RBA governor Phil Lowe

Australia’s governing class is finally starting to have a conversation with itself about the wage stagnation it has inflicted on Australian workers, but it still doesn’t get it.

The government remains in denial about wage growth, with Pollyannaish budget forecasts that the RBA now appears to have no confidence in and, if pressed, an allusion to its trivial $10-a-week tax cuts (which are actually supposed to address bracket creep), not the years of poor wage outcomes most workers have endured. The Reserve Bank has been more forward on the issue, and yesterday governor Philip Lowe tackled the issue head-on with some comments that have gotten considerable attention.

His most important observation — made in a speech to many of the culprits in depriving workers of pay rises at the Australian Industry Group — related to the impact of wage stagnation on inflation, and thus on monetary policy. We’ve long assumed that the next move in interest rates was up — but the schedule keeps being pushed back. Yesterday, Lowe appeared to push it back yet again. “Any increase in interest rates,” he said, “still looks to be some time away.”

Indeed, if wages growth were to continue at around its current rate for an extended period, it is unlikely that the rate of inflation would average around the midpoint of the inflation target in the period ahead. Wages growth of 2% and reasonable labour productivity growth are unlikely to make for 2.5% inflation on a sustained basis.

Indeed, would further wage stagnation even lead to another rate cut? That would jolt the “lift rates for the sake of lifting rates” crowd.

Lowe also detailed how stagnation was affecting the economy. “[R]eal debt burdens stay higher for longer. Many people who borrowed expected their incomes to grow at something like the old rate rather than the current rate. With their expectations not being realised, the real value of the debt stays higher than they expected and this is likely to affect their spending decisions.”

The other indirect way it affects the economy is that “beyond these purely economic effects, the slow wages growth is diminishing our sense of shared prosperity. If this remains the case, it can make needed economic reforms more difficult.”

That stirred up the “economic reform” mob in the commentariat (and prompted a stupid claim that Lowe had “challenged voters” from the Financial Review). Economic reform is holy writ among that crowd; the perceived failure of successive governments to undertake Reform (industrial relations deregulation, spending cuts, company tax cuts, slashing red tape) is an heretical abandonment of faith. Anything that threatens the cause of Reform must be decried.

But Lowe is being too optimistic. Courtesy of wage stagnation, years of corporations enjoying the upside of privatisations while consumers got the downside and unpunished corporate misconduct, voters regard economic reform as a code for screwing them over to the benefit of companies. Three per cent wage growth won’t fix that.

Lowe yesterday struggled with explaining why wages growth is so low despite a long period of strong jobs growth and employers reporting growing labour shortages, offering a laboriously convoluted explanation about how information technology uptake by leading firms was making slow-adopter firms screw down on labour costs more to try to compete. It seems that, whatever else, there’s a rule that Lowe and his colleagues must not mention the more obvious reason: that the industrial relations landscape and the decline of unions has made collective bargaining and industrial disputation more difficult for workers across Western countries, undermining their capacity to secure pay rises.

In any event, Lowe confirmed any wages growth was a long way off, even though 3%-range growth was far more preferable than our current 2% level — though he didn’t mention the many private sector workers who are struggling on 1% growth and going backwards. Any recovery would be, to use the bank’s favourite word at the moment, “gradual”. Like, Lowe seemed to be saying, very gradual. Zeno’s Paradox gradual, perhaps. Which means the next rate rise is a long way off.

