Nine’s 2019 success is likely riding on the outcome of the video-on-demand streaming wars and, as major US producers Disney and Warner Media ready themselves for battle with Netflix, Nine must pick a side.

As part of the Nine-Fairfax merger, the new Nine ended up with 100% ownership of Stan (Australia’s number two streaming service). What light has emerged from the financial black box that is StreamCo suggests that Stan is a rarity in the world of subscription video on demand (or SVOD in the trade’s ugly acronym). The company expects Stan to break even this year, and is surprisingly well placed to emerge as the key Australian player.

According to various reports, Netflix has about 4 million household subscribers in Australia. Stan claims to have about 1.2 million. Off the back of Ten’s takeover by CBS, Ten launched an Australian version of the parent company’s All Access streaming service in December, although no figures are yet available. But Stan risks becoming collateral damage in the global battle between market leader Netflix, tech platform players like Amazon, Facebook and YouTube, and the 2019 launches of Disney’s streaming service (branded as Disney+) and Warner Media’s as yet unnamed platform.

In December Stan announced a major content deal with Disney for the foreseeable future, suggesting a continuing relationship when Disney launches its own streaming service in the US. Nine will be hoping this sort of content depth will accelerate subscriber numbers to close the gap or even overtake Netflix in Australia.

This also suggests that the best outcome for Stan is for it to become the Australian proxy for one or more of the US giants. This may also be the best outcome for, say, Disney which could derive a revenue stream without building its own consumer sales and distribution network in Australia.

Such a deal would recognise that the Australian market is just not big enough to sustain every global streaming service at minimum viable level. In that Australian way of duopoly, there’s probably space for two of any substance with the right pricing — plus some version of Foxtel’s pay TV business, although that model is increasingly squeezed by on-demand options.

In the US, Disney has already pulled its content from Netflix to focus on its own service. Disney will use its own material and the content it is inheriting from the 21st Century Fox merger that included a controlling stake in US streamer Hulu. Warner Media’s planned launch this year will be built off its ownership of, among others, HBO, Cartoon Network and CNN (that are currently broadcast in Australia by Foxtel).

On the tech side, Apple and Facebook are both talking up their US$1 billion content investment plans and Amazon is continuing to expand its library.

Netflix has a significant first mover advantage. It has an identifiable look, a better user experience and a more effective algorithm for identifying potential streaming choices. It’s got deep data and has direct-to-consumer in its DNA. These are all significant advantages. But the market seems to have fallen out of love with it — Netflix’s share price is down a third since its July 11 peak — and the company is weighed down by content costs as it lacks the back-catalogue and the content brands of the major producers.

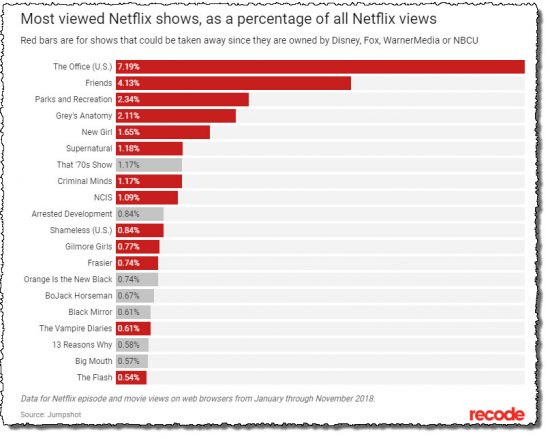

Last month it agreed to pay Warner Media US$100 million for the 2019 rights to Friends — a show that stopped production 15 years ago. (Stan has rights to Friends in Australia). The reason came in a December analysis in Recode: Friends is the second most popular program among US Netflix subscribers, with about 4.1% of total views. All that content, and Americans opt for old repeats. Go figure!

Whether Warner Media or Netflix wins out on this deal is hotly contested and points to how streaming may shape media in 2019.

Nine faces a further challenge with Stan. Just about all these SVOD services are ad-free. Nine’s core competence is advertising. How long will it be able to resist the temptation to start slipping ads into Stan’s streaming?

What would be the point of ads on Stan or Netflix? It’s part of their core appeal as a product. I recall when Foxtel put ads onto their service and all of a sudden it was just regular old TV.

If ads start appearing in stan I’m gone.

If Stan or Netflix get ads I’ll dump both of them. Stan isn’t doing much these days so they may have to go anyway. Catchup TV with 9Now & TenPlay cover most items that you think you should watch, but window of opportunity, is only 7 days in most cases. SBS on-demand also has a narrow window. The free Fairfax TV was good, most TV episodes & movies didn’t expire.

There’s another one called Web View, that is also free, apparently it’s closing in March.

The big monopoly will continue, until there’s no decent free-to-air shows on.

Hopefully ABC / iView & SBS / on-demand stay with us.

“How long will it be able to resist the temptation to start slipping ads into Stan’s streaming?”

That is the day I unsubscribe, although I’d stay on if there was a subscription level which included no ads. I’d happily pay SBS right now for an ad-free version of its streaming servivce; the inserted ads are a horrible viewing experience, always awkwardly breaking the flow.