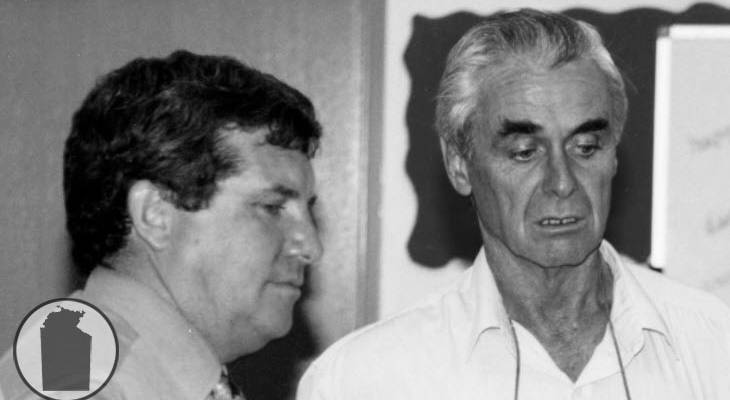

Shane Stone (left) and Graeme Lewis

This is the first of several articles drawn from research into political fundraising in the NT – here dealing with an early and as yet undocumented aspect of Northern Territory economic history.

The Darwin Shuffle had its origins in the administration of the Northern Territory by the Commonwealth government from 1911 through to 1974 and was perhaps best described in the explanatory memorandum for a bill presented to the New South Wales parliament in 1986. The Darwin Shuffle:

… involved the movement of a parcel of shares by a company incorporated in one of the States onto a newly-created register of members in the NT, where the shares were transferred at a lower duty than that chargeable in the originating State. The shares were then moved to a register in another State.

That all sounds innocent enough, if not a little boring, but stamp duty and the paying of it had been a running sore for the Commonwealth’s administration of the NT from at least the early 1970s. From 1947 to 1974 the NT was governed by a Legislative Council made up of a blend of Commonwealth-appointed and locally elected members. From 1974 to self-government in mid-1978 the Legislative Assembly consisted wholly of locally elected members.

In August 1971 the Northern Territory News reported that the locally elected members were revolting, again refusing to allow the introduction of new stamp duty legislation that the Commonwealth’s man, assistant administrator Martyn Finger, described as “a matter of essential Government business”. Finger reckoned the NT was punching well below its weight in the collection of duties compared to the Australian Capital Territory, where a population of 140,000 had contributed $3 million in duties the previous year. The NT population of 70,000 people yielded a paltry $150,000 for the same period.

Similar reform attempts were frustrated by locally elected members in December 1971, February and May 1972 and again in February and October 1973 when Finger told the Legislative Council that the NT was being used as a tax haven to avoid stamp duty on traded shares. Finger noted that the NT was the only Australian jurisdiction where such a duty was not imposed and that from July 1972 to August 1973 shares worth $130 million were transferred through the NT, representing a loss of $780,000 to the states where the companies were registered.

Finger had a final fling in February 1974 when, in a “don’t tread on me” moment, elected members sent Finger away with the words “no increased taxes without increased representation” ringing in his ears.

Finger’s foreboding that the NT had become a tax haven was no doubt prompted by protests from the States, who had lost millions of dollars in stamp duty revenue to the rebellious representatives in the far north.

Tax havens need clients in order to succeed and NT Archives records show that Perth-based businessman Alan Bond was an early adopter of the Darwin Shuffle, using the Darwin office of accounting firm of Wilson Bishop Bowes and Craig to restructure his business affairs in August 1973. Wilson Bishop Bowes and Craig later became one of the founding members of “big four” accounting firm Pannell Kerr Forster.

Read the rest of part one on The Northern Myth blog here.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.