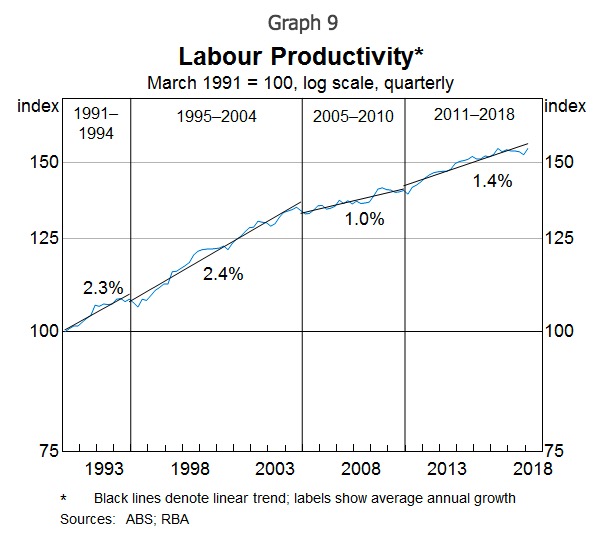

One more thing: for all those neoliberal heroes at the Business Council or in the commentariat who reckon industrial relations deregulation boosts productivity, Lowe had an interesting graph showing the impact of WorkChoices on labour productivity. Maybe we should be re-regulating workplaces.

“[R]eal debt burdens stay higher for longer. Many people who borrowed expected their incomes to grow at something like the old rate rather than the current rate. With their expectations not being realised, the real value of the debt stays higher than they expected and this is likely to affect their spending decisions.”

And the financial institutions are loving it – household debt the elephant in the room.

‘It seems that, whatever else, there’s a rule that Lowe and his colleagues must not mention the more obvious reason: that the industrial relations landscape and the decline of unions has made collective bargaining and industrial disputation more difficult for workers across Western countries, undermining their capacity to secure pay rises. ‘

The RBA is a who’s who of the Liberal Party and their mates.

“The revelations pose serious new questions for Reserve Bank Governor Glenn Stevens about what the bank knew of Australia’s worst corporate corruption case.

In July 2014, WikiLeaks released a secret censorship order prohibiting publication throughout Australia of information that “reveals, implies, suggests or alleges” corruption involving a number of past and present high-ranking Malaysian, Indonesian, and Vietnamese officials”

GREG BARNS [Barrister] : There needs though to be an examination of the governance arrangements at the RBA, because this all happened in circumstances where you had the board of the RBA and underneath it these subsidiaries. Effectively, you’ve got to look at the board’s conduct, the subsidiary’s conduct, and find out how it was that these quite huge sums of money were paid to people in circumstances which I think many would say were at least questionable.

Explosive new evidence shows that RBA subsidiaries paid more than $3 million in commissions to a Malaysian arms dealer to secure bank note contracts in Asia. Even after the arms dealer was sacked for corruption, the payments continued with the RBA’s approach.

http://www.abc.net.au/7.30/content/2012/s3588021.htm

With former West Germany and now Germany, with an economy largely based upon manufacturing, being the clear exception to this problem of declining wages.

Manufacturing was estimated to be the most powerful engine for the creation of wealth by that noted Philosopher.

Henry Ford defied his critics by instituting a doubling of his workers’ wages to the famous “Five Dollar Day”, and with Smith having declared wages to be “Returning Capital”, Ford recouped his wage bills when his workers were then able to purchase the goods they manufactured.

During the rationalisation of the Australian Steel Industry, starting in the early 1980’s ,BHP went against the grain of other large businesses by declaring it had no problem with high wages for its workers, potential and probably actual steel customers.

By contrast the service industries, which can by definition only enhance the efforts of the real productive sectors of the economy, will only make a profit by downsizing its wages bill, since it dies not manufacture anything and cannot thus increase its wealth doubling or tripling its services.

Is this illustrated by the old quip that we can all create employment for each other by taking in each other’s washing?

People are busy but nothing is actually being created.

So while the ignoramuses of the right destroy much of Australia’s manufacturing sector, the only real source of wealth which comes with an accelerator attached, and pursue profit at the expense of wages in the service sector, then spending and more importantly savings power declines in the nation.

All. ironically, expounded nearly two and one half centuries ago, with no one having learned anything at all, it would seem, from the author in question?

very true – Australia relies now on performing services to each other – – biggest gains in employment;loyment NDIS, health sector. Produces nothing – consumes everything. By logic we must be the unhealthiest country in the world as our biggest sector is human pathology. and disabled human beings.

