The big global accounting firms — the architects of multinational tax evasion and systemic conflicts of interest in financial transparency — cemented their place as Australia’s major political donors in 2017-18, an analysis of the Australian Electoral Commission’s political donations data shows.

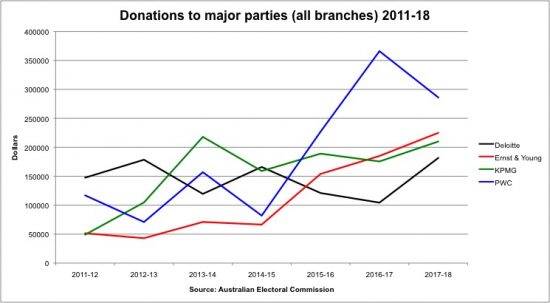

The Big Four — who reap billions of dollars from taxpayers via government contracts — now rival the once unchallenged mega-donor, the financial services sector, in the size of their largesse to the major political parties. In 2017-18, they combined to give just over $900,000 to Labor and the Coalition, up from $830,000 in 2016-17 — a remarkable increase given there was no federal, Victorian or NSW election during the year. In 2015-16, ahead of the federal election called by Malcolm Turnbull, they only gave around $690,000.

The finance sector, consistently the biggest industry for political donations, has given around $1.7 million in total to both sides every year in recent years, with 55-60% going to the Coalition. In 2017-18, it again gave $1.68 million in total. However, that covers not merely the big banks (except NAB, which stopped donating two years ago) but major insurance companies, foreign banks, Visa (a major donor that gave around $100,000 to the Coalition and $60,000 to Labor) and lobby groups like the Financial Services Council and, now, the Australian Bankers Association, which began donating in 2017-18 (wonder why). So on a per company basis, the Big Four are now the dominant political donors.

Even though its donations actually fell in 2017-18, PWC is still the biggest, handing around $180,000 to the Coalition and over $100,000 to Labor, but Ernst and Young has been increasing its donations every year and handed over $100,000 to each side in total, while KPMG gave over $130,000 to the Coalition and $70,000 to Labor; Deloitte gave over $95,000 to the Coalition and around $86,000 to Labor.

Many of these donations flow not to the federal branches of the parties but state branches — understandable given the companies rely on state governments as much as the Commonwealth for consulting work. PWC, for example, gave over $17,000 to South Australian Labor, $17,000 to WA Labor, over $40,000 to the ACT Liberals and the Victorian Liberals. Ernst & Young gave $33,000 to Queensland Labor ($33,000, like $27,500, is a GST-type number, suggesting it was a “purchase” of a fundraising forum membership), around $40,000 to WA Labor and $24,000 to the Victoria Liberals.

The surge in Big Four donations comes at a time of increasing pressure on them. The extent to which they are co-conspirators in multinational tax avoidance has drawn increasing attention internationally and locally — Michael West has been assiduous in exposing how the big audit firms are complicit in massive tax avoidance.

And the major conflicts of interest between the consulting work that generates tens of billions for the Big Four world-wide and their auditing role is continuing to attract attention, with three of the four in the UK now agreeing to cease combining audit and consulting work and ASIC recently releasing another report identifying how “the provision of non-audit services to clients raised concerns about the appearance of independence being compromised” in major audits here.

Labor is also threatening to cut back on the lucrative flow of public service contracts to the Big Four, bringing services back in-house that have been de facto outsourced by fake cost-cutting by successive governments — public service funds are cut and public servants retrenched, only for large firms to be brought in to do similar work more poorly and for a higher cost.

Like the finance industry, the Big Four seem to think their best means of heading off regulation that will curb the lucrative flow of revenue from tax avoidance advice, conflicted auditing and public sector contracts is to pump money into the major political parties in the hope they won’t move against such big donors. That worked for several years for the finance sector, which bought political protection from the Liberals. But in the end nothing could buy off the outrage about the abuses of the banks. The same fate may yet befall the Big Four.

