Australia’s tumbling housing prices are sending more and more mortgage holders underwater. A small but growing share now owe the bank more than their properties are worth, i.e. they have “negative equity”.

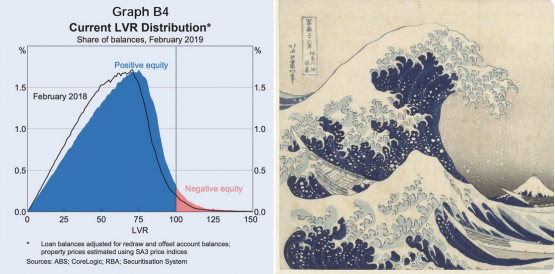

The Reserve Bank of Australia is highly alert to the risks of negative equity and just published an extended analysis of it. Among that analysis was the following graph, which shows the loan-to-value ratio (LVR) of Australian mortgages. Those with a ratio above 100 are underwater, or in negative equity. The graph shows that negative equity is more prevalent now than in February 2018.

When I look at this graph I can’t help but see a “great wave” looming up and threatening to break over the Australian economy.

Negative equity is problem both for individual mortgages and for financial stability, as the RBA explains:

A borrower having difficulty making loan repayments who has negative equity cannot fully repay their debt by selling the property. Negative equity also implies that banks are likely to bear losses in the event that a borrower defaults.

Australians who get into negative equity are more likely to default on their loans, leaving the banks with the problem. So negative equity is likely to be bad for the health of our banks, which is not great news considering how much of the Australian economy they constitute, not to mention their oversized share of our sharemarket.

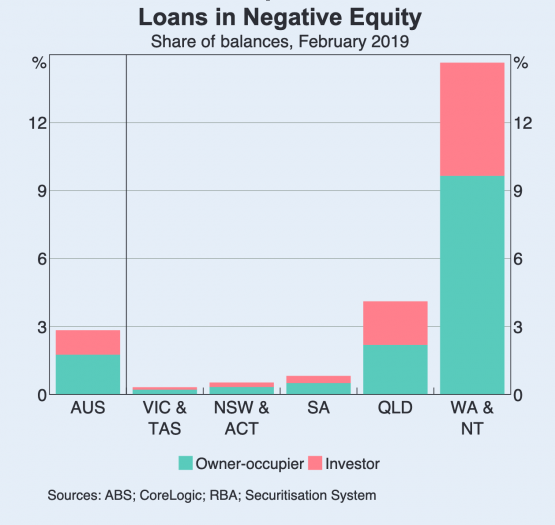

The good news is loans in negative equity remain low in most of Australia. With most loans requiring a 20% deposit and house prices having fallen less than that in Sydney and Melbourne, most of the country is still above water. It is only WA and NT — where house price falls have been going for years — that have significant problems, as the next graph shows.

Unemployment

“Evidence from Australia and abroad suggests that borrowers who experience an unexpected fall in income are more likely to default if their loan is in negative equity.”

That’s the RBA again, with an implicit warning — we won’t get defaults unless we also get “an unexpected fall in income.” Where could that fall come from? A sharp uptick in unemployment. And here’s where it gets complicated.

Falling housing prices could themselves generate economic weakness that causes rising unemployment. It might be because we spend less at the shops when our asset values are falling. Or it might be via a fall in construction employment. But the risks are entangled. The further house prices fall, the bigger the chance of rising unemployment, and the higher the level of both negative equity and of defaults that make the economy worse.

GFC redux?

However, Australia is not likely to see a repeat of the US housing crash, in which banks became insolvent and needed bailing out. For one thing, our mortgages are structured differently. We have what they call full-recourse loans. In America, borrowers who got behind on their loans could just hand the house back to the bank and walk away. Here you have to keep paying or actively default. Another reason not to expect a huge financial crisis is that our financial regulations were designed and implemented with the GFC in mind.

But you can have plenty of economic problems without financial contagion affecting our big, well-regulated banks. There’s always a lot of smaller lenders and property businesses that could end up in strife.

So will the great wave break over us, and put lots of mortgage holders underwater? There’s two things to watch – unemployment and house prices. If the former goes up as the latter continues to sink, that could eventually capsize our long run of stability and growth.