“Germany, with an economy largely based upon manufacturing, being the clear exception to this problem of declining wages.”

“Clear exception” do you say? Don’t worry : I’ve accustomed myself to correcting your mistakes. Now to some evidence and some arithmetic

https://www.statista.com/statistics/612505/average-annual-real-wages-germany

Over the last 20 years : give or take :

Year 2000 $41,388

2016 $46,384

Percentage (compound) increase per year is : ___ ? Do you want me go give you the answer tomorrow or do you want to try to calculate it yourself ? Hint : the answer is LESS than 1%

Let me suppose that you don’t like the graph above : it tends to contradict what you have written. Then take a look at

this : https://tradingeconomics.com/germany/wage-growth

The “problem” is NOT associated with the decline in manufacturing in Australia but with an inability to develop high-end tertiary industry product. “Heavy Metal” (or some such name) and I had a recent discussion on this point.

Des – you ought to know better : its NOT “very true” at all; partially true : possibly.

“With former West Germany and now Germany, with an economy largely based upon manufacturing, being the clear exception to this problem of declining wages.” – actually you’re wrong here. The SPD (Labour) and Greens coalition which came to power in Sept 1998 responded to a stagnating German economy (and a famous article in The Economist which called Germany “The sick man of Europe) by loosening a whole lot of legislation and weakening workers’ protections and as a result Germany is faced with the same problems as most western countries of casualisation of the workforce and stagnant wage growth for the average worker. Last year the steel industry unions managed to negotiate a very good agreement in one state of Germany but there have been no flow-on effects into the wider economy. Deutsche Post (20% of which is still owned by the state) ignores continued calls to make postal and package delivery staff part of their permanent workforce and all the big car manufacturers employ tens of thousands of workers on a special type of temporary contract. All of these people are outside the protections of the industrial relations system. These were unplanned consequences of the SPD/Green reforms, but Merkel’s conservatives and the SPD (who have been a part of the Grand Coalition for most of Merkel’s time in office) show little interest in changing the system. And just like here in Australia, they have been neglecting investment in public infrastructure to such a degree that the economy is suffering. And many regions of former East Germany are still economic waste lands – almost 30 years after reunification.

I have an embargoed comment (of 20:38, which hopefully, will be released in a few hours) that states, with graphs etc., much the same thing. I also went to some trouble to point out in my post of 14 June 14:42 (and in previous posts) the idiocy of the assertion to which you refer – but that guy won’t be told.

“The Economist which called Germany “The sick man of Europe”

It was actually Turkey who was called the Sick Man of Europe – towards the end of the 19th century – in regard to the moribund administration (and hence the economy) of the Ottoman Empire – but never mind.

“Germany is faced with the same problems as most western countries of casualisation of the workforce and stagnant wage growth for the average worker.”

Just my point in regard to “causation” which is far from simple or linear. There are fewer but much more effective unions in Germany and France. As a “cause” for stagnation we can eliminate any reference to Unionism (or lack of it) per se.

” Last year the steel industry unions managed to negotiate a very good agreement in one state of Germany but there have been no flow-on effects into the wider economy. ”

You are correct to identify this even as a micro event. An analogy would be mining in Australia circa 2013. Those that entered the industry (in any capacity) were well remunerated but there was no “flow-on”. Despite retentions the industry is still well remunerated – compared to the “remainder” of those engaged elsewhere with similar skills.

Some if those commenting below labour their points without much profit, but the facts which they choose to ignore remain. Post-war Germany based its growth back to wealth on manufacturing, (though those in the various “service” industries might wish, for obvious ego problem reasons, to wish otherwise), with the Marshall plan having something to do with it.

Heavy industry sought to be and succeeded in being self financing, thus being able to dictate which parts of capital and labour should enjoy the “profits”.