What do you make of the big four firms increasing their political patronage? Write to boss@crikey.com.au with your full name and let us know.

There is no justification for corporate donations to political parties. For corporations, which rely in great part on low value/high price contracts with government agencies, the conflict of interest is disgraceful.

– Ban all corporate donations to political parties. Only allow donations from people on the electoral roll with donations limited to no more the $100 per person per year. Political parties success should be based on their ability to attract, engage and retain membership and popular support for their policies and programs. 100,000 active members are a powerful electoral force. (I would be surprised of total membership of all political parties was that many today).

– Apply the same limitations to public advocacy groups and the “think tanks”. If they have a large subscriber base of adult, registered electors, they will have a large public voice to advocate for policies or programs.

– Ban all lobbyists. They are corrupt influence peddlers and deserve no place in our parliament. Our parliamentarians are our representatives. We do not need a special class of parasite to represent us to our own representatives.

Some parasites are useful, I’d just call them what they are: spivs.hustlers,rent seekers and conmen!

Up there Griselda – agreed on all fronts.

What a wonderful thing it would be if Labor started working assiduously in that direction.

Force the conservatives and greedy rich to organise themselves properly instead of relying on their corrupt networks, and let organisations like GetUp thrive on grass roots support – we might eventually see democracy working properly.

Well said, GL…we can but hope that the next government does something about this ‘corruption’ of democracy!

Plain & simple – a koala stamp to Griselda.

If this doesn’t reappear in Crikey’s end segment tomorrow it could only be because there were so many more sensible & worthy comments

High unlikely.

I totally agree a not for profit advocacy association seeking a better world cannot get tax deductability…. why do donations to political parties get tax deductability !!!! the kind of tax deductabilty large doners get is just another legal form of tax evasion …the system is always pitched to those who have the most resources I am getting sick of the blatant inequality

Labor should be shouting from the roof tops if they have a serious commitment to reduce the parasitic practice of out-sourcing consultancy work. I doubt it is something that they will implement as policy.

There has been zero gain to the Australian tax payer with poor advice from the over payed and ethically challenged corporate accountancy firms.

They are after all designed to extract ever atom of value for themselves from any tender or contract.

Governmental accountancy tasks need to done by a government department, or expect an benefit from the work to be a secondary concern to any corporate interests.

Labor and Liberal would never allow their corporate benefactors to lose income at the tax payers expense.

Overpaid!

Insurance? Never can tell how far the fall-out from Financial Services debacle might flow? Simply disgusting!

No accounting for habits?

But let’s face it – these firms are looking after their own interest – “continued service insurance”?

While the parties are quite prepared to look out for their donor’s interests.

As a party dependent on expensive advertising (depending on party : overseas media mogul patronage for example?) : cut them off and you cut off your “revenue flow”?

Yep, it’s legal corruption. This isn’t corporate philanthropy, these are bribes. Money is paid and something is expected in return.

In general agree with Crikey on much, and disagree with so much that Katter says BUT! It seems to be a fact that a large percentage of the people that sought to come to Australia via Indonesia, paid to fly into Jakarta, made their way by bus or plane to the South and then paid significant money to get onto boats to arrive in Australia. A large percentage of those being young men of South Asian or Middle-Eastern decent trying to establish a base for families to follow. This seems similar to the disproportionate number of middle-eastern and South Asian men who happened to claim to be less than 18 when choosing to migrate to Sweden, totally overturning the Male to Female demographic ratio of 18 year olds in that country – not surprisingly because the age limit for more lenient consideration was 18!

Those seem more like economic migrants trying to jump the queue as opposed to being refugees and asylum seekers seeking relief from persecution – the real refugees are sitting in impoverished camps in the middle-east, Bangladesh, Africa, and Central America, too poor too hungry and without any resource to get on a plane and boat to bypass immigration application queues.

A perspective from Asia!