Do you think mortgage lending is a threat to the economy? Write to boss@crikey.com.au with your full name and let us know.

But….but….Crikey, Crikey – I thought it was all about insufficient supply!!!!

Ho ho ho…O the frabjous joyous hilarity and japery of Australian housing market ‘expert analysis’. The very best clown show of all time. Such dazzling little gems it throweth up – no particular offence to you at all Jase to note the vast acreage of Meeja now being given over to earnestly po-faced explications of – wooo-woooo, mysterious expert economic tech talk alert, folks – ‘negative equity’. Why ever not let’s go back half a step more and start with 1 + 1 = 2, then…? O chortle….

It’s a measure of two mournful Oz housing market truths:

A. firstly, how skull-rootingly unsophisticated/financially illiterate/gullible the majority of us now are about property, even as our collective financial destinies (house owner or not) have become ever more deeply entwined in it. Feeling the need to explain ‘negative equity’ to anyone grown up at all, but especially anyone who is the proud owner of a half million dollar mortgage, is akin to feeling it necessary to explain the concept of ‘left’ and ‘right’ to a B Double license holder. It’s a terrifying yardstick however you hold it – either of how insanely patronising and ill-judged an ‘expert’s’ judgement/understanding of their own target audience is, or actually of how terrifyingly acute it is ie how insanely incompetent their target audience’s grasp of their own responsibilities truly are.

B. More pertinently, it reveals how desperately our ‘expert’ Economists are trying to make it look like they have it all under analytical control, exactly when the housing analysis sector is (mostly) finally realising how thoroughly they’ve duped themselves and us (or you, actually). Rule one of being a public commentator: when you get it dead wrong… babble non-stop (loudly, redundantly, pointlessly) about the utterly obvious motherhood details of the unfolding right outcome (you completely failed to analytically preempt). Gosh, they’re all saying, there’s this deeply complex experty economicky thingie called ‘negative equity’, did we mention it earlier? No matter….here, let us expertly explain it expertly for you, expert-style, now that you’re (ahem) drowning in it. They are pompously doing this in exactly the same point-missing way they quacked endlessly and patronisingly on about ‘supply and demand’ on the way up into the bubble.

You idiots. Idiots, and cowards. (Where’s your ‘supply shortage’ now, Bernard Keane?)

Once again. Let me tell you about what has happened to the Australian property market this millennium.

For two decades through the generational theft years of progressively more insane taxation policy distortions – starting with 1999’s harmless little CGT halving, which triggered the accumulating ruinous spiral-into-unsustainability – the experts have sneered ‘supply and demand, o uneducated idiots’ at those of us who pointed out repeatedly what is now playing out in real time, before our eyes: that the property hotspots became (by self-fulfilling reflexivity) in essence a contrived Ponzi scheme con trick. The more you invest, the higher the pump, the better the (early bird) return, repeat…the higher the return the bigger the next pump, the more you invest the higher the return repeat the more the pump you invest the higher the pump return you more higher pump the return invest higher pump invest return pump invest return pump invest…all of it fuelled, really, by those boring old insane housing tax policy rorts.

Rip offs. Fiscal legal pilfering. Generational theft. It’s been the biggest tulip lunacy epidemic in Australian economic history. And it’s implicated us all, while making a tiny percentage of us obscenely, unproductively and undeservedly rich. Thank you, Mr Costello and Mr Howard.

But now it’s done. And of course here at Crikey a few of us stoopid thread nobodies have been through all this many times b4. But once more, the punchline: all that’s left to the thing now is…the thing with Ponzis.

The thing with Ponzis is…that once they stop pumping themselves up they fall until true supply and demand equilibrium kicks in. Because what really dies when a Ponzi dies is the insanely exhuberant sentiment. That’s a oncer. You can’t re-Ponzi a dead Ponzi…which is what everyone is now frantically trying to pretend you can. Uh uh. It’s gone. Real (or close-ish) intrinsic value supp & dem is where we’ll eventually land. And…God knows where that actually is. We’ve all forgotten what a house is actually…um, worth, because it’s been a few decades now since the market has been close to sustainably undistorted. (Except way away from the Ponzi hotspots of course…though even these areas are indirectly affected by Ponzi-linked stuff, like overall bank loan profiles, risk, etc). Alas as Jase points out our entire domestic economy is predicated on those now-evaporated Ponzi hotspots. Every last aspect of it has become shaped to a contrived spine that has…now turned to jello.