The historically chose in closely include their work forces in their “enterprise” management and the workforce where definitely better rewarded than others in maufacturing across the globe. no problems.

What is happening at this very moment, by way of recent changes. is totally irrelevant to the argument.

Arguments actually, originally made by Smith, perhaps the incorrigibles commenting below should become his students, instead of dreaming up their own versions of economic reality tediously presented for the unpalatable and unhealthy consumption of others on this site.

“Marshall plan having something to do with it” [“it” being manufacturing – my addendum].

Actually the Marshall Plan had EVERYTHING to “do with it”; about 12-15 billion dollars of Keynesian pump-prime in 1946 currency. Pity the yanks, except in drips in drabs, didn’t apply the same methods to their own economy until 1942 – which was still in chronic depression in 1941. The New Deal was no more than 1/2 to 3/4 hearted in this regard – but I digress.

“What is happening at this very moment, by way of recent changes. is totally irrelevant to the argument.”

What is irrelevant to “this very moment” is the reference (and implication of 70 years ago) to the Marshall Plan!

The content of the following link is the last word! In fact the data contradicts the first edition of SideView.

https://www.statista.com/statistics/295519/germany-share-of-economic-sectors-in-gross-domestic-product

Irrelevant seems the apt descriptor for most of your offerings, and probably why not many will actually ever bother to read them.

Much quantity, little quality, and not responding to any measurable demand at all.

Glad someone has finally “belled the cat” about the relationship between the decades-long, ideologically-driven attack on industrial relations and in particular on the role of unions in maintaining wage parity. For some reason, it has become heretical, even within the Labor Party to say this for fear of being tarnished with the ‘anti-economy’ brush. Time to begin a new narrative that does not look at the issue in a simplistic, binary form. Trump et al are the results of the impact of this serious sense among the community of a lack of the fair distribution of income and prosperity.

Beautiful computer generated graphs do not explain any problems just show what the problems are – The Governor is wrong – it is not that wages growth that is the problem it is the government and government generated costs that is the problem.He said . “[R]eal debt burdens stay higher for longer. ‘ Yes – people are saddled with the creeping charges for living by governments – commonwealth, state, local -all increasing charges on top of utility charges etc – so the wages people have cannot pay for these as well as consumer spending -wage income growth will not fix the problem, the charges, taxes will immediately obliterate any wage growth. Business has not increased its charges because of the competitive commercial activity. In fact businesses cannot afford to have wages growth as businesses face the same struggle as wage earners. There are added problems in the system. For instance, as an example of subtle increasing costs to business -as of July if an employee needs to come to a training session to up skill themselves they must be paid a minimum of 3 hours [ at present they just receive payment for the training time attended] whether the session lasts on hour or two hours. Guess what there goes in house updates. So Phil Lowe is perplexed – perhaps the gurus should take a break from their computers and analyse and address the systemic problems like they did in the past – otherwise any idiot can prescribe more of the same – guess what results in more of the same outcomes.

No. Business profits are increasing faster than wages. Put differently, a smaller proportion of gains made by businesses are being returned to workers than in the past. That’s the whole point.

So the big business puppets at the RBA have finally woken up that low wages kill an economy, how long will it take the corrupt big business puppets in the coalition to break free from the trickle down thievery they imported from the U.S.A and change policies, or do we have to wait another 12 months till the ALP takes over and puts the economy back on track.Desmond, it seems you arrived on the same trickle down space ship the clowns in the coalition

So the big business puppets at the RBA have finally woken up that low wages kill an economy, how long will it take the corrupt big business puppets in the coalition to break free from the trickle down thievery they imported from the U.S.A and change policies, or do we have to wait another 12 months till the ALP takes over and puts the economy back on track.Desmond, it seems you arrived on the same trickle down space ship the clowns in the coalition

As far as institutional capture goes, listen to the “Labor” spokesbot Andrew Leigh on why nothing can be done differently, whilst gumBoil Shlernt mewls about… something..something until listeners lose the will to live.