Last year, Labor and the government brawled over whether inequality was worsening in Australia. Labor argued it had reach a multi-decade high; the government claimed that the Gini coefficient, in Treasurer Scott Morrison’s words, “the accepted global measure of income inequality around the word — that figure shows that it hasn’t got worse”. That statement relied on keeping the period in question narrowly confined, because there’s no doubt that since the Hawke government began its deregulatory economic program, inequality has worsened in Australia, though not badly as many other countries, even as all incomes have grown strongly in real terms.

In any event, the Gini coefficient is just one number for the whole economy. It’s less helpful in explaining changing inequality between different areas of the economy, or different geographical areas, or between different demographics. And that’s relevant now, because there’s strong evidence that young Australians are doing very badly from our current policy mix — and that that harm is worsening, while senior Australians are benefiting from it.

In 2014, John Daley and Danielle Wood of the Grattan Institute published The Wealth of Generations on how younger generations in Australia can no longer assume higher living standards than their parents. In summary,

Over the last decade, older households captured most of the growth in Australia’s wealth. Despite the global financial crisis, households aged between 65 and 74 today are $200,000 wealthier than households of that age eight years ago. Meanwhile, the wealth of households aged 25 to 34 has gone backwards.

Much of that shift relates to the house price boom, of course. But it also derives from changes in income growth, with the income of older Australians rising more quickly. And it derives from the fact that “governments are also spending much more on older households for pensions and services, particularly health … government transfers from younger to older cohorts are now so large that future budgets may not be able to afford them as the population ages.”

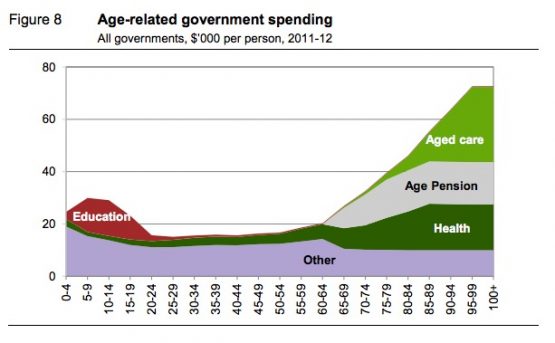

As the Productivity Commission noted in 2013, because of health and ageing needs, government spending starts flowing toward people once they reach retirement age.

But Daley and Wood spotted that the level of intergenerational transfers facilitated by government had dramatically tilted toward over-65s in the later part of the 2000s.

The intergenerational inequity identified by Wood and Daley reflects long-term policy settings under both sides of politics — especially in relation to the subsidising of housing investment by taxpayers and the willingness of governments to hand more concessions and transfers to seniors. Since 2014, there have been efforts by Labor to tilt the policy playing field somewhat back toward younger and lower-income Australians in areas like negative gearing and capital gains tax, superannuation tax concessions and, more recently, dividend imputation refundability. While demonising Labor for these policies, the government has also moved to address the rorting of superannuation tax concessions by older and high-income Australians.

But since Wood and Daley prepared their report, it seems that intergenerational equity has worsened. Further work published by Wood with Trent Wiltshire last year shows that in 2015-16, households headed by over 45 year olds showed by far the largest growth in wealth. And 2016 data showed, unsurprisingly, that younger people had suffered the greatest falls in home ownership rates across all income levels since the 1980s. But it’s not merely about the impact of home ownership on wealth. The wage stagnation that has hit workers in recent years may have contributed to under 35s having the lowest household income growth of any major age group between 2003-04 and 2015-16, while 55-64s and over 65s enjoyed the highest income growth.

And as the population ages and health and aged care spending increase (the PC estimates that health care, aged care and the aged pension will together require 5.7% of GDP more spending in 2060 than today), the current disproportion in government spending will continue to increase in favour of older Australians, even if it doesn’t add directly to their wealth or incomes.

Younger Australians have already lost out to older generations in wealth via our housing and tax policies. Wage stagnation is curbing what should be their opportunity to enjoy strong income growth. And the ageing of the population will mean that government spending will increasingly be directed at seniors as well. It’s a triple whammy that leaves our young people at the bottom of the economic pile while the rest of us enjoy higher wealth, higher incomes and benefit from taxpayer funding.

Talking to an 18 year old yesterday who was about to start a work contract at a government institution.

Tenure – 1 month.

Gets counted as part of the ‘jobs growth’ myth I suppose.

Should that not be the Gina coinefficent?

That’s a Jethro.

Remember when Howard’s c.v. read “mean and tricky”?

And a devious unconvicted war criminal.

Young people must unionise.

I smell revolution in the air

Alas, I think that stench is the kiddies having filled their nappies in sheer petulant rage when they find their unearned sense of entitlement frustrated.

As opposed to baby boomers lifelong sense of entitlement?