So naturally everything about that economy will now feed as viciously and draggingly into the collective down-draft as it did exuberantly and irrationally into the whoosh up. We have a property glut where once were hotspots (but of course, that’s exactly the Ponzi point…all that real supply finally making it to the party at exactly the moment the phantom demand leaves…soooo Ponzi, man). We have dead foreign investment, we have zero wage growth and record household debt, all feeding back into no spending cash, dead spend economy, fewer businesses, jobs and wage rises, not more, less spending, etc…all the while as commodity exports rapidly move through (if not past already) Australia’s last-gasp cycle of keeping our fat line of credit fat(tish) the lazy, stupid, climate-burning (ie soon to disappear too) way.

Supply side grunt will save us though, BK! Just dig more coal, that’ll keep the coal price booming, just as it kept the house price…erm…yes, dig more coal and build more houses, houses and coal, coal and iron, iron roofed coal houses, hooray…everybody loves Australia, they’ll buy our Ozzie Way forever!

Ozzie Ozzie Ozzie – hooray for expert economists!

I think we ain’t seen nuthin’ yet. I reckoned two years ago house prices would fall by about forty percent at least, and I see no reason to change that, a bit over a third of the way there as we now be.

Best. Clown. Show. Eva. But what do we know. We’re interwebz comment thread morons. Dumbest of the dumbest of the dumb.

Thanks for posting, Crikey. Appreciate the space. JR.

/irony

Still all true. As you know. Chrs.

//irony

Chrs Crikey. Space always appreciated.

I’m not so sure that many of the at risk cohort paid a 20% deposit – the supposed ‘gfc’ can’t happen here argument is not as strong as it seems.

Also, many recent buyers are immigrants, I.e. almost exclusively in western Melbourne areas such as Tarneit, Caroline Springs, Point Cook etc. Nothing wrong with that, however they may be tempted to hand back the keys and head home if negative equity really turns. Good luck to Aussie banks trying to collect mortgage debts in Guangzhou and Mumbai

Another big difference between Australia in 2019 and the USA in 2009 is that hordes of people in the US were given mortgages with very small interest rates of 1-2% for the first year or two, with almost no deposit. after which they often ballooned to 10-12%. Totally unsustainable in the long term in a non-recourse market, and especially in a market where unemployment went through the roof, and totally different from what has happened here. No comparison in fact.

How long has this ocean swell been building? The all-round enthusiasms to deregulate/ flog the state and com banks. They were the winds that got the long wave started. Thanks to Keating et al, “markets” were reassigned as benign forces of nature. We could all be investors and make a motza. Surf the waves to riches. And within a twinkling, bright young things and anyone with a lazy 100k is leveraging to their bank’s content.

GFC calmed the swell for a bit. But government underwriting soon got the breeze back up. Banks have duties to the share price you know. serious shit. But finance surfing’s like a hit. What a synergy – Endless credit from overseas, daddy gov wearing the risk, and all the toys to be had. Enjoy the ride.

Now the wave is getting bottom friction. The peak is arching forward and the jagged rocks below are taking shape. It’s too late to transition back to calm. It’s a dumper, but don’t panic- good breath holders and the lucky will survive.

Neil Hauxwell

It might be a good idea to a) take a longer perspective, and b) credit banks (and other housing lenders) with a bit of sense.

This problem has existed in the past on numerous occasions, and the worst thing the lenders can do, for themselves as well as the borrowers, is put the loans into default and sell the houses. They lose money and the borrowers lose everything.

If you take a longer perspective you will see that the negative equity situation will change. Properties might have negative equity now and for the next few years, but over a longer term, maybe 5-7 years, almost all of them will be back in the black. It always happens.

The other thing is that the mortgage is almost always the borrower’s highest priority. The borrower will pay the mortgage before any other debt, because the borrower wants to keep the house.

So if the bank waits, in the vast majority of cases, the Interest arrears will be paid off and the equity will become positive. The bank knows, or should know, this.

It’s not in their interest to sell up as soon as they can.