Philip Lowe, governor of the Reserve Bank of Australia.

The Australian economy dangles by a single thread: the ability of the Chinese government to prevent a financial meltdown. China is in a debt pickle of gargantuan proportions, and Philip Lowe, governor of the Reserve Bank of Australia, made it clear he is deeply concerned.

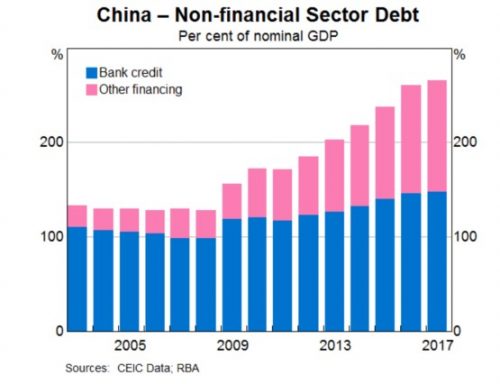

China’s debt has risen from around 100% of GDP to over 250% in the last two decades. You may consider this especially startling when you consider that its GDP has risen 11-fold over that time. China’s debt is far out of line compared to other developing countries and even more than many developed countries. This rarely ends well.

“The build-up of financial risks like those seen in China is almost always followed by a marked slowdown in GDP growth or a financial crisis,” Lowe said last week in an address to the Australia-China Relations Institute.

A crash or “marked slowdown” in China would be disastrous for Australia. We rely on China to take a share of our merchandise exports equivalent to that taken by Britain in the 1920s. China is our largest source of tourists and our number one market for education exports.

A Chinese collapse is not necessarily inevitable, Lowe made sure to point out, before presenting a range of ominous facts. Foremost among the gloomy portents was this: “during the big run-up in debt, a lot of bad loans were made.”

A financial crisis normally has bad loans at its heart. Whether the money was loaned to the Greek government or US subprime borrowers, loans that can’t be repaid turn a debt into a disaster.

In the shadows

China’s major banks are regulated tightly. Much lending happens in other places, via an estimated 3500 small institutions and practices such as businesses lending directly to one another. They call this “shadow banking” and it is represented by the pink bars in the above chart. The shadow banking sector has quadrupled its share of a rapidly-growing economy, adding enormous froth and tremendous risk to the market.

Lowe stated China’s debt growth follows the liberalisation of its financial system. “It’s worth recalling that we saw a similar process here in Australia,” he said. “In our case, this did not end well.”

The early ’90s saw two Australian state banks collapse — State Bank of Victoria and State Bank of SA, along with the Pyramid Building Society and several credit unions, all attributable to actions in the decade following deregulation. It is unlikely all those 3500 under-regulated lending institutions are solvent. The question is whether they can be saved and/or closed without causing a panic.

Dodging the crunch

Our only hope is the Chinese government somehow saving the financial system from collapse. The Communist Party is deeply involved in the markets, very powerful and exceedingly motivated to avoid an economic disaster that could undermine its legitimacy.

We need Xi Jinping and his band of economic bureaucrats to prevent China from having its own Lehman Brothers moment. Lehman Brothers — once America’s fifth largest investment bank — collapsed in 2008. It brought down the US financial system and ravaged the global economy.

Lehman’s fall did not come out of the blue. Prior to Lehman failing, the investment bank Bear Stearns also entered extreme difficulty. With some help from the US government, it was taken over by JPMorgan Chase at an extreme discount. Its failure foreshadowed the horror to come.

If China has a Bear Stearns, it might be HNA — a regional airline that turned into a global conglomerate, which now has $94 billion in debt it most likely can’t repay. Its share price has collapsed and it is desperately selling off the assets it acquired worldwide. Chinese banks (of the state-owned variety) are being kind to HNA by lending to it despite its extreme financial strain.

Someone, somewhere is eating the losses made by these rapacious conglomerates, and we better hope their appetite doesn’t wane.

Will communism save us?

History needn’t always repeat if you can learn lessons from it. The US let Lehman go partly because of Bear Stearns. Saving Bear was costly and made some people very unhappy. China has the benefit of more experience — it knows letting Lehman go was a disaster that revealed how awfully interlinked the whole financial system had become.

It’s a funny old situation for market economists. If the market had its way in China we’d see collapses and full-on financial contagion. Our sole source of hope is that the communist government of China is able to meddle in those markets. Here’s hoping they meddle well.

If the US govt. meddled with QE’s why won’t the Chinese govt.?

Private sector debt is always a problem. The writer fails to mention Australia’s private sector debt ballooning during the Costello “surplus budgets” and now sitting at 150% or more of GDP. Not as bad as China’s but not very nice either. And here is the punch-line: simple accounting ensures that unless we have a large trade surplus like Norway, govt. surplus budgets will always mean increased private sector debt. Why do we want to “bring the govt. budget back to surplus”?

As fearsome as a Chinese financial ‘bomb’ might be . . . the very thought of how an under pressure Trump may exploit a Chinese financial meltdown. Xi Jinping’s option . . . ?

America, and the globe, facing off to a truly armageddon moment. A political ‘bomb’ from which none would survive.

Why worry ? – America’s relatively unregulated economy survived with Government chipping in – So China a more controlled and flexible economy [because the Government can act at will and promptly, effecting the whole nation] is actually more resilient – so cause & effect cannot be merely transplanted from Western experience. China is regulated by and for social reasons not economic – so looking at graphs and computer screens are not the deciding factors in society.

Michael Hudson in his counterpunch.org interview on his special field of “Bronze Age Finance” argued that most successful empires of the ancient world saved themselves from the same problems presently being faced by China by instituting debt -forgiveness when disaster threatened.

Effectively wiping the debt slate clean and starting again; familiar as the Jubilee Year in the Old Testament, but also practiced at the same era in other parts of the “Near East”.

Incidentally, in the above interview Hudson said that the Western Roman Empire repudiated this financial tactic and we all know what happened to them, and why, don’t we?

Why can’t , and why shouldn’t the present Chinese “Empire” avoid that mistake?

Here’s hoping they don’t get tripped up by that imfamous arrogance, mainly about what the rest of the world might have to offer them , which has caused them so much trouble in the past.

No mention that China currently holds $2T (as in trillion) of US Treasury Bonds, a good proportion of which is maturing in the next 18months.

What odds that Xi & co are perfectly au fait with concept of fiat currency? Until the 1990s the renminbi was effectively purely a domestic currency.

As to the history of intrinsic – as distinct from assigned – value, apart from noodles & fireworks, the really big idea that Marco Polo brought back from the Celestial Realm was paper money. It was called ‘cash’ and took a while for gweilo to catch on but…

Would that “cash” be the about same as a bank note?

The Knights Templar issued them in the West some time before Marco went wandering, but that is not to say that they did not get the idea from the Central Kingdom.