The Grattan Institute report on housing released today illustrates how, when it comes to housing, Australia’s middle- and higher-income earners have successfully waged economic war on the young and low-income earners over the last 40 years.

The success is clear from some compelling data in the report: ownership of housing by 25- to 34-year-olds has fallen from over 60% in 1981 to 45% in 2016. And ownership among the lowest 20% of income earners has fallen from between 60-70% for all groups under 55 to below 50% — and to just above 20% for 25- to 34-year-old low-income earners.

Despite Scott Morrison bizarrely trying to insist the report is some sort of vindication of the government, the very first recommendation from the report is “The Commonwealth Government should limit negative gearing and reduce the capital gains tax discount”. The report finds that not merely did the Howard government’s 1999 capital gains tax changes significantly encourage property investment, but that it has particularly harmed low-income earners because investment has been channelled into low-value homes.

It’s not merely the way our tax system subsidises property investors to compete with low-income and young housing buyers, of course. The report identifies a range of well-known factors. The report praises immigration as economically beneficial overall to Australia, but argues state governments have failed to plan for it effectively, leading to additional pressure on housing. And perversely, we have a tax and welfare system that discourages downsizing and rewards seniors for hanging onto property they no longer need.

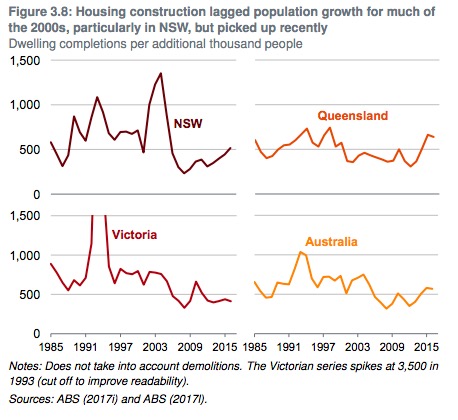

But the biggest problem is in housing supply. Across Australia, the supply of new housing fell away in the 2000s, and only recovered in the current housing construction boom — though we’re still not back to where we were in 2003, nationally. In this regard, the New South Wales Labor Party — supposedly a party dedicated to looking after workers’ interests, but more famous for its blatant corruption — should be singled out for stunning negligence. New housing supply fell off a cliff under Bob Carr and only began recovering at the end of the Labor years under Kristina Keneally, likely helped by the Rudd government’s social housing stimulus package. Yet more evidence that NSW Labor shouldn’t be allowed near power in Australia’s largest state for many years to come.

But high- and middle-income earners don’t just have the tax system on their side against low-income earners, they’ve weaponised NIMBYism to prevent greater housing supply being added to the crucial “middle ring” of cities, where there’s already strong infrastructure links and economic activity, locking low-income earners and younger people out. As the report says:

Most people in the established middle suburbs already own their house. Most of them don’t like new developments in their neighbourhoods – the NIMBY syndrome. And so most people in Sydney believe that additional population should be housed primarily outside the existing Sydney boundaries.

NIMBYism — and local councils that pander to it — in turn makes housing in those suburbs even more expensive, another win for middle and high-income earners. This problem is improving a little, the report finds, but “Australian cities still have relatively little medium density development in their extensive middle rings”.

Middle- and high-income earners in established suburbs have a strong ally in their NIMBYism in the media. Fairfax publications in Sydney and Melbourne, in particular, love to exploit all sides of the housing debate: lamenting the state of housing affordability for young people and low-income earners while Domain generates big profits from the metropolitan real estate market. Meantime its journalists relentlessly push an anti-development line that attacks new infrastructure projects and housing development that might offend residents in established suburbs.

This is a class war, in which people on high and middle incomes have used a skewed tax system and NIMBYism to enrich themselves at the expense of low-income earners and young people. The economic dislocation of preventing people in entire job categories from living anywhere near where they work because they can’t afford housing, the congested infrastructure as they travel an hour to get to their jobs, the lack of workers to provide core services where they are needed, is the price we’re all paying for this victory. That low-income earners and young people now face stagnant or falling wages to fund ever more expensive housing merely adds to toxic economic outcome we’ve manufactured for ourselves.

Good stuff, Crikey, why we need you more than ever! The story of intergenerational theft [or, economic bullying-with-deception] should be disseminated as a cautionary tale for toddlers, and in suitable forms through to Uni. We willed it / we allowed it, per the privileges of the Boomers and the avarice and competition of the post-1980 Market Forces boosters. We all tend to MF where we control the F. We lost the supposed objectivity of the government bureaucracies to inform and promote the Public Interest; the academics became overwhelmed in commercialised uni’s and colleages and generally chose MF and Property rather than social-conscience propaganda per ACOSS etc . What can be done to shift the trends? – I believe that it will require a wide and deep collapse of asset ‘values’, experienced over at least ten years, to shift the morals and behaviour towards evidence-based fairness. In such a period, cashed-up foreigners will take over billions of assets, and ordinary Australians will blink their way into a diminished sovereignty. Thanks Boomers.

There’s bugger all monetary fluidity in the mortgage belt – who else was Howard-Costello (with members of this government) going to spray with their “Middle Class Welfare for Votes” policies (financed off the back of the mining boom) besides asset-rich home owners?

The poor and put upon could fend for themselves thanks to milk-shake and sanga tax cuts.

I agree strongly with the thrust of the Grattan report (as reported in the media; I haven’t read the report), particularly what’s said about tax incentives. However as a Boomer with a valuable house in the middle ring of suburbs I do want to say one word in defence of what’s being described as NIMBYism.

I, like most others in my demographic, bought a house in the middle ring because of the amenity of the area: quiet; green; peaceful. Contrary to the report and what Crikey says, housing density where I live is very definitely increasing and it’s having a hugely detrimental effect on the amenity I described. Right now, next door but one is a block where one 3 bedroom house has been knocked down and currently two 3-level 4-bedroom houses are being built. Just around the corner on a single (larger) block one 3-bed house has been replaced by five, yes five, 3-level houses, most of them 4-beds but also a couple of threes. Not a tree or blade of grass was left on either block; there has been some “landscaping”, but what’s been planted has so little space and light that it’s not likely to thrive.

Why shouldn’t I raise every objection possible when yet another developer proposes the same again?

Obviously, you have the right to object and to try to obtain a better outcome. Development can be more sensitive to the area, requirements can be made for more green space etc, but the “middle ring” was once outer and as it becomes closer to the centre pressure is inevitable. The amenity is available in other areas, probably further out and probably at attractive value. Current landholders have rights but “incomers” who want to live closer to where they work also have rights.

Robin: the problem with your analysis is you have the means to move somewhere else with the “amenity” you seek; the young (who have not benefited from the windfall capital gain as you have) have much less means to find shelter close to the services and employment to which they need access. It’s a big country, and you’re blessed with both capital and mobility. I suggest you use them.

From BK:

“Yet more evidence that NSW Labor shouldn’t be allowed near power in Australia’s largest state for many years to come.”

Yeah, fair comment probably.

But …. then there is this, from a bit over a year ago, which would warrant the same conclusion? Surely?

“Up to 20 ex-Liberal MPs and businessmen tried to break the law in the lead-up to the

2011 NSW election, the state’s corruption watchdog has found.”

[That ‘ex-Liberal” is a nice touch don’t ya reckon?]

https://www.sbs.com.au/news/mps-tried-to-evade-donations-laws-icac

It leaves me wondering why no Xenephon-esque party or personality has sprung up in NSW politics.

Both majors are so riddled with corruption scandals that the best they can do is argue over who had more ties to Eddie Obeid and who can do the most to nobble ICAC. Meanwhile the NSW Greens are the in-fighty embarassing state chapter of all the state Greens. And this is the largest most powerful state in Australia! Surely it is worth someone’s time to try and do a Xenephon there.

BK fails to mention the Barry/Baird/Beryl group selling off everything NSW once owned at cut price-rates to developer mates nor the criminal actions they’ve overseen in relation to water rights/use and land clearing laws.

Lets not forget Libs like Nick G. & Arthur S. had direct ties to Eddie O. in his little water supply rort as well. Then there’s the turfing out of public housing tenants who lived too close to the CBD , the multi – billion spend for stadiums that will never be filled, and the soon to be white elephant WSA and so much more.

Good piece BK thanks.

I was lucky to have a great bank manager back in 1981; they still existed then.

He authorised a loan for me, a young, single female RN, for my first home, a modest studio in Coogee.

That gave me the start I needed to secure housing close to my work through the years and now into old age and retirement.

Thank you Mark Harris of Wesptac Balmain. Hope if your still around you had a happy life.

And 37 years later you are well-to-do, because it could be done in 1981, when it was being done almost exclusively for Australian citizens; but in 2018 no single, or even most married two-income RNs at any of Sydney’s hospitals can afford what was possible for you. Because it’s no longer being done almost exclusively for Australian citizens – quite the opposite. There are some yeses, but to my mind many noes, in BK’s article. Including his apparent belief that our middle class is not under attack.

Agree that the middle class are also under attack Norm.

You are right that what was possible for me is impossible for those today.

Who can raise finance and how to buy into real estate these days is deeply wrong.

BTW, I guess I’m well to do compared with many, many Australians and I know I’m very fortunate.

I don’t have much disposable income however and am not entirely financially secure because I missed out on adequate super having to retire at 50 because of ill health. I’m very grateful for the aged pension and medicare otherwise I’m be selling my home to survive.

You were not just lucky, EG, it was quite normal for a single person or couple to get a house loan if you had a deposit and a steady income. House prices in ratio with incomes were (in retrospect) very affordable. My wife and I, while living a very comfortable existence renting in Neutral Bay, were able to save a deposit for a house in Manly within 3 years. We are now in our 6th home since then and all the moves have been very lucrative in our favour. Property articles and magazines talk endlessly about why this is, but the only real reason I think is sheer lack of supply. I read recently that Australia is now several hundred thousand homes below demand. The coastal rural shire where I live now has had no rezoning and release of land to speak of since 1988, so no wonder prices are through the roof.

I don’t know how this can be fixed in the short term now, but what can and should be done is look to overseas solutions. In European countries, the majority of people rent, the rentals are owned by governments, investors or corporations and operate under extremely strict guidelines.

In Australia greater rental protection and long term rental agreements would alleviate much suffering at the hands of greedy investors. A massive build of social housing would allow both the older and younger generations to live with dignity at or near the poverty line. At the same time, regional councils should be forced to release more land to maintain house prices at least at current levels.