It’s a well known fact that anywhere on Earth you’ll find a happy-go-lucky Australian traveler with an accent broad enough to make you cringe. What’s less well known is that Aussie’s travel insurance won’t cover anything — delay of trip, medical treatment, damage to possessions — caused by a terrorist incident.

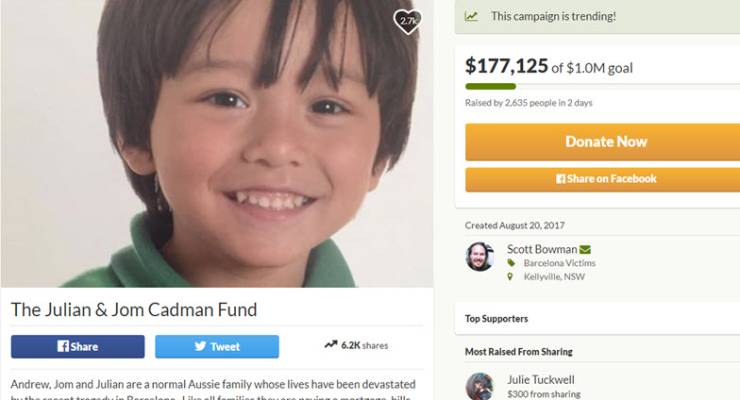

This was the situation slain child Julian Cadman’s mother, Jom, found herself in after the Barcelona attack. Family friend Scott Bowman set up a crowdfunding site to help with funeral costs for Julian and her (potentially years of) ongoing surgery. The crowdfunding site has currently raised $170,000.

He told The Daily Telegraph on Friday that “their travel insurance might not cover acts of terrorism and Jom is going to have ongoing medical expenses”.

Really? Not covered?

As Bernard Keane wrote in Crikey on Wednesday, we are “just as much at risk of attacks as ever, from as many terrorists as ever, representing a greater variety of terror groups than ever”.

Despite this, funeral costs, changes to hotels and flights, damaged property and medical fees resulting from a serious terror attack are not common or standard inclusions in travel insurance, especially cheaper ones.

“Terrorism is a relatively new issue for insurers to deal with. If insurers don’t understand what level of risk a factor poses, or there’s uncertainty in it, they are reluctant to offer coverage of it,” said a spokesman for the Insurance Council of Australia.

But over the last couple of years, terrorism inclusions have begun to appear.

“As the industry gets more data and that data becomes more granular, more companies will start to include terrorism coverage.”

He added consumer demand for specific terrorism clauses in travel cover is not particularly high.

“Out of hundreds of thousands of phone calls and website hits annually, we’ve had less than a dozen enquiries about terrorism cover for travel insurance.”

The other sticky issue these days is whether an attack is officially considered terrorism? Turns out, if you’re wanting to claim, insurance companies are going by what governments officially declare.

I hope the spelling ‘traveler’ is just a typo’ and not an acceptance of the American spelling instead of ‘traveller’. It’s an offence, and rather offensive, to use the American spellings instead of the good old, and very logical, British spelling.

The insurance industry, always alacritous updating charges are curiously tardy, not to say dilatory, when it comes to updating risks.

Now that terrorism, thanks to the West’s wildly overfunded spook establishment, is as normal as Delhi belly or a bite from a rabid monkey in Bali, surely it should be just another line in the fine print?

Or could it be that insurance doesn’t want to come within cooee of “existential threats” anymore than it does floods caused by rain/dam burst/Act of Spaghetti Monster?

Anyone tried to buy climate change coverage?

Munich Re, one of the largest – struggled for a couple of years

Hi AR – 96 per cent of household policies bought in Australia have flood cover. Some insurers cover terrorism under certain circumstances and more will do so as they develop a better understanding of the risk and how to price that risk.

Has always been the case.

Most travel insurance does not cover acts of so called conventional war, either.

The statement the Insurance Council provided to Crikey says:

Travel insurance policies may not cover financial losses resulting from acts of terrorism. However each policy is different. Some policies may provide cover under certain conditions for affected travellers who have already embarked on their trip. Many policies will cover medical costs. Some will also pay for additional travel and accommodation costs, lost luggage or repatriation, while a small number may cover cancelations due to acts of terrorism.

In other policies, terrorism remains a general exclusion and is not covered at all, so it is important that travellers check each company’s product disclosure statement (PDS) if this type of cover is important to them. Travellers who have been affected or are considering cancelling their trip should contact their insurer for guidance.

Campbell (insurance industry flak?) – “96 per cent of household policies bought in Australia have flood cover” which they resist paying out on by arguing when a flood is not a flood.

Is it pluvial or fluvial, blocked drains a hundred kliks away or uncompleted levees as swamped Lismore?

AR – I am head of communications for the Insurance Council and provided my details to the Crikey journalist when she contacted me for this misleading article.

Please refer to the Federal Government’s standard definition of flood, introduced in 2012. It applies to home, contents and small business policies.

The definition of flood is:

• the covering of normally dry land by water that has escaped or been released from

the normal confines of:

• any lake, or any river, creek or other natural watercourse, whether or not altered or

modified; or

• any reservoir, canal, or dam.

Campbell

So a pluvial flood wouldn’t be covered by an insurance policy, since there’s been no escape of water from any lake, natural watercourse, reservoir or canal? If the flooding of a house is due to severe rainfall on a bitumen surface just up the road?

Hi Wayne – storm damage is covered in home and contents policies. Once storm water flows into a river, and the river breaks its banks, it’s a flood. In some cases a property may have both types of damage.