 90Billion investment in renewables a bit of a contradiction there I think or you agree power pricing are going to go up and up. Australia contribute 1.4% od the emission in the world and with the “Paris Agreement” countries like China and India will be able to increase their emission up to 50% that seems fair as they have to produce all the solar panels and turbines.

I say that David, because the price I pay has little to do with the cost of production. In Australia there is so little regulation that suppliers can and do charge whatever the market will bear. Contrary to promises, prices rises soon followed privatisation, it had little to do with the cost of production and everything with corporates doing what comes naturally, fleecing the public.