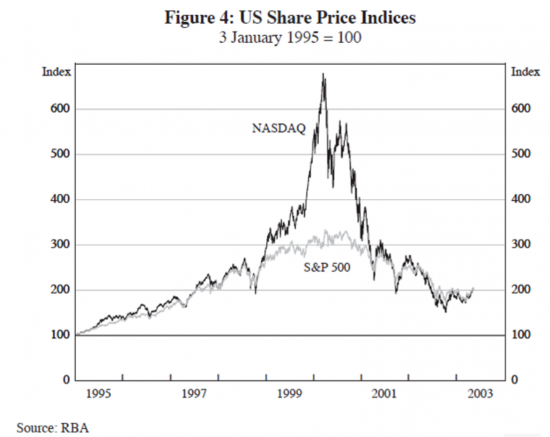

History sometimes repeats. The US looks to be on the brink of another tech wreck. The feeling in the air is similar to that in March 2000, when the NASDAQ Index famously tipped over its frothy top and began a precipitous descent.

The portents are present. Retail investors are perfectly fluent in ways of valuing firms that have no profits. (Twitter’s price-to-sales ratio at IPO was 45 and Snapchat’s was 58) Meanwhile the CEO of a perpetual loss-making company publicly mocks the prospect that he might one day be bankrupt.

The combined intensity of hope and hubris looks finally sufficient to begin the conflagration and the global media is in position, ready to report on it. Headlines will come thick and fast, because so many of the names involved — Amazon, Facebook, Apple, Netflix — are consumer brands interwoven with our lives.

In the autoplay videos on US news sites, the talking heads will elbow each other out of the way to deliver their proclamations of doom and disaster. But, here in Australia, it might be like watching reports of an earthquake — we will get a sense of the dread, but probably feel no tremors.

For all the public relations effort that went into talking about fomenting an ideas boom, Australia’s tech sector is a little thing. We remain, to the frustration of Malcolm Turnbull, a country that rides on the back of the iron ore truck and the Chinese tourist.

When the dust settles, we may find that has once again been a good thing.

In 2000 the last US tech bubble burst, bringing down pets.com and its overcapitalised ilk. The Australian economy didn’t even flinch. While recession gripped the United States, we kept on growing. Australia even managed to introduce a brand new, complicated Goods and Services Tax that year, and the economy kept on spitting out positive trend GDP growth numbers.

As the RBA wrote in 2011 “the bursting of the tech bubble did not lead to large negative wealth effects in Australia as the absence of large tech firms meant that the domestic equity market continued to rise through to 2002 as global markets declined”.

The same absence could be noted in Australia today. While the technology industry is certainly bigger than it was in 2000, it is far from a behemoth. The ABS keeps tabs on things via a “computer system design and related services” category in the national accounts. It has risen from 0.75% of our GDP in 2000, to a little under 2% in 2017. That is one-third the size of manufacturing, which as we know has shrunk dramatically.

The tech index of the S&P ASX200, meanwhile, is no NASDAQ. A modest list of twelve stocks, it includes the ones that own realestate.com.au, carsales.com.au, Domain.com.au, the accounting software MYOB, and the share registry companies Computershare and Link Administration. These are all good businesses, but they aren’t the kind of giant global names that are currently trading at frighteningly elevated price-earnings ratios.

This lack of loss-making “story stocks” is something that is held against us, as a rule. Many people insist Australia must emulate America: innovate or die! (And when they say innovate they want it to involve 28 year old dudes in t-shirts doing machine learning.) But look at what happened after the last US tech wreck. It wasn’t a tech industry that lifted. Instead Australia’s much-derided mining industry was in the perfect position to deliver an enormous boom.

People make fun of our economy’s reliance on flat whites and foreign tourists, education and health. But those industries have big strengths. They may not make the finance news, but they employ far more people than our tech companies do and they almost never explode in a giant bust.

When the sound of the tech bubble bursting is reverberating in our ears, there should be some comfort in that.

Totally agree Jason, a tech wreck in US may be not much more than a news report for us, and as they don’t pay any tax here will have no effect on budget positions and very little on jobs.

And how much of that tech bubble bursting was just facebook taking a beating?

Um, I work in the tech sector, and I can report that the popping of the bubble back in 2001 had quite an effect. I knew a lot of software developers who were unemployed for extended periods. I was “lucky” in that I worked in defence between 2000 and 2005. I was looking for a new job for about the last two years of that time without success, but at least I was paying my rent.

I can also recall back in about 1997 when Netscape had its IPO, and went from a share price of about US$1 to US$70 in the space of a few days. I thought to myself “there’s no way this can last…”.

Overall – not too bad Jason – if a tad too general. In some (many?) respects

you are correct : ‘People make fun of our economy’s reliance on flat whites and foreign tourists, education and health. But those industries have big strengths.” but is it going to last forever?

The premiums that (large) Chinese firms paid for overseas quals (degrees) are no longer in existence which rather removes a principal justification for an overseas qual (other than personal glamour). Secondly Oz once upon a time did have tech industries for the first 30 years of the 20th century; for example optics, comms and medicine – until Menzies screwed the sector; long story to be argued elsewhere.

Take a look at wealth creation in the tertiary sector for 1st word countries over the last 25 years. Oz/NZ are in the unusual (unique?) position that a significant percentage of GDP is from their Primary Sectors but Oz/NZ are 1st world countries notwithstanding.

There is something of an implication that Oz/NZ does not have an over-valued market but the merest glance at the property (residential and commercial) puts paid to that assumption. A decent shock (epidemic or earthquake or other natural disaster) affecting (e.g.) 15-25% of the population would bring the entire sorry mess to its knees. Ditto anywhere else you say : yes – agreed, but we’re discussing overvalued markets.

Lastly, if you or anyone else thinks that we can just lounge about accepting deteriorating educational standards and not create a market for venture capital (no such realistic market exists) just accept to be taken over.

Can’t see it. The examples used in the article have growing cashflows, not the promise of future cashflows like in the early 2000s. It’s just a generic bear article, with very little analysis.