Nine and Fairfax have announced they will merge to become Australia’s biggest integrated media company, called “Nine”. It is the first merger under media reforms passed last year which removed restrictions on how many media voices one company could own in a single market.

Under the deal, Nine will acquire Fairfax’s shares, Nine’s CEO Hugh Marks will remain CEO and Nine chair Peter Costello will be chair. Three current Fairfax directors will be invited to join the new Nine board — Nine will have four votes to Fairfax’s three. Nine shareholders will own 51.1% of the new business, and Fairfax shareholders will own the remaining 48.9%.

The business will include Nine’s free-to-air TV network, Fairfax’s Domain, video streaming platform Stan (currently owned by Nine and Fairfax), Fairfax’s newspapers and websites, and Macquarie Media radio networks.

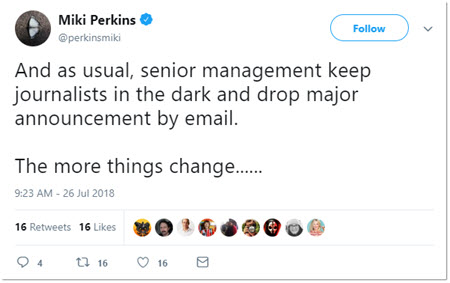

An announcement to the ASX this morning said the merger would deliver savings of $50 million over two years, but did not identify how many staff would be affected, or how the newsrooms of the two companies would work together. Marks said in a call to investors and analysts that most of the costs would be saved in duplication of services, and said that the board would be happy to adopt Fairfax’s charter of editorial independence: “This deal is not about cost saving, it’s about investment in content,” he said.

Marks said in the joint announcement that the merge would mean the new Nine would “reach more than half of Australia each day through television, online, print and radio”.

In the call, Fairfax CEO Greg Hywood said the deal was the “best outcome” for the company’s journalism.

News of the deal — and loss of the Fairfax brand — is a particular blow to Fairfax staff, whose newsrooms have been razed in recent years.

In an email to staff, Hywood said “there will be plenty of Fairfax Media DNA in the merged company and the board”. “At the end of this process the business will be a media company of scale, depth of offering and digital capacity and opportunities like no other in our region,” he said.

Nine and Fairfax launched Stan together in 2014, and last week Fairfax and News Corp announced they would be sharing printing presses in Queensland and New South Wales.

The deal will create a company with sufficient bulk to resist News Corp’s continuing encroachment. Will the Murdoch family’s News Corp take the risk and launch a bid for Seven? Relations between Kerry Stokes and the Murdochs have grown closer in the past three years.

Media analyst Roger Colman said that as well as rivalling the News Corp empire, the new company would have the resources to “cross-fertilise” their revenue enhancers — Domain, Stan, Nine’s digital news platform 9now. “This is now a chance for this combined group to put resources against News Corp newspapers in Sydney and Melbourne, and online traffic is now the only difference between News Corp’s REA Group (real estate listings) and Domain. Nine can deliver substantial enhancement there,” Colman said.

The Fairfax share price is well under the $1.27 a share that the shares reached in May last year when Fairfax was the subject of two abortive offers from US buyout groups, Hellman & Friedman and TPG. Both groups withdrew their approaches after doing due diligence on the Fairfax books. Fairfax shares sank, but steadied after it managed to spin off 40% of its Domain property business to Fairfax shareholders late in 2017.

Now in the media landscape, Seven West Media is left looking like a shag on a rock. Its high debt (a promised $650 million by June 30) was too much for the debt-scarred Fairfax board to take on in any merger, leaving Nine as the only dance partner left. Hywood would not comment on any bidding war. This looks more like a surrender than a merger of equals.

Stokes will now be left to decide whether to sell to News Corp, or launch bids for smaller rivals like Southern Cross, or even buy Bruce Gordon’s struggling WIN TV business. But that debt millstone will prevent some or all of these deals happening. Stokes may have to bite the bullet and take Seven West private, but there he missed the boat when the shares were under 60 cents earlier in the year and not closing in on $1 as they are now. Stokes is the loser and there is nothing more damaging to a billionaire’s self-esteem as being as a loser in an industry in which he always saw himself as a major player.

The deal will need to be approved by shareholders yet, which Marks said was likely to take several months.

Sad really there used to be a semblance of balanced reporting with Fairfax . We will now have the two largest media groups totally right of centre and totally Biased. Check out Brisbane’s Courier Mail with their disgraceful coverage of the Longman bye election . Thank goodness the Brisbane Times was not yet polluted.

Well this is one subscriber that they are going to lose. Although the way the Age has been going I was already considering .

It is likely that the regions will be particularly hard hit – I can see a lot of the local papers being disbanded and one of the last ways to keep councils honest will be gone. And the media will be come even more Sydney/Melbourne-centric.

That’s a compelling concern and one I haven’t seen mentioned before. Sad days indeed 🙁

Nobble ABC & SBS? Check

Place Fairfax under the effective control of former Liberal MP Peter Costello? Check

Give $30m to Foxtel? Check

Wow, seems the Liberal Party plan of making our media landscape mimic that of Soviet Era Russia is proceeding apace. Poor fella, my Country.

And with Costello as Chair. Remember when last in power he gagged funded non-profits from advocacy at penalty of losing their Commonwealth funding. The Coalition has continuing form as championing free speech – for those who agree